Bank cashier shot at by robbers in Jaipur

Police reached the spot on information and rushed the injured cashier Narendra Singh Shekhawat to a private hospital.

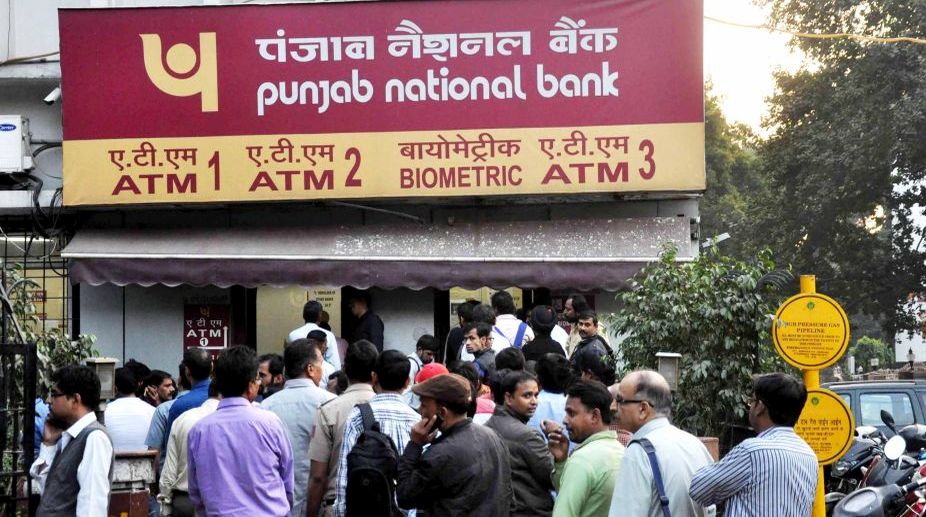

PNB (Photo: SNS)

In the wake of PNB scam widened to Rs 12,700 crore, the Financial Services Secretary Rajiv Kumar today said that public sector banks (PSBs) have been given a 15-day deadline to take “pre-emptive” action for identifying gaps and to gear up for rising operational and technical risks.

Executive Directors and chief technological officers (CTOs) of PSBs have been asked to prepare a blueprint to enhance preparedness for combating increasing risks.

“15 days deadline for PSBs to take pre-emptive action and identify gaps/weakness to gear up for rising Ops and Tech risks; To learn from best practices and pinpoint strategies including tech solutions; clear accountability of senior functionaries,” Kumar said in a tweet.

Advertisement

15 day deadline for PSBs to take pre-emptive action & identify gaps/Weaknesses to gear up for rising Ops & Tech risks; To learn from best practices & pinpoint strategies including tech solutions; Clear accountability of senior functionaries.#EASE @PMOIndia @FinMinIndia @PIB_India pic.twitter.com/tankAMtBem

— Rajeev kumar (@rajeevkumr) February 27, 2018

The financial services secretary further added that it will be the responsibility of “Group of EDs and CTOs” to learn from best practices across the banking sector and identify weakness in existing arrangements.

The fraud-hit PNB, late last night, reported an additional Rs 1,300 crore unauthorised transactions, taking the estimated quantum to Rs 12,600 crore in the scam related to diamond trader Nirav Modi and owner of Gitanjali Gems, Mehul Choksi.

In a 11.22 p.m., late night filing with the stock exchanges on Monday, the bank said: “In continuation to our filing with stock exchanges on February 14, 2018, we have to inform that quantum of reported unauthorised transactions can increase by $204.25 million.”

Earlier, PNB, the second largest public sector bank in India, had said it had detected a $1.8 billion fraud in the Brady House Branch in Mumbai.

“The bank has detected some fraudulent and unauthorised transactions (messages) in one of its branches in Mumbai for the benefit of a few select account holders with their apparent connivance,” the filing by PNB earlier said.

Initially it had put the quantum of such transactions at around Rs 11,300 crore.

(With agencies inputs)

Advertisement