India’s democratic dilemma

The fake news industry has grown by leaps and bounds under the tutelage of the BJP.

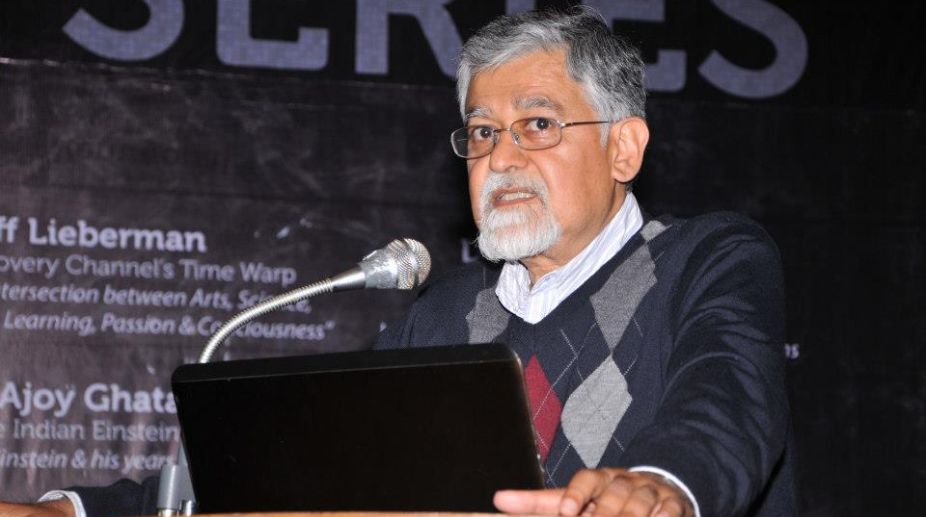

Arvind Virmani (Photo: Facebook)

Eminent economist Arvind Virmani served the government for almost 25 years and was an adviser to the Union Government at the highest levels. He proposed many policy measures for the improvement of the economy. He was appointed India's representative to the International Monetary Fund in 2009, was Chief Economic Advisor to the government of India and authored the Economic Survey in 2008-09. He attended Doon School and graduated from St Stephen's College, Delhi, and from California Institute of Technology. He holds a doctorate in economics from Harvard University.

In an interview to PRASHANT MUKHERJEE, he shared his views on demonetisation, the Budget and monetary policy. Excerpts:

Q. Let me start with your views on demonetisation?

Advertisement

A: The decision of demonetisation taken in November 2016 itself suggested that there will be a ‘collapse of retail trade’. It’s simple logic ~ if you withdraw 86 per cent of the currency from circulation, sales will collapse. When I say retail trade it includes not only sale of goods and services but also wage labour. Having said that,we should find out if there was any positive impact of demonetisation. In order to sustain the fight against black money now that the step has been taken, voluntary compliance, meaning declaration of income for payment of tax, may go up, but to support this, the government needs to introduce some incometax reforms. There would be a positive effect on the housing sector. There is a black: white ratio of 50- 50 on a real estate deal. Hence, it’s conceivable that there will be reduction in the ‘black’ portion that will automatically bring down prices by 30 to 50 percent. Further to support this, state governments need to reduce the ‘circle rate’ and ‘stamp duties’ drastically. However, the effect on these items will not last beyond 3-5 years, unless complementary measures are taken to reduce new generation of black money. The government needs to make credit easier to sustain this. But apart from tax evasion, there is a huge politician-bureaucratpolice-criminal (PBPC) nexus which first needs to be reformed and addressed.

Q. What is your assessment of the impact of demonetisation on GDP?

A: My initial assessment was that the economy will take a hit for the year to the extent of 0.25-0.50 per cent on the GDP. But when the actual data came for December, then I expanded my scope as the impact on growth could be to the tune of 0.25 per cent to 1 per cent.

Q. If you were the current Economic Advisor to the government would you have advised demonetisation?

A: I was in government for 25 years. Almost every year, I used to give the government a list of reforms that it needs to consider for the economy. Never in my 25- year career have I recommended demonetisation and would have never done so.

Q. On the recent RBI monetary policy, do you think there is a further scope for reduction of key benchmark rates?

A: All my analysis over the last 12 months was that the monetary policy should have been loosened. But given what I know about the Monetary Policy Committee (MPC), this is very unlikely to happen. Moreover, by changing the stance from ‘accommodative’ to ‘neutral’ and not reducing key benchmark rates, it's hardening of monetary policy. In my view it is completely wrong. I am focusing very much on the current domestic scenario but the MPC is too focused on global aspects like what the Fed will do, what is the global GDP forecast, among others.

Q. How do you view the proposal of the government on fiscal deficit?

A: Fiscal deficit is an indicator where global rating agencies rate the economies. If one has to improve its ratings, the fiscal deficit should be reduced. In the medium term, if the country needs to be stronger it has to reduce its fiscal deficit to zero. I am very happy as the FRBM committee, for the first time, recommended reducing the fiscal deficit target below 3 per cent. This is a step in the right direction.

Q. How big a concern is declining private investments in the economy?

A: Private investments have been declining since the last 3 years and it is a serious concern. Part of this is the global economic conditions. The global demand was very low and hence private investments were down. But the good thing is that government expenditure has increased and the infrastructure sector is moving. However, I don’t buy the logic of recapitalising banks for huge bad debts, instead the government should reduce its stake in PSU holdings. It should only hold 25 per cent of the equity and the rest should be allowed for private investments.

Q. The Economic Survey has suggested the concept of Universal Basic Income to the government. What are your views on the idea of UBI and should it be implemented at all since it could cost anywhere between 4- 5 per cent of India's GDP?

A: Universal Basic Income (UBI) has been suggested in US and other developed countries as a solution to their problem of worsening income distribution over the past several decades. It is of little relevance to our problems and conditions. Since the 1960s the key issue in India has been poverty alleviation. In the 1990-2000s some of us analysed the record of poverty alleviation and came to the conclusion that poverty could be eliminated by devising a system that reduced leakages and administrative overheads. One such system was a negative income tax (proposed by me for India in a 1999 reform paper) for eliminating poverty. Surjit Bhalla and I have recently calculated that such a system of Net Income Transfers (NIT)/direct cash transfers could be fully funded by the current budget for food subsidy and MGNREGA.

Q. What your views on electoral bonds?

A: The electoral bond is an innovative but limited idea, which could be useful for relatively honest tax payers, businesses and companies. It would make it possible to use tax paid income to make political donations, instead of evading taxes solely for the purpose of meeting extortionary demands for donations from political leaders and parties. The bond doesn't, however, provide for tracing the payment from a specific donor to a specific party. However, even though it is a small step, it is welcome, because most reforms are built on a series of incremental steps, where each step encourages others to demand more reforms.

Advertisement