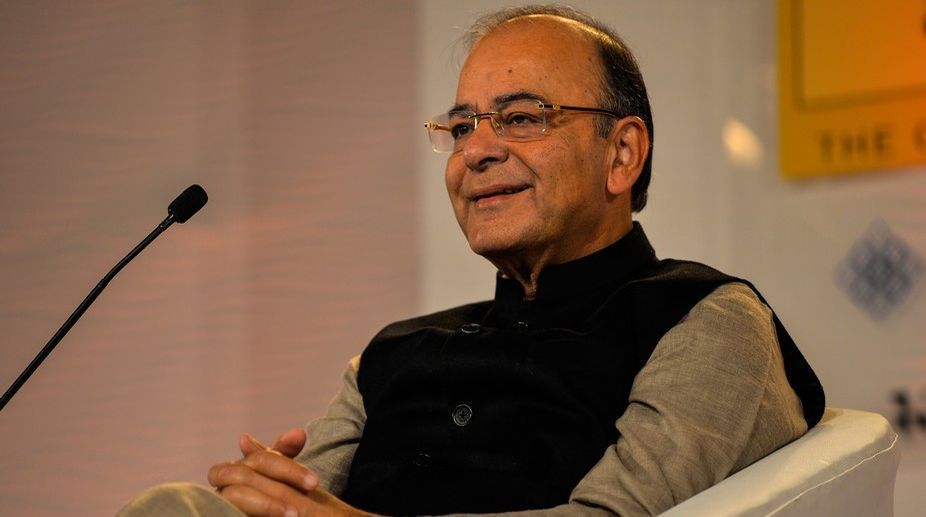

Finance Minister Arun Jaitley on Saturday exuded confidence that there will be no more fiscal slippages as the financial position is likely to be comfortable from the next fiscal.

Brushing aside any immediate need to worry about rising global oil prices, Jaitley said an assessment should not be made based on hypothetical situation concerning crude prices as the trend in the last three days has been the opposite (with prices falling again).

He added that at this stage he was not worried about any slippages on the fiscal front.

Addressing a press conference after meeting RBI’s board in a customary post-Budget exercise, Jaitley also said that the last decision of the Monetary Policy Committee, chaired by RBI Governor Urjit Patel, to keep interest rates unchanged was a “balanced decision”.

“… as far as fiscal situation is concerned, I see next year to be more comfortable as far as revenues are concerned. I cannot see at this stage that there would be any slippages,” he said.

The finance minister in Budget 2018-19 projected a higher fiscal deficit of 3.5 per cent of the GDP for the current fiscal, as against the target of 3.2 per cent, on account of GST implementation and deferment of spectrum auction.

The fiscal deficit or gap between total expenditure and revenues has been pegged at 3.3 per cent for the next fiscal as against the Fiscal Responsibility and Budget Management (FRBM) Act mandate of 3 per cent.

With regard to the Budget proposal of fixing the minimum support price (MSP) of kharif crops at least 1.5 times that of the cost of production, Jaitley said the issue was discussed in this meeting because it takes place in the light of the Budget.

“How to implement this and what impact it can have on farmers, commodity prices and export competitiveness, all these issues were discussed. It was an academic discussion,” he said.

With regard to long-term capital gains tax, the finance minister said it was not part of this meeting but was discussed in Sebi’s board meeting.

Asked about the rate transmission by the banks, Patel said one of the banks reduced its Marginal Cost of funds-based Lending Rate (MCLR) two days ago.

“In terms of transmission if you measure since the easing cycle started by MPC and you compare the MCLR now actually there has been good transmission.

“Actually what happened was that transmission came late and I must admit that some of the transmission came after demonetisation because we had a financial intermediation taking place in the system,” he said.