India’s CAD declines to 1.2 pc of GDP in Oct-Dec quarter reflecting stronger economy

The decline in CAD reflects a strengthening of the macroeconomic fundamentals of the Indian economy.

The decline in CAD reflects a strengthening of the macroeconomic fundamentals of the Indian economy.

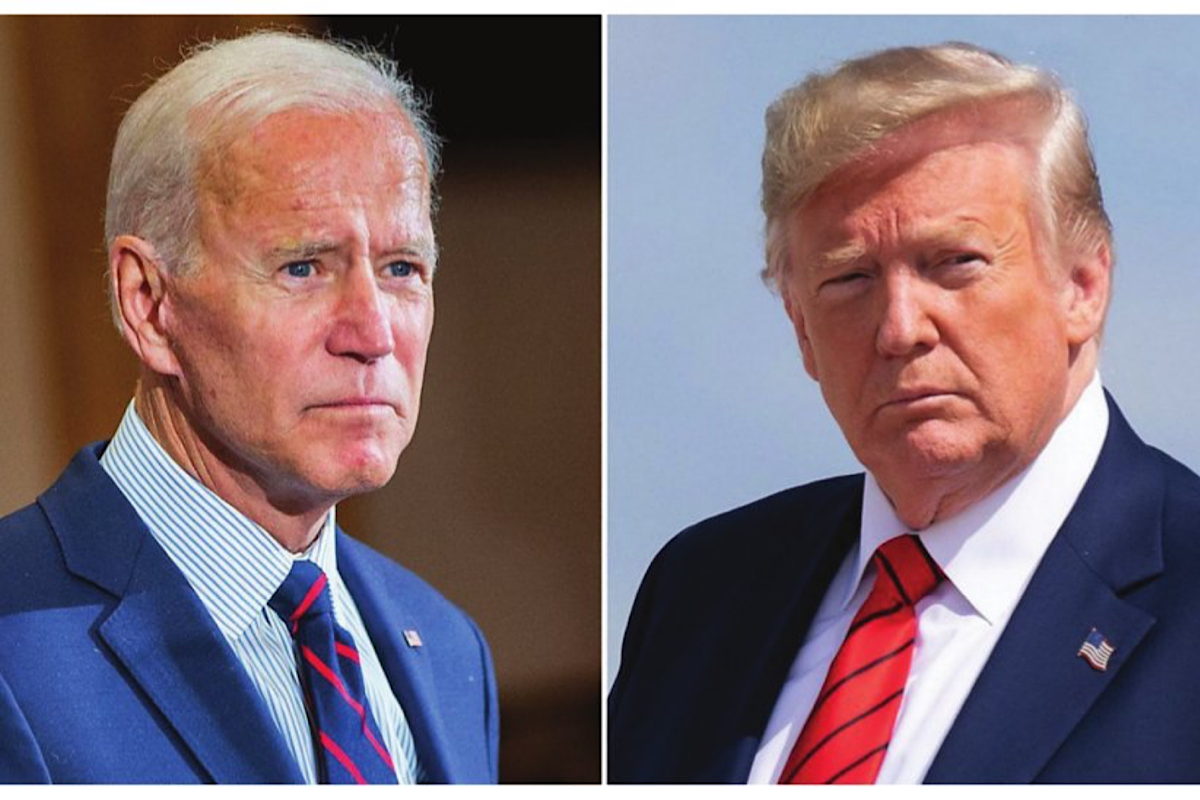

Within global economies, America’s resilience shines brightly, defying the dire predictions of naysayers and sceptics. Against a backdrop of uncertainty and volatility, the US economy has emerged as a bastion of strength and vitality, demonstrating a remarkable ability to weather storms and navigate through turbulent waters.

Money makes the world go round, so sang Sally Bowles in the famous movie Cabaret. Money today keeps the global economy ticking, and if the central banks stop printing money, we would already be in a 1930s Depression.

In the narrative of a nation’s economic performance, GDP growth often takes centre stage, like the star student’s report card that parents eagerly await.

A decade after steadily decline in investment to GDP, capex has emerged as a key growth driver in India, global brokerage, Morgan Stanley said.

In post-Covid times, the Fed embarked on a most aggressive and irresponsible monetary policy of hiking interest rates, leading to predictable financial instability all over. All other countries including India have been blindly following its prescriptions even when interest rate hikes were clearly failing to arrest inflation

Small and Medium-Sized enterprises account for 29 per cent of the nation's GDP, 49 per cent of exports, and more than 63 million businesses nationwide says Umesh Revankar, Executive Vice Chairman, Shriram Finance.

The Union agriculture minister was speaking at the launch of Kisan Tak TV channel and website of the India Today Group.

Indian industry saw progressive liberalisation and removal of bottlenecks after 2014, beginning with increasing the cap in the defence sector, first from 26 per cent to 49 per cent under the approval route, and then to 74 per cent under the automatic route and 100 per cent under the approval route. All brownfield projects now allow 75 per cent FDI under the automatic route and 100 per cent by the approval route

The adverse factors affecting the US and European economies put our own economy at risk. To enumerate: the Indian economy faces the danger of capital outflow because of higher US interest rates. Then, we are importing inflation through higher cost of imported goods and because household incomes in the West are falling, our own exports are unlikely to rise in the short run, ruling out a quick solution to the CAD problem