Stock market bounces back; banks, metals shine

Sensex was up 599.34 points, or 0.83 per cent at 73,088.33, while the Nifty was up 151.20 points or 0.69 per cent at 22,147.

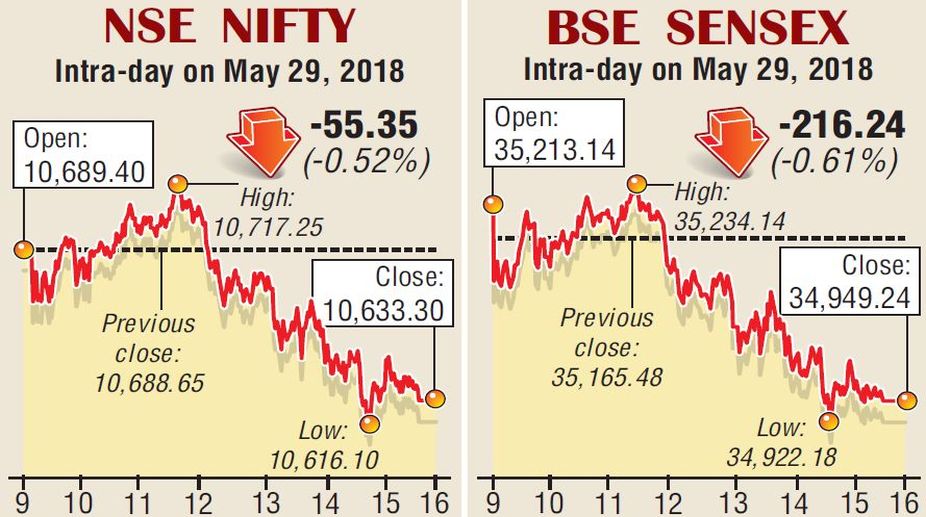

Disrupting the gaining momentum of the past three sessions, the equity market on Tuesday lapsed into consolidation mode as speculators hammered banking and metal stocks selectively to book profit ahead of Thursday’s scheduled square-up or rollover of F&O derivatives for May.

Decline in the partially convertible rupee after Monday’s sharp rise also added selling pressure on equity benchmarks of Bombay Stock Exchange and National Stock Exchange.

Analysts say the local currency slipped 33 paise as it resumed 67.62 per United States dollar (Monday’s closing was 67.43/$) on month-end dollar demand by exporters and banks.

Advertisement

Banking operations are likely to be affected by the two-day nationwide strike by their employees. Dalal Street participants have been monitoring global crude oil prices and its impact on the rupee.

As selling pressure built up in the afternoon, the 30-scrip Sensitive Index slipped under the 35,000-level. The losses were capped by gains in auto, IT and heavyweights such as Larsen and Toubro and Bharti Airtel.

Bank shares, private as well as state-run, fell in tandem, trimming the gains of the past ten days. The volatility, analysts say, is likely to persist over the next two or three sessions in view of F&O expiry for the current month on Thursday.

Analysts say foreign portfolio investors or FPIs have stepped up their withdrawal ignoring improved India Inc’s performance in the last quarter of FY 2017-18. They are being guided more by developments in the US and Europe where Italy faces a financial crisis.

Volatile Treasury bills yields in US are said to be a major reason for FPIs to cut their exposure to equities in India. For the second month in a row, they have so far dumped shares worth Rs 9,948.23 crore in May on the back of net sales of Rs 9,620.56 crore in April.

A big collapse in stock indices was thwarted by domestic fund investors who according to latest data (up to 28 May) are net buyers of stocks worth Rs 12,769.15 which is more than their April’s investment of Rs 8,663.88 crore.

What bothers FPIs? According to Macquarie’s IS Bhatia, earnings in emerging markets are practically flat for three-four years. In the banking segment the resolution process has been dragging on for some time. Issues of corporate governance too need to be looked into and settled.

The outflows on account of FPIs withdrawal is likely to persist for at least a quarter or two. However, analysts say jump in investment by DIIs suggest their strategy of stock specific action could be yielding positive returns for their millions of retail investors.

The Sensex closed for the day at 34,949.24 (-216.24) points down 0.61 percent. Nifty ended 0.52 percent low at 10,633.30 (-55.35) points. Nifty Bank and Nifty PSU Bank were among top losing sectors.

They ended 26,254.80 (-359.45) points and 2,940.05 (-89.40) points down at 1.35 percent and 2.95 percent respectively. In Sensex eight shares were up and 23 down. For Nifty the ratio was 16:34.

The highlight of the day was engineering giant L&T hitting its fresh 52-week high on brisk buying by investors after the company’s earnings data exceeded Dalal Street brokers’ estimates for Q4 ended 31 March.

Larsen stock intra-day valued more than 5 percent to Rs 1,514.05 on BSE but gave away some of its gains as traders did not spare it from profit booking.

The market has accepted L&T management’s commentary that the company would perform better in 2018-19 although it had written off orders worth Rs 16,000 crore owing to projects delay. But the company expects better orders from the Centre and state governments.

L&T feels corporate orders will take another two years to revive. “L&T is caught at the crossroads of headwinds and tailwinds simultaneously,” said the management.

As crude oil prices soften further on likely increase in pumping by Russia and OPEC (Organisation of Petroleum Exporting Countries), stocks of oil marketing companies such as Indian Oil Corporation, HPCL and BPCL improved. These OMC shares have been on the upswing for the past two sessions gaining up to 8 percent.

Advertisement