RBI decides to keep repo rate unchanged for fourth consecutive time

In its last three meetings in April, June, and August, the RBI kept the repo rate unchanged at 6.5 per cent.

In its last three meetings in April, June, and August, the RBI kept the repo rate unchanged at 6.5 per cent.

The moderation in the country's retail inflation in April has validated the Reserve Bank of India's (RBI) decision to pause the repo rate in its first 2023 monetary policy meeting, according to SBI Research.

"As financial conditions tighten, global financial markets are experiencing surges of volatility, with sporadic sell-offs in equity and bond markets, and the US dollar strengthening to a 20-year high," the minutes said.

The 50 basis points hike in the repo rate coupled with inflationary pressure is likely to impact the sentiment of the Housing sector particularly in the affordable and mid-range housing segments.

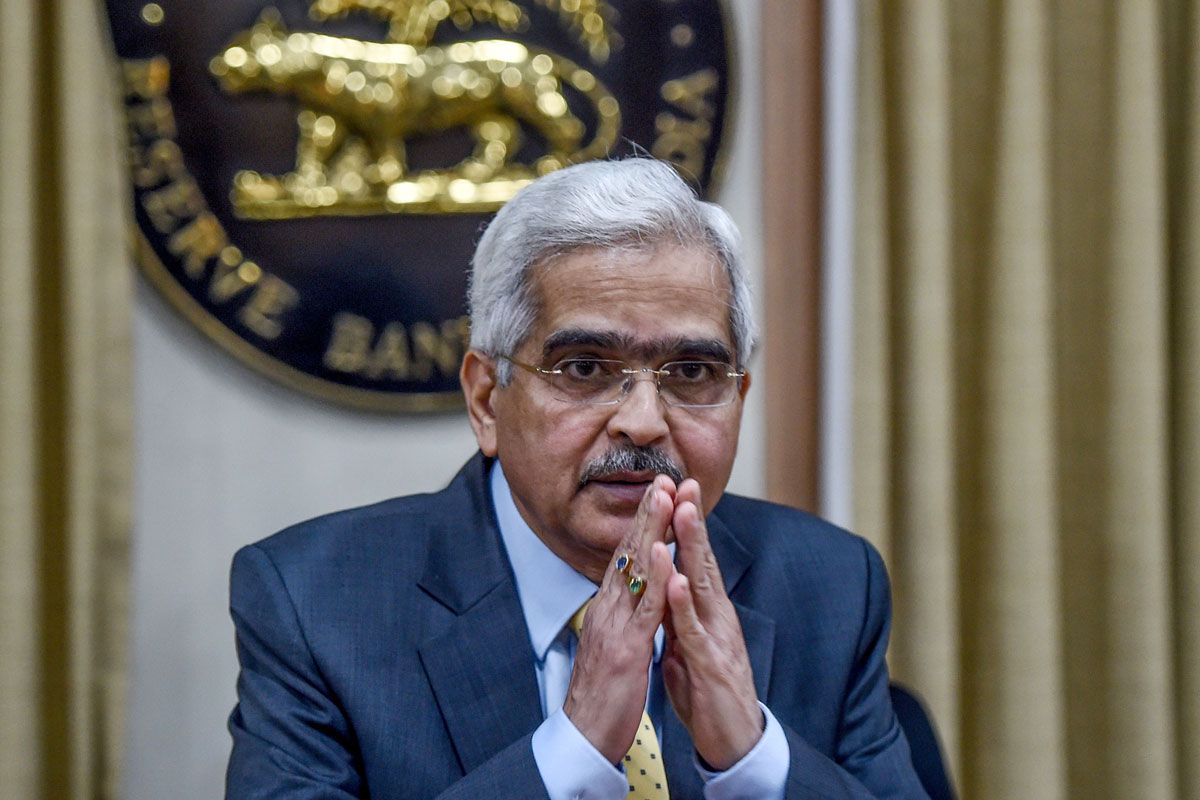

As expected earlier, the Reserve Bank of India's Monetary Policy Committee (MPC) in a 5:1 decision increased the repo rate by 50 basis points to 5.90 on Friday. The RBI Governor Shaktikanta Das, heading the MPC, announced the hike to subdue the inflation.

Among the individual stocks, Tata Steel was the top gainer on the BSE, rising around 4 per cent.

The Monetary Policy Committee (MPC), headed by the Governor Shaktikanta Das, also decided to keep the reverse repo rate at 3.35 per cent.

The Monetary Policy Committee (MPC), headed by RBI Governor, is scheduled to meet for three days beginning August 4 and will announce its decision on August 6.

Shaktikanta Das added that COVID-19 pandemic perhaps represents so far the biggest test of robustness and resilience of our economic and financial system.

The latest cuts come after RBI, last week, had reduced repo rate by 40 basis points to 4 per cent from 4.40 per cent.