RBI MPC member predicts ‘less severe’ high food inflation

The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) member highlighted that going ahead, as India develops, the problem of high food inflation would be "less severe".

The Monetary Policy Committee (MPC), headed by the Governor Shaktikanta Das, also decided to keep the reverse repo rate at 3.35 per cent.

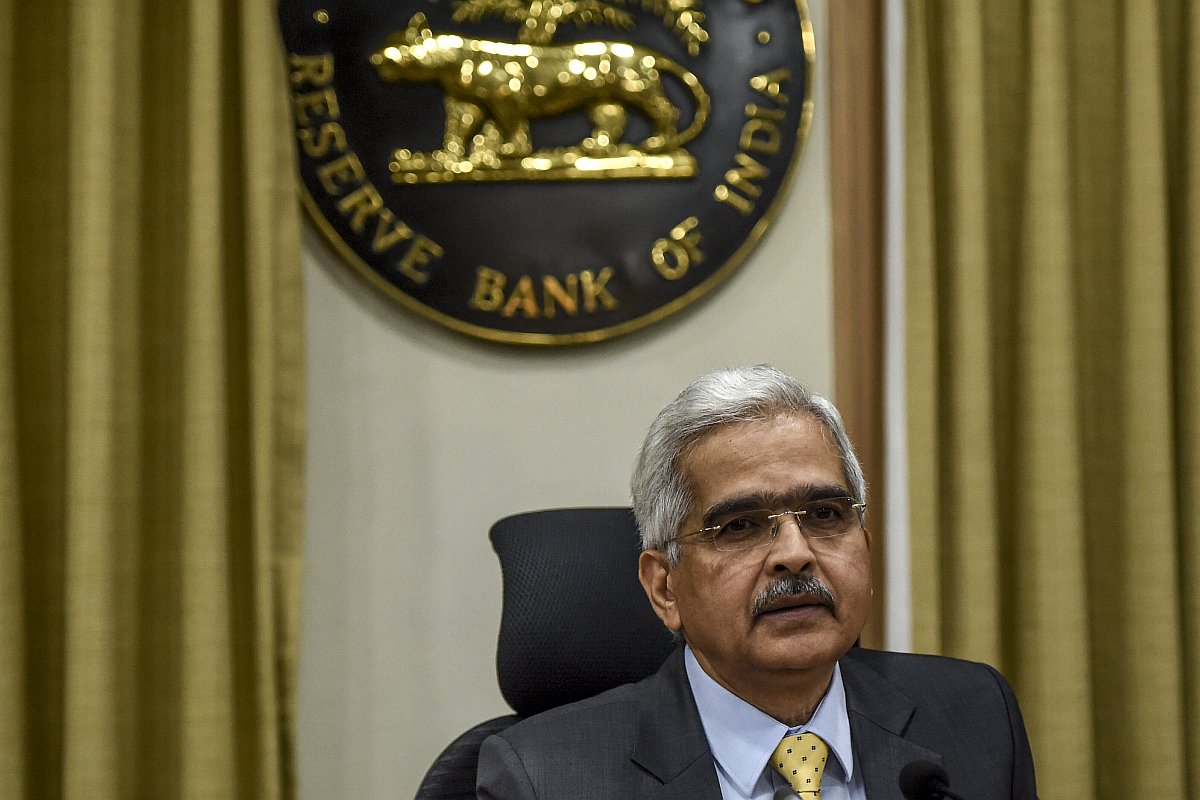

Reserve Bank of India (RBI) Governor Shaktikanta Das speaks during a press conference at the RBI head office in Mumbai. (Photo: AFP)

The Reserve Bank of India’s (RBI) Monetary Policy Committee on Thursday decided to keep the benchmark repo rate unchanged at 4 per cent, lowest since 2000.

The Monetary Policy Committee (MPC), headed by the Governor Shaktikanta Das, also decided to keep the reverse repo rate at 3.35 per cent.

The MPC voted to maintain accommodative stance, thus opening up possibilities for more future rate cuts.

Advertisement

Keeping the economic stress caused by the pandemic, the Reserve Bank of India also decided to permit a one-time restructuring of corporate loans. The central bank is also constituting an expert committee under KV Kamath that will look into resolution plans and other required financial parameters to be factored in it.

The restructuring will be allowed as per the prudential framework issued on June 7, 2019, RBI Governor Shaktikanta Das said.

Last week, Finance Minister Nirmala Sitharaman had said that the government is working with the RBI on the need for restructuring of loans to help the industry tide over the impact of COVID-19.

“The focus is on restructuring. Finance ministry is actively engaged with RBI on this. In principle, the idea that there may be a restructuring required, is well taken,” Sitharaman had said.

In February, the RBI decided to extend the benefit of one-time restructuring without an asset classification downgrade to standard accounts of GST-registered micro, small and medium enterprises (MSMEs) that were in default as on January 1, 2020, in line with the Budget announcement.

Stressed MSME borrowers would be eligible for restructuring of debt, if their accounts were classified standard, Das added.

The governor also raised the Loan-to-Value ratio against gold to 90 per cent from current 75 per cent, to mitigate COVID-19 impact on households.

Advertisement