RBI decides to keep repo rate unchanged for fourth consecutive time

In its last three meetings in April, June, and August, the RBI kept the repo rate unchanged at 6.5 per cent.

In its last three meetings in April, June, and August, the RBI kept the repo rate unchanged at 6.5 per cent.

The moderation in the country's retail inflation in April has validated the Reserve Bank of India's (RBI) decision to pause the repo rate in its first 2023 monetary policy meeting, according to SBI Research.

"As financial conditions tighten, global financial markets are experiencing surges of volatility, with sporadic sell-offs in equity and bond markets, and the US dollar strengthening to a 20-year high," the minutes said.

The 50 basis points hike in the repo rate coupled with inflationary pressure is likely to impact the sentiment of the Housing sector particularly in the affordable and mid-range housing segments.

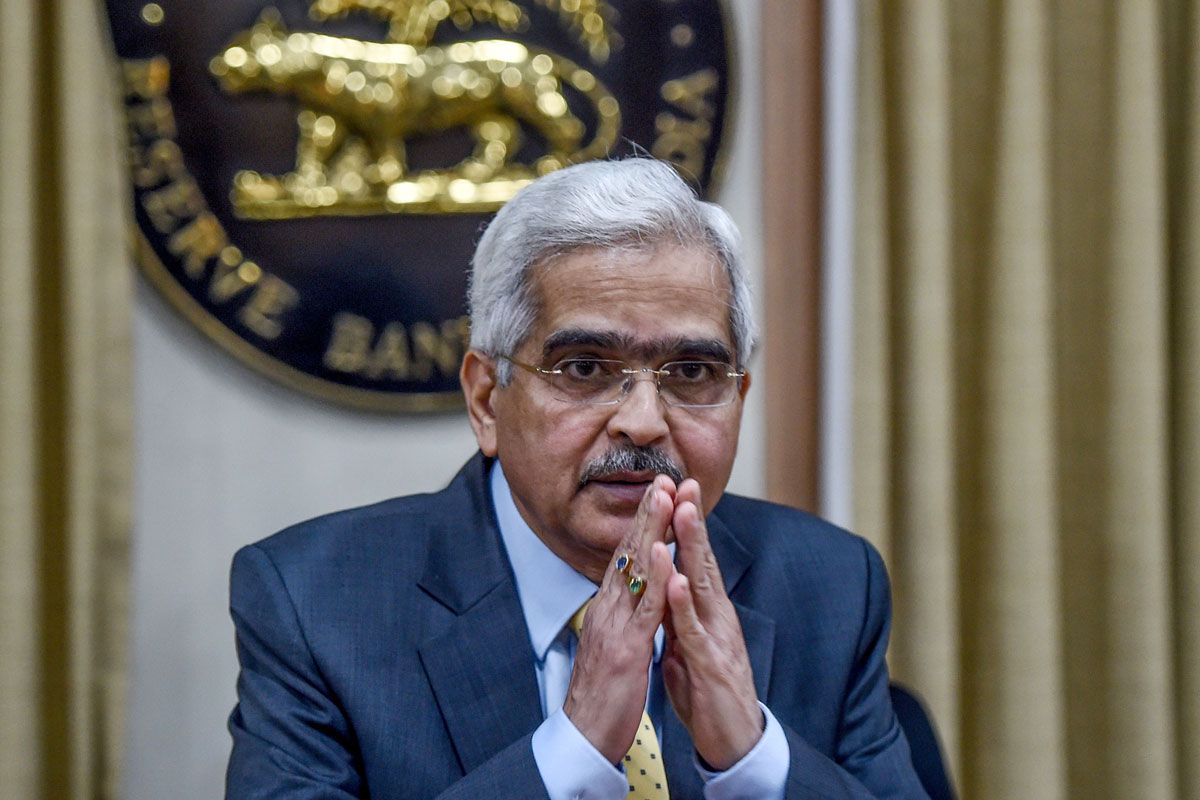

As expected earlier, the Reserve Bank of India's Monetary Policy Committee (MPC) in a 5:1 decision increased the repo rate by 50 basis points to 5.90 on Friday. The RBI Governor Shaktikanta Das, heading the MPC, announced the hike to subdue the inflation.

The Reserve Bank of India (RBI) is likely to hike the policy repo rate by 40 basis points to 4.80 per cent on Wednesday and increase the inflation forecast for the current fiscal to above 6 per cent from its earlier projection of 5.7 per cent, according to market analysts and economists.

RBI Governor termed the recent inflations as "transitory" and "driven by adverse supply side factors"

The central bank has retained growth projection of 10.5 per cent for the current financial year as was estimated in its February bi-monthly policy.

The cut is expected to impact all categories of loans offered by the bank.

RBI had last revised its policy rate on May 22, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.