Rajnath Singh files nomination after impressive road show in Lucknow

Union ministers Smriti Irani & Kaushal Kishore also file nominations

In pre GST era the States had multiple laws which entitled them to impose taxation at different points. The States were scared of the fear of the unknown but the Central Govt. persuaded States with a 14% annual increase from the tax base of 2015-16 for a period of five years, said Jaitley.

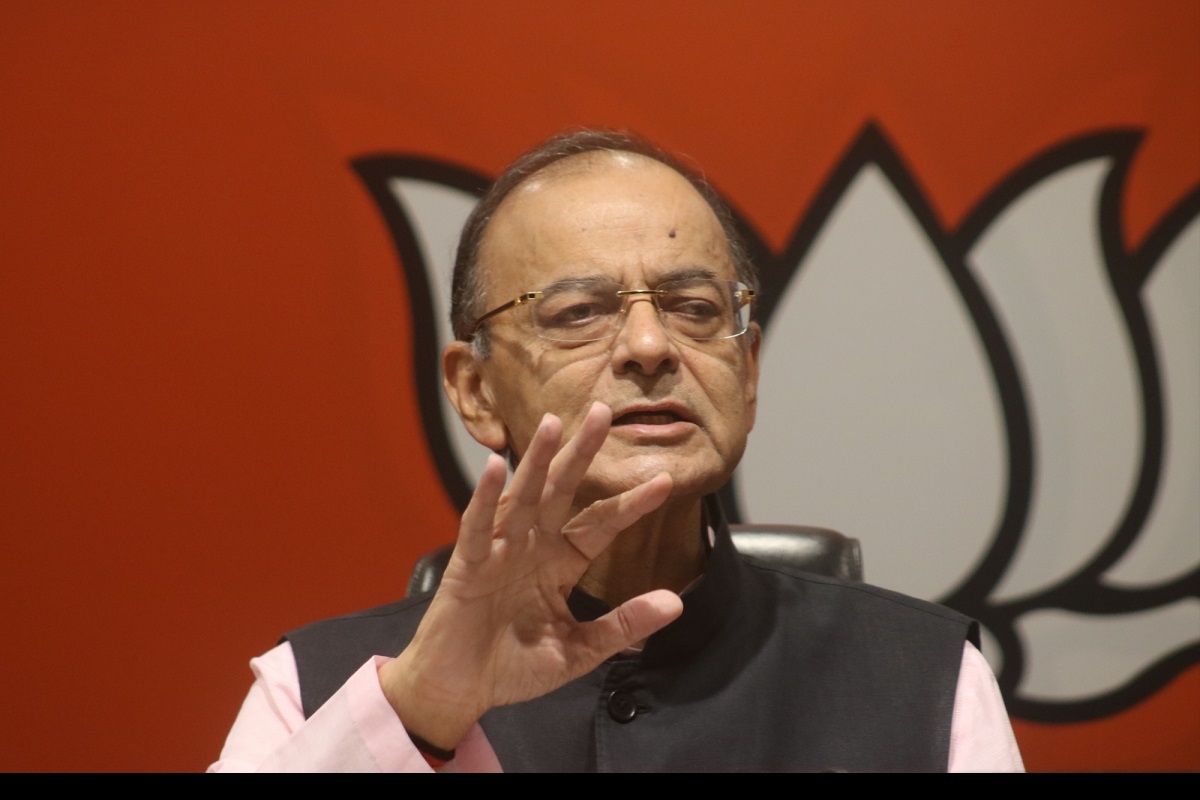

Arun Jaitley addresses a press conference in New Delhi, on April 2, 2019. (File Photo: IANS)

Former Minister of Finance and senior Bharatiya Janata Party (BJP) leader Arun Jaitley, on Monday, shared his thoughts as the Goods and Services Tax (GST) completes two years.

Jaitley posted a series of tweets to put across his point.

“Today, the GST regime enters its third year. It has been the monumental restructuring of one of the world’s clumsiest indirect tax system. The challenges to implement the GST were compounded by some outlandish and exaggerated comments of the not so well-informed.

Advertisement

“In pre GST era the States had multiple laws which entitled them to impose taxation at different points. The States were scared of the fear of the unknown but the Central Govt. persuaded States with a 14% annual increase from the tax base of 2015-16 for a period of five years.

“The GST merged seventeen different laws and created single taxation, with this new system the days of filing multiple returns, entertaining multiple inspectors and additionally facing the inefficiency – trucks being stranded at the State boundaries for days altogether, vanished.

“The high taxation of pre GST era pinched the consumers’ pocket and acted as a disincentive against tax compliance. The last two years have seen each of the meetings of the GST Council reducing the tax burden on consumers as the tax collections improved.

“As on today, most consumer items have been brought in the 18%, 12% & 5% GST category. Only luxury, sin & some white goods remain in 28% slab. A sudden reduction of all categories can lead to a massive loss of government revenue leaving the government without resources to spend.

“The assessee base in the last two years has increased by 84%. The number of assessees covered under GST today are at 1.20 crore. This obviously leads to higher revenue collections.

“In the pre-GST regime, the rich & the poor, on various commodities, paid the same tax. The multiple slab system not only checked inflation, it also ensured that the Aam Aadmi products are not exorbitantly taxed. A Hawai chappal & a Mercedes car cannot be taxed at the same rate.

“My own experience of two years while chairing the GST Council was that Finance Ministers’ of States, notwithstanding the political position their parties take, have displayed a high level of statesmanship and acted with maturity. I am sure this trend will continue in future.”

Advertisement