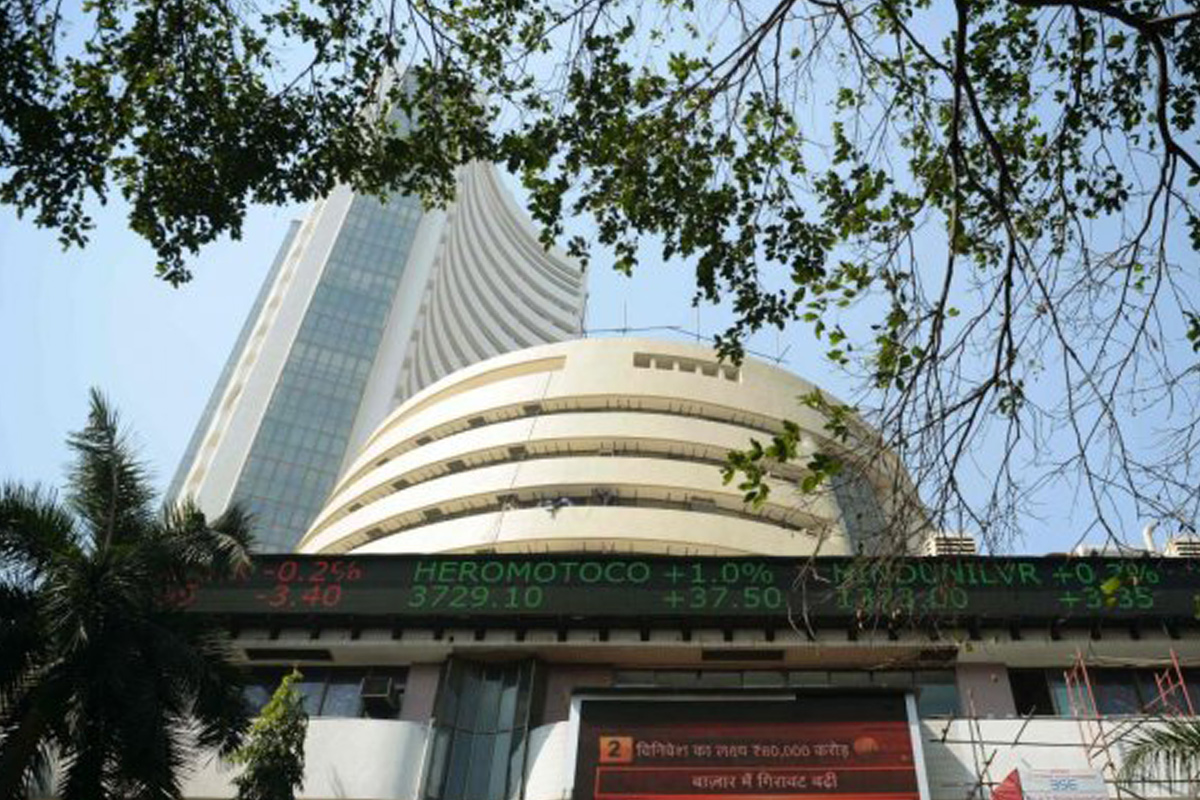

Stock market extends winning steak; PSU bank at new high

Sensex closed 487 points, or 0.66%, higher at 74,339.44 while the Nifty closed the day with a gain of 168 points, or 0.75%, at 22,570.35 on the monthly F&O expiry day.

The losers batch on the BSE was led by Tech Mahindra, slipping 1.76 per cent, followed by HDFC, ICICI Bank, Infosys, HDFC Bank and Kotak Mahindra.

HDFC twins dropped up to 1.17 per cent during the early trading hours, dragging the index down. Index major Reliance fell 0.59 per cent. (Photo: AFP)

Domestic markets plunged during the early trading hours on Wednesday, backed by heavy selling in the financial, IT and energy stocks as investors booked profit after sharp gains in the previous session.

The S&P BSE Sensex opened lower by 60.37 points or 0.14 per cent at 44,595.07. At 10.26 a.m. the 30-share index was trading 188.41 points or 0.42 per cent lower at 44,467.03 levels.

Similarly, the NSE Nifty was at 13,070.85, down by 38.20 or 0.29 per cent. It had opened at 13,121.40.

Advertisement

The losers batch on the BSE was led by Tech Mahindra, slipping 1.76 per cent, followed by HDFC, ICICI Bank, Infosys, HDFC Bank and Kotak Mahindra.

HDFC twins dropped up to 1.17 per cent during the early trading hours, dragging the index down. Index major Reliance fell 0.59 per cent.

Among gainers, Asian Paints, Tata Steel, Titan rose by 2.50 per cent, 2.39 per cent and 1.97 per cent respectively.

Equity benchmark indices Sensex and Nifty had rallied to fresh lifetime highs on Tuesday, backed by gains in IT and finance stocks amid persistent foreign capital inflows. The 30-share BSE Sensex zoomed 505.72 points or 1.15 per cent to end at its fresh closing record of 44,655.44. Similarly, the broader NSE Nifty surged 140.10 points or 1.08 per cent to close at its all-time high of 13,109.05.

Meanwhile, other Asian markets shed early gains due to profit booking.

Tokyo stocks dropped by 0.17 per cent and China by 0.22 per cent. Australian stocks also dropped 0.38 per cent.

Oil prices dropped in Asia with the benchmark, Brent Crude, falling by 0.53 per cent to USD 47.16 per barrel.

Advertisement