Bidding farewell to Maryse Conde

Speak of Segu outside Segu, but do not speak of Segu in Segu.

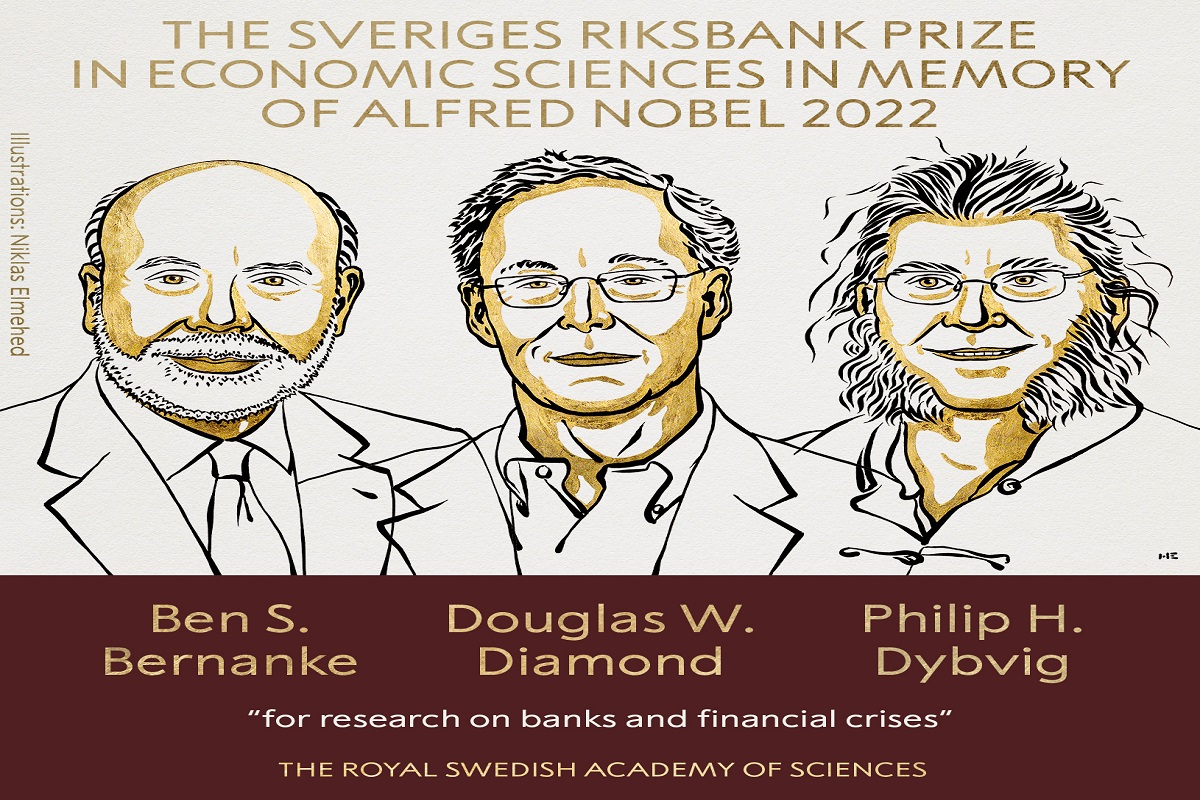

The Sveriges Riksbank Prize in Economic Sciences for 2022, popularly called the Nobel prize for economics, has been awarded to three American economists, Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig “for research on banks and financial crises.”

Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig (Photo: Twitter/The Nobel Prize)

The Sveriges Riksbank Prize in Economic Sciences for 2022, popularly referred to as the the Nobel prize of economics, has been awarded to three American economists, Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig, for their research on banks and financial crises.

The Royal Swedish Academy of Sciences, stated in their prize declaration, “The three Nobel laureates have contributed to understanding banks, bank regulation, banking crises, and how financial crises should be managed. Modern banking research clarifies why we have banks, how to make them less vulnerable to crises and how bank collapses exacerbate financial crises. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.”

The work for which Ben Bernanke, Douglas Diamond and Philip Dybvig are being recognised has been crucial to subsequent research that has enhanced our understanding of banks, bank regulation, banking crises and how financial crises should be managed.#NobelPrize pic.twitter.com/4drJwZ0yF9

Advertisement

— The Nobel Prize (@NobelPrize) October 10, 2022

Research started in the early 1980s

The foundation of the research was laid by Ben Bernanke, Douglas Diamond, and Philip Dybvig.

In the early 1980s, they started their research to find answers to some of the questions such as; Impact of collapse of the banking system, could we manage without banks? Why are some banks unstable and, why? How can society improve the stability of the banking system? How long do consequences of a banking crisis last? And, if banks fail, why can’t new ones immediately be established so the economy quickly gets back on its feet?

Ben Bernanke’s Contribution

Ben Bernanke analyzed the Great Depression of the 1930s, the worst economic crisis in modern history. Among other things, he showed how the way the bank were run in those days, was a decisive factor in the crisis becoming so deep and prolonged.

According to the press release of The Royal Swedish Academy of Science, an analytical article formulated by him in 1983 showed, when the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society’s ability to channel savings to productive investments was thus severely diminished.

Bernanke’s research shows that bank crises can potentially have catastrophic consequences on the economy. This insight illustrates the importance of well-functioning bank regulations and was also the reasoning behind crucial elements of economic policy during the financial crisis of 2008–2009, the Academy said in the release.

At the time, Bernanke was head of the US central bank, and the Federal Reserve, and was functional in the transition of knowledge from research into policy. Later, when the pandemic hit in 2020, significant measures were taken to avoid a global financial crisis.

Prior to Bernanke’s study, the general perception was that the banking crisis was a consequence of a declining economy, rather than being a cause of it. Instead, Bernanke established that bank collapses were decisive for the recession developing into a deep and prolonged depression.

Douglas W. Diamond and Philip H. Dybvig’s contribution

Diamond and Dybvig developed theoretical models that explain why banks exist, how their role in society makes them vulnerable to rumors about their impending collapse, and how society can lessen this vulnerability, said the Academy.

How Banks functions?

In an article from 1983, Diamond and Dybvig develop a theoretical model that explains how banks create liquidity for savers, while borrowers can access long-term financing.

Their model is based upon households saving some of their income, as well as needing to be able to withdraw their money when they wish.

Diamond and Dybvig show how through above process banks create liquidity. The bank thus creates money, not from thin air but from the long-term investment projects to which it has lent money.

Monitoring of borrowers by banks-A key task

In an article from 1984, Diamond analyses the conditions necessary for banks to take on another important task, namely monitoring borrowers to ensure they honor their commitments.

In his article, Diamond assumes that the bank can monitor borrowers at a certain cost. The bank makes an initial credit evaluation and then follows how the investment progresses.

With this, many bankruptcies can be avoided and societal costs are reduced. Without the bank as an intermediary, this type of monitoring would be too difficult or overly costly.

Advertisement