Lok Sabha elections: BJP’s second list of candidates out, Khattar to contest from Karnal

Names of union ministers Nitin Gadkari and Piyush Goyal also feature in the second list of BJP's 72 Lok Sabha candidates.

The NDA government on 1 February, Friday, presented the last Budget before the nation heads for the Lok Sabha elections.

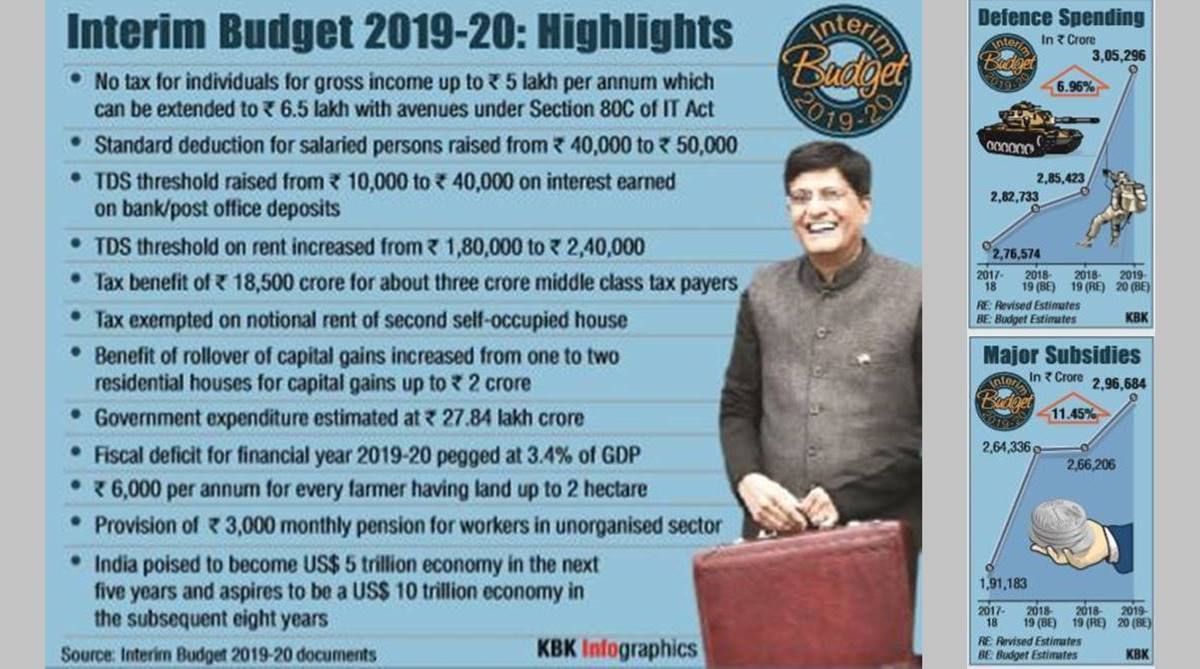

Interim Budget 2019 Highlights: The NDA government on 1 February, Friday, presented the last Budget before the nation heads for the Lok Sabha elections. In his maiden Budget speech in Parliament, Union Finance Minister Piyush Goyal announced a slew of sops for the farmers, middle class, small traders and workers.

The Budget this year has been dubbed Interim Budget in the wake of the impending elections to be held in the next couple of months.

The focus was clearly on the electorate when Goyal announced a full rebate for tax payers with an annual taxable income of Rs 5 lakh. The significance of the announcement could be gauged from the almost 3-minute long desk thumping by the MPs from the ruling party and the alliance partners in approval of the decision.

Advertisement

In a bid to woo the farmers, who have often registered their grievances across states, Goyal announced the PM Kisan Samman Nidhi (PM-KISAN).

The scheme is designed to benefit 12 crore small and marginal farmers who have landholdings of less than 2 hectares with Rs 6,000 per year to be deposited directly into the accounts of the farmers in three instalments.

Goyal also said that there will be a 2 per cent interest subvention on an incremental loan of Rs 1 crore for GST registered SMEs.

While presenting the Budget, Goyal said, “The country witnessed its best phase of macro-economic stability during 2014-19. Annual average GDP growth during 2014-19 is higher than any government since 1991.”

He said that India is now the 6th largest economy in the world today while it was the 11th largest in 2013-14.

The Finance Minister said that the government has broken the back of inflation “from backbreaking inflation during 2009-14”.

Before a packed Lok Sabha, the FM said that India has achieved 98 per cent rural sanitation coverage and 5.45 lakh villages are now “Open Defecation Free” thanks to the ambitious Swacchh Bharat Abhiyan

Highlighting the government’s achievements in tackling corruption, Goyal said that the culture of “phone banking” has been stopped.

“Government has implemented measures to ensure ‘Clean Banking’ and has already recovered Rs. 3 lakh crore in favour of banks and creditors,” he said.

Goyal said that the government’s initiatives such as demonetisation and Fugitive Criminal offenders Act have been able to bring under tax undisclosed income of about Rs 1,30,000 crore.

“Government walked the talk on corruption and ushered in a new era of transparency,” he said.

The following are the highlights of the Budget 2019-20

Farmers

– PM-KISAN launched for the benefit of 12 crore small and marginal farmers who will be provided with assured yearly income of Rs. 6000 per annum

Outlay of Rs. 75,000 crore for FY 2019-20 with additional Rs. 20,000 crore in RE 2018-19

– Outlay for Rashtriya Gokul mission increased to Rs 750 crore

– Rashtriya Kamdhenu Ayog to be setup for sustainable genetic up-gradation of the bovines

Read More: Govt announces PM Kisan Samman Nidhi, Rs 6000 per yr for farmers with less than 2 hectares of land

– New separate Department of Fisheries for welfare of 1.5 crore fishermen to be set up

– 2 per cent interest subvention to Farmers for Animal husbandry and Fisheries activities; additional 3 per cent in case of timely repayment.

– Interest subvention of 2 per cent during disaster will now be provided for the entire period of re-schedulement of loan

Direct Tax proposals

– Income upto Rs. 5 lakh exempted from Income Tax

– More than Rs. 23,000 crore tax relief to 3 crore middle class taxpayers

– Standard Deduction to be raised to Rs. 50,000 from Rs. 40,000

Read More: Income tax limit raised, no tax for people earning up to Rs 5 lakh per annum

– TDS threshold to be raised from Rs. 10,000 to Rs. 40,000 on interest earned on bank/post office deposits

– Existing rates of income tax to continue

– Tax exempted on notional rent on a second self-occupied house

– Housing and real estate sector to get boost:-

TDS threshold for deduction of tax on rent to be increased from Rs. 1,80,000 to Rs. 2,40,000

Benefit of rollover of capital gains increased from investment in one residential house to two residential houses for capital gains up to Rs. 2 crore.

Tax benefits for affordable housing extended till 31st March, 2020 under Section 80-IBA of Income Tax Act

Tax exemption period on notional rent, on unsold inventories, extended from one year to two years

Labour

– Fixed monthly pension to 10 crore unorganised sector workers under Pradhan Mantri Shram Yogi Maandhan scheme

Rs 3,000 per month after 60 years of age with an affordable contribution of only Rs 100/55 per month

MGNREGA

– Rs. 60,000 crore allocation for MGNREGA in BE 2019-20

Health

– 22nd AIIMS to be setup in Haryana

Fiscal Programme

– Fiscal deficit pegged at 3.4 per cent of GDP for 2019-20

– Target of 3 per cent of fiscal deficit to be achieved by 2020-21.

– Fiscal deficit brought down to 3.4 per cent in 2018-19 RE from almost 6 per cent seven years ago

– Total expenditure increased by over 13 per cent to Rs. 27,84,200 crore in 2019-20 BE

– Capital Expenditure for 2019-20 BE estimated at Rs. 3,36,292 crore

– Centrally Sponsored Schemes (CSS) allocation increased to Rs. 3,27,679 crore in BE 2019-20

– National Education Mission allocation increased by about 20 per cent to Rs. 38,572 crore in BE 2019-20

– Allocation for Integrated Child Development Scheme (ICDS) increased by over 18 per cent to Rs. 27,584 crore in BE 2019-20

– Substantial increase in allocation for the Scheduled Castes and Scheduled Tribes :–

Allocation for SCs from Rs. 56,619 crore in BE 2018-19 to Rs. 76,801 crore in BE for 2019-20, an increase of 35.6 per cent

Allocation for the STs increased from Rs 39,135 crore in BE 2018-19 to Rs. 50,086 crore in BE 2019-20, an increase of 28 per cent

– Government confident of achieving the disinvestment target of 80,000 crore

– Focus now on debt consolidation along with fiscal deficit consolidation programme

Poor and Backward Classes

– There will be 25 per cent additional seats in educational institutions to meet the 10 per cent reservation for the poor from upper class communities

– Targeted expenditure to bridge urban-rural divide and to improve quality of life in villages

– All willing households to be provided electricity connections by March 2019

MSME and Traders

– 2 per cent interest subvention on an incremental loan of Rs 1 crore for GST registered SMEs

– At least 3 per cent of the 25 per cent sourcing for the Government undertakings will be from women owned SMEs

– Renewed Focus on Internal trade; DIPP renamed to Department for Promotion of Industries and Internal trade

Defence

– Defence budget to cross Rs 3,00,000 crore for the first time ever

Read More: Defence Budget enhanced beyond Rs 3 lakh crore for first time

Railways

– Capital support of Rs.64,587 crore proposed in 2019-20 (BE) from the budget

– Overall capital expenditure programme to be of Rs. 1,58,658 crore

– Operating Ratio expected to improve from 98.4 per cent in 2017-18 to 96.2 per cent in 2018-19 (RE) and to 95 per cent in 2019- 20 (BE)

Vulnerable sections

– A new committee under NITI Ayog to identify all the remaining De-notified nomadic and semi-Nomadic tribes.

– New Welfare development Board under Ministry of social justice and empowerment for development and welfare of De-notified nomadic and semi nomadic tribes

North East

– Allocation to be increased by 21 per cent to Rs. 58,166 crore in 2019-20 BE over 2018-19 BE

– Container cargo movement through improved navigation capacity of the Brahmaputra

Entertainment Industry

– Indian filmmakers to get access to Single window clearance as well for ease of shooting films

– Regulatory provisions to rely more on self-declaration

– To introduce anti-camcording provisions in the Cinematograph Act to control piracy

Digital Villages

– The Government to make 1 lakh villages into Digital Villages over next five years

Other Announcement(s)

– New National Artificial Intelligence portal to support National Program on Artificial Intelligence

Advertisement