Stock market ends five-day winning streak

At close, Sensex was down 609.28 points, or 0.82%, at 73,730.16. Meanwhile, Nifty opened higher at 22,620.40 and touched a low of 22,419.90 in intraday trades.

Earnings data for the January-March quarter, that has so far conformed to market’s expectations, continue to accelerate gains in equity benchmarks of Bombay Stock Exchange and National Stock Exchange.

The quarterly, as well as yearly numbers being announced by corporate India over the past fortnight, confirm that positive growth momentum is picking up across all segments for the first time in many quarters.

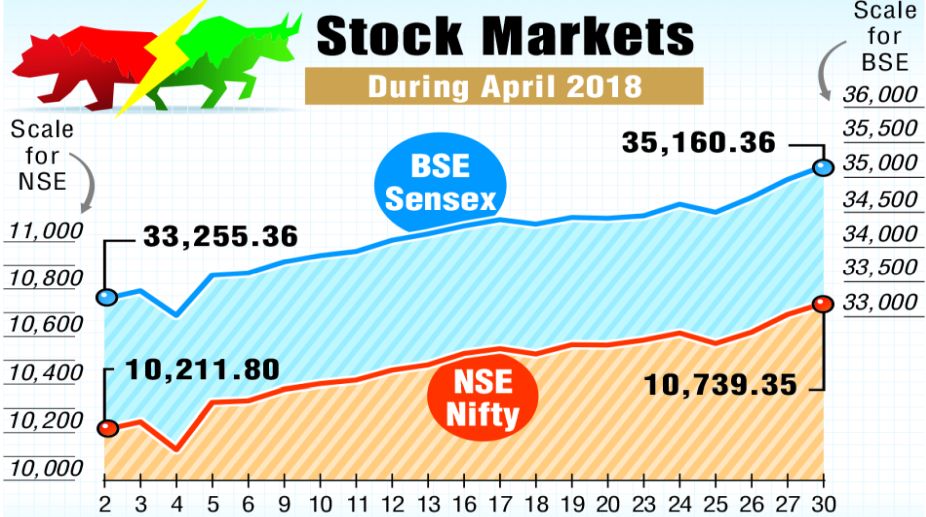

April has seen a turnaround in the 30-share Sensitive Index of BSE and 50-scrip Nifty of National Stock Exchange regardless of significant profit booking by foreign portfolio investors or FPIs in large cap stocks. Not just value buying or short covering but fresh aggressive investment by domestic funds and institutions contributed to gains accrued in Sensex and Nifty, say analysts.

Advertisement

Sensex on Monday was firmly anchored above the 35,000-level and Nifty too was above 10,700 points.

The biggest mortgage lender HDFC and its kin HDFC Bank with IT bigwigs Tata Consultancy Service, Infosys Technologies and the banking sector were the main contributors to the upside journey of Sensex and Nifty on Monday. The BSE benchmark ended 35,160.36 (+190.66) points up 0.55 per cent.

Nifty gained 0.44 per cent to end 10,739.35 (+47.05) points. Nifty Bank and Nifty PSU Bank consolidated their last week’s gains as they ended Monday at 25,531.60 (+137.00) points and 2,863.65 (+48.75) points increasing 0.54 per cent and 1.73 per cent respectively.

HDFC was to declare its Q4 numbers after market hours but almost all brokerages polled by business media gave thumbs up to its earnings citing most stable asset quality and likely growth in corporate lending and for affordable housing.

Motilal Oswal said the mortage lender’s asset quality was healthy for the past several quarters even as it underlined the need for monitoring the asset quality of its corporate loan portfolio.

HDFC Bank, the favourite of FPIs, too, has been consistent in improving its performance quarter after quarter. Analysts say it clearly stands out as the best performing private lenders compared to peers such as ICICI Bank and Axis Bank.

Sentiment in the money or financial market perked up following Reserve Bank of India’s decision of last Saturday removing restrictions on FPIs’ investment in the government Treasury and corporate bonds.

Analysts say this would soften bond yields and attract much required increase in off-shore inflows via FPIs. Apparently, RBI’s decision to withdraw the limit on holding period by FPIs was taken after subdued response to its recent bond auctions.

Equity markets from the US to Dalal Street have been playing down the rising bond yields — and volatility— as is evident in steady climbs of stock indices purely on corporate earnings. Current corporate and financial sector performance is the only trigger that is driving the indices up.

Latest data suggests FPIs were net sellers of Rs 9,235.09 crore in domestic equity up to 27 April. They were net buyers just for two days 11 and 12 April when their buying was Rs 731.20 crore. DIIs ( net) bought shares worth Rs 8,401.90 crore in the same period.

However, analysts expect a spell of volatility in Dalal Street ahead of the election to Karnataka Assembly due on 12 May.

The outcome that will be clear by the afternoon of 15 May is likely to influence further course of the stock market until the next three crucial state polls in Madhya Pradesh, Rajasthan and Chhattisgarh where the Bharatiya Janata Party is in power.

Geopolitical conditions elsewhere are fast improving as is seen from two Koreas coming closer in a bid to end their long-drawn feud. Analysts say as in the past, the market would like to see BJP sailing through the coming assembly polls since India Inc. supports its pro-reform Rightist policies.

In Sensex on Monday 25 stocks advanced and six declined. For Nifty the ratio was 33:16:1 . Gainers in BSE benchmark included Yes Bank Rs 360.90, 3.57 per cent; HUL Rs 1,698, 2.27 per cent; TCS Rs 3,529, 2.15 per cent; Kotak Mahindra Bank Rs 1,210.50, 1.85 per cent; and SBI Rs 246, 1.38 per cent.

Advertisement