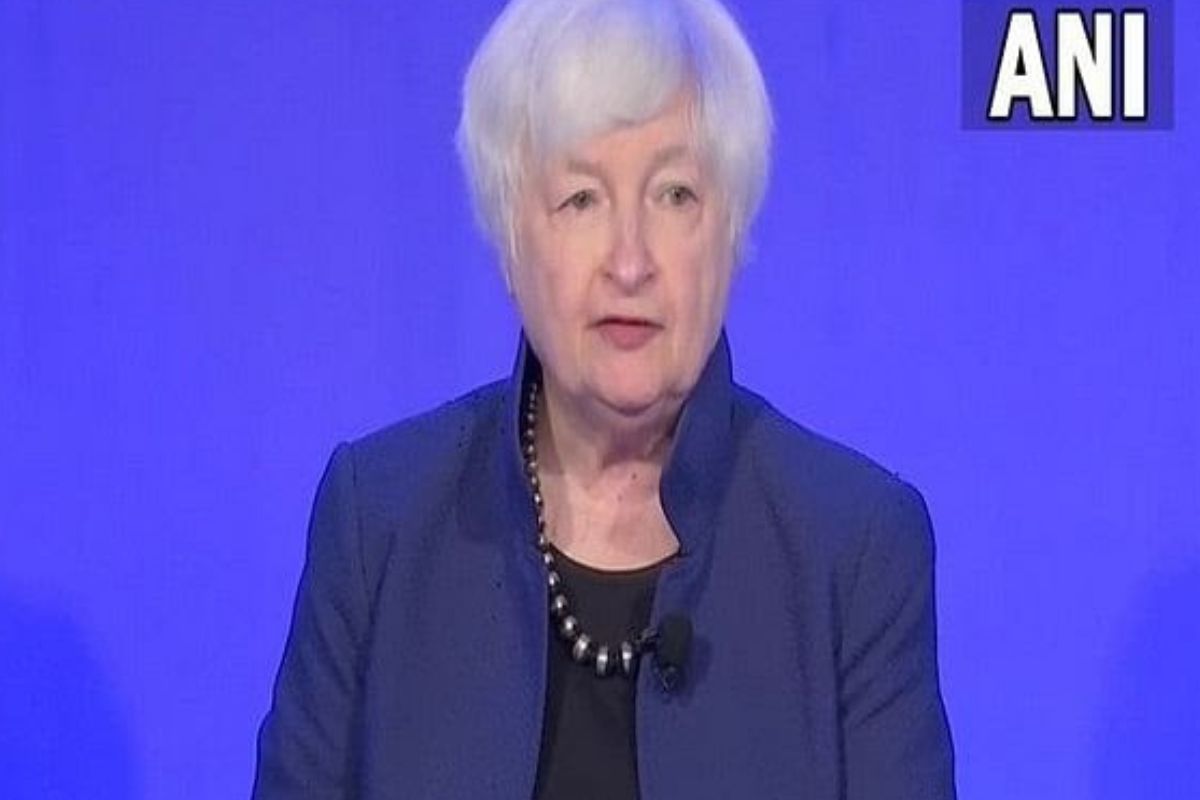

US Treasury Secretary, Janet Yellen has ruled out a bailout from the federal government for the now-collapsed Silicon Valley Bank.

“During the financial crisis, there were investors and owners of systemic large banks that were bailed out,” Yellen said on CBS News in an interview with “Face the Nation” on Sunday, referring to the 2007-2009 financial crisis that led to a massive government rescue aimed at heading off a wider catastrophe. “And the reforms that have been put in place mean that we’re not going to do that again. But we are concerned about depositors and are focused on trying to meet their needs,” she added.

Yellen said she’s been hearing from depositors all weekend, many of whom are “small businesses” and employ thousands of people. “I’ve been working all weekend with our banking regulators to design appropriate policies to address this situation,” the Treasury secretary said, declining to provide further details.

The bank’s failure has also raised concern about a repeat of the 2008 financial crisis, but Yellen sought to reassure Americans that the collapse is an isolated incident, reported CBS News.

“What I do want to do is emphasize that the American banking system is really safe and well-capitalized, it’s resilient,” said Yellen.

California regulators shut down Silicon Valley Bank on Friday after depositors rushed to withdraw money last week amid concerns about its balance sheet. The Federal Deposit Insurance Corporation (FDIC) was appointed receiver, and regulators are working to find a buyer for the institution, which ranked as the 16th-largest bank in the US before its failure.

The collapse of the 40-year-old bank, which catered to the tech industry, is the largest financial institution since the failure of Washington Mutual in 2008.

The collapse, the second largest bank failure in US history, roiled Wall Street for Monday morning’s opening of the stock market.