Foreign fund inflows in Indian stocks highest after 20 months in August

Meanwhile, FPIs have turned net buyers in Indian equity markets for two consecutive months through August and helped domestic indices to stay buoyant.

Meanwhile, FPIs have turned net buyers in Indian equity markets for two consecutive months through August and helped domestic indices to stay buoyant.

Call it a moment of epiphany or homecoming, the parties of the head honcho of one of the top 5 outdoor advertising agencies in India used to be the talk of the town. The parties were replete with the biggest of Bollywood stars as attendees.

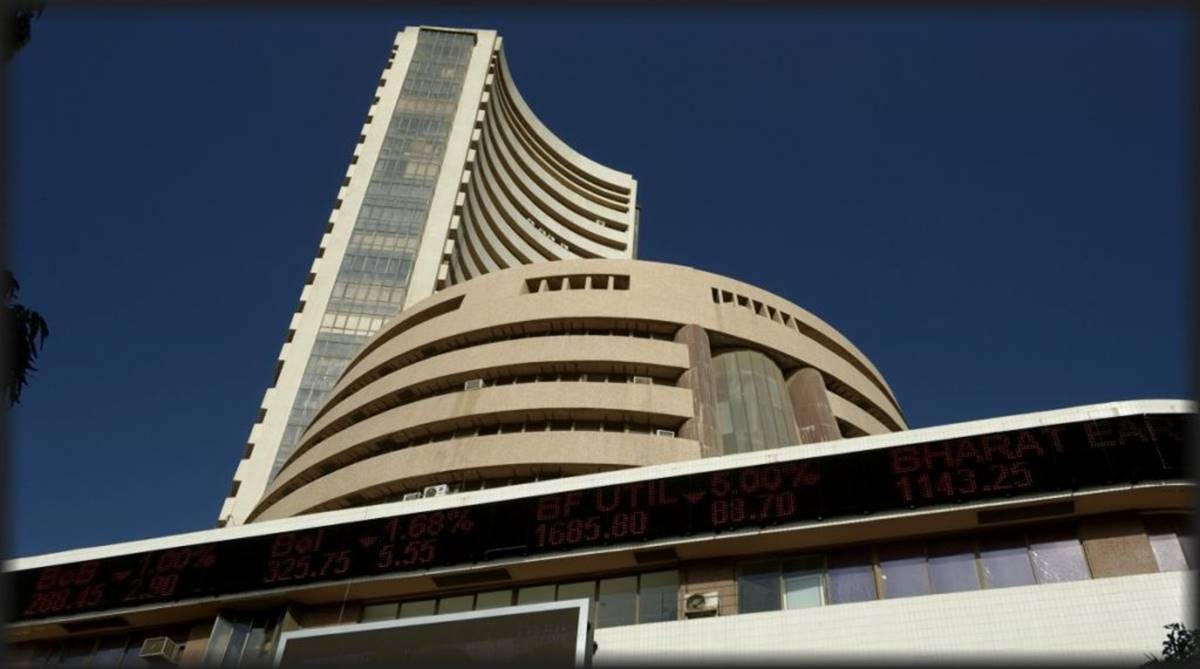

The Sensitive Index (Sensex) of the BSE, which had closed at 36,212.91 points on Wednesday, opened higher at 36,258 points.

According to analysts, caution ahead of key macro-economic data, coupled with a rise in demand for US dollars also dragged the rupee lower.

At 3.30 p.m., the Nifty50 provisionally closed at 11,023.20 points -- higher by 74.90 points or 0.68 per cent -- from its previous close of 10,948.30 points.

Taking a cue from global markets, the key Indian equity market indices on Thursday opened higher.

The key Indian equity market indices on Thursday opened higher despite weakness in Asian stocks. The Sensitive Index (Sensex) of…

Positive global cues on the back of trade war fears easing between major world economies pulled the key Indian equity…

The key Indian equity indices opened on a positive note on Monday. The wider Nifty50 of the National Stock Exchange…

The key Indian equity market indices on Thursday opened higher but with a cautious approach ahead of the January futures and options…