Many large companies to move Appellate Authority against GST demand notices

In recent days, an increasing number of GST notices have been sent to many companies mainly on account of alleged discrepancy in input tax credit (ITC).

In recent days, an increasing number of GST notices have been sent to many companies mainly on account of alleged discrepancy in input tax credit (ITC).

Crosses Rs 20 lakh crore mark in FY24

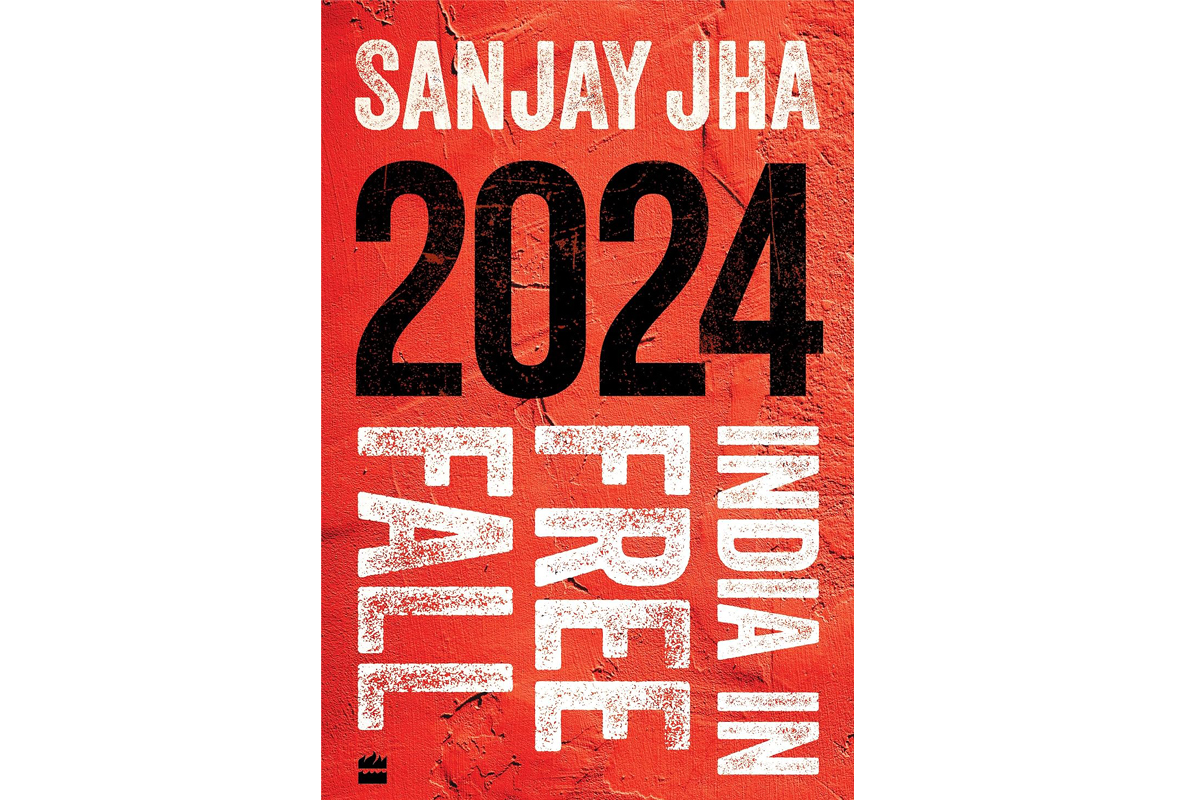

The fake news industry has grown by leaps and bounds under the tutelage of the BJP.

The search operation was conducted by the Office of the Deputy Commissioner of State Tax, Range-A, Lucknow.

Union Minister for Finance Nirmala Sitharaman will inaugurate the one-day conference and will also deliver the keynote address.

The CBI has arrested a commissioner of the Goods and Services Tax (GST) department from Kanpur and eight others, including…

In a rare display of speedy resilience stock market indices took the Finance Minister Arun Jaitely’s budget announcement imposing 10…

The year 2017 has been one of the most defining years for the retail sector in many ways. It was…

Consumer rights advisers help consumers in safeguarding their interests and protecting their rights. In this premise, they render every bit…

The Deputy Chief Minister of Delhi, Manish Sisodia hit out at the Union Budget 2018-19 on Thursday, saying that “BJP…