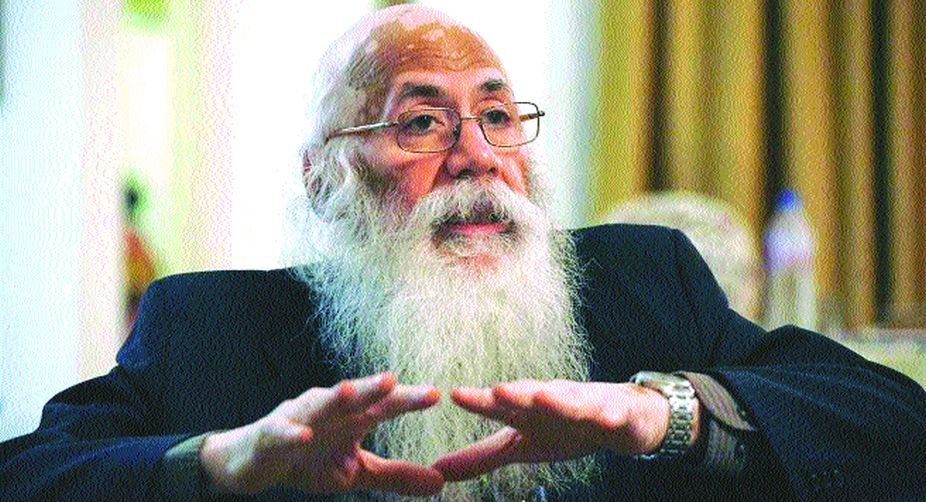

Arun Kumar, a former professor of economics at Jawaharlal Nehru University, is an authority on black money. He has authored The Black Economy in India, one of the most authoritative accounts on the extent of the problem in the country. In an interview, Prof Kumar explained the consequences of demonetisation and its impact on the economy and jobs. Excerpts:

Q. What are the short-term and long-term effects of the demonetisation exercise?

A. The short-term impact has already begun. Economy is slowing down in all sectors, including agriculture, industries and services. Unemployment is increasing rapidly and so is the hardship of the poor. If the cash crunch lasts for two to three months, it would have a long-term effect spread over the next three years as investment will slow down. Then it cannot be reversed.

If the cash crunch persists beyond a month, non-performing assets (NPAs) of the banks will increase, making it difficult to get credit. It will feed into the sickness of the industry.

Q. What is your estimate of job losses?

A. Tens of millions will face crisis in their lives, especially the unorganised sector which employs 94 per cent of the country’s workforce. The poor are badly affected, they are losing jobs. Four lakh jobs may be lost in one industry, say in the export sector like textiles. Agriculture, which employs maximum workforce in the unorganised sector, is also facing problems and labour there is having difficulty. They are not getting work because people don’t have cash to pay them. Whether it’s rural or urban areas, the poor have been hit the hardest as for them everyday employment matters.

Q. When will the pain start for the middle class?

A. The middle class is already feeling discomfort but they have not yet begun to feel the pain as they are using credit and debit cards. However, the real pain will start when their income gets affected. It’s when demand falls and production slows that middle class people will face lay-offs. And they will begin to feel the pain.

Q. What will be the impact of the cash-crunch situation on GDP growth?

A. GDP growth will come down by at least two per cent. Some people are calling it an exaggeration because there are financial people who would not like to project a rapid decline. Most businesses are down. Some like the wholesale trade are down to 30 per cent. If the growth becomes negative after November, the average growth rate for FY 2016-17 may turn out to be two to three per cent.

Q. How long will the currency shortfall last?

A. The currency shortage will continue for eight months to one year and not just 50 days specified by the government. RBI is trying to replace in a very short period of time all the old currency that has been printed over the past 15 years. There is bound to be shortage of paper and ink. A tender to buy ink was floated recently by the RBI.

Q. What should the government do to ease crisis?

A. RBI should print 50 per cent more currency to meet the increased demand created due to people hoarding cash as they expect the shortage to continue. Until RBI prints more notes and replaces all the scrapped currency with it, the government should allow people to use old currency to make up for the shortage. If there is a shortage of currency, people will have difficulty in buying, impacting demand. Real shortage will be seen in the first week when the salaries are paid.

Q. What do you think about the government’s idea of shifting to a cashless society? There’s a fear that online transactions are not safe.

A. India is not prepared to be a cashless economy. In India, where literacy and prosperity levels are very low compared to America, I do not see it going cashless in 10 years. However, more people in urban areas may turn towards it than in rural areas. But to expect that it will happen in one to two years is not true. The US is the most cashless society at present but even there everybody uses a huge amount of dollars. Many people are afraid to use credit and debit cards. They fear that there will be spamming.

Q. Will demonetisation meet the government’s objective of checking black money, counterfeiting currency and terrorist financing?

A. It can’t be achieved by only removing black cash and not stopping black income generation. Black wealth is accumulated over many years and black money is only a small part of it. Next year black money will again be generated. The modus operandi is like this. From the cash you earn, you keep a certain portion aside. You make these savings and want to earn returns on it. Since you do not want to keep it idle in beds or lockers, a lot of this black cash would be circulating. Just like the black economy, the cash will circulate and people use this money. Many politicians and policemen would give it to businessmen to earn returns. The mechanism of generation of black money is continuous.

As far as counterfeit notes are concerned, they are only 400 per million, which is very small. RBI says there is only Rs 400 crore worth of counterfeit currency out of a total Rs 17.5 lakh crore currency in circulation. Terrorists need financing. So, they print these fake notes and circulate it. It’s used only once and goes out of the system. So they have to print more and more money. That is what you have to stop. But it is not possible to stop it through demonetisation, because there are state actors across the border involved in counterfeiting. They can counterfeit the new currency notes also.

Q. What will be the effect of this move?

A. Black money or the cash component that may be immobilised is only three per cent of the total black income generated this year. The total black money generated over the past many years is around Rs 90 lakh crore which is about 60 per cent of the GDP. Of Rs 14.5 lakh crore which the government is hoping to get back, at least half will be in circulation with the businesses, while five to six lakh crore will be in households. So assuming that three per cent population owns much of the black wealth, you would have immobilised only three lakh crore through this move. So, the black income will continue to be generated as it is done through investment in things like gold, property while it may not depend much on cash circulation. So to expect that a lot of black money will be revealed is futile. The point is that the problem of black economy which was created over the past 70 years cannot be solved overnight. But it also creates problems for the white economy as both are intertwined.