To ensure accountability on the part of cable operators, the Punjab Cabinet on Monday approved levy of an entertainment tax by urban and rural local bodies on DTH (direct to home) and local cable connections.

As per the Cabinet decision, local bodies will be eligible to impose and collect a nominal entertainment tax of Rs.5 per DTH connection and Rs.2 per local cable connection per month with the enactment of ‘The Punjab Entertainments & Amusements Taxes (Levy & Collection by Local Bodies) Act 2017’, which will replace the earlier entertainment tax system under the new GST regime.

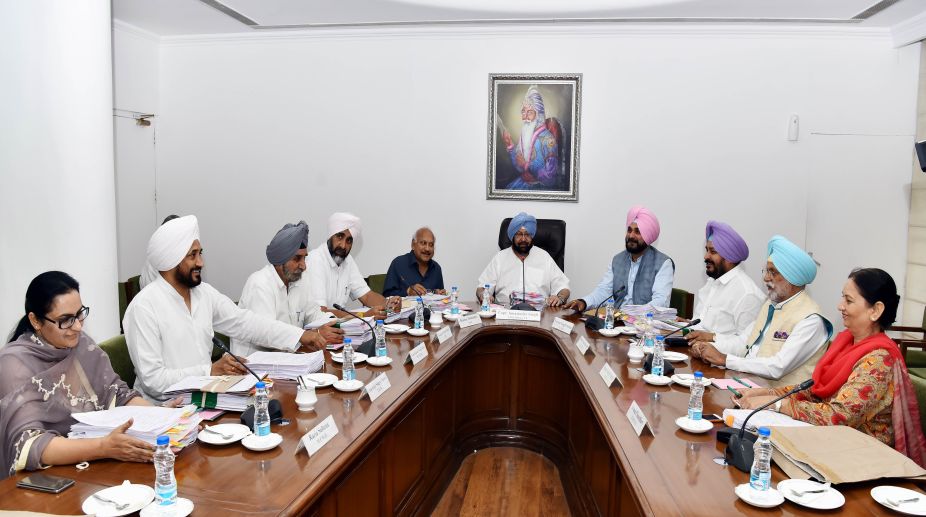

The government proposes to bring the new legislation in the next session of the Assembly. Local Bodies minister Navjot Singh Sidhu told the cabinet, chaired by the chief minister Amarinder Singh, that the nominal tax would ensure accountability on the part of cable operators.

With the new tax structure in place, the government would be able to ask them to disclose details of their connections, which they have so far been prone to hiding in order to evade tax.

The move follows a proposal mooted by the Local Government department, allowing all the urban local bodies and gram panchayats to levy such tax. However, no entertainment tax has been proposed for Cinemas, Multiplexes, Amusement Parks and similar other places providing facilities for entertainment and amusements.

With nearly 16 lakh DTH and 44 lakh cable connections in the state, the local bodies are expected to earn annual income of Rs.45 to Rs.47 Crore following the imposition of the tax, which is likely to mop up Rs.9.60 Crore and Rs.36.96 Crore respectively from the two segments.

It may be recalled that after introduction of Goods and Services Tax (GST) by the Union government with effect from July 1, 2017, entertainment tax being levied and collected by the state government through the Department of Excise and Taxations stood withdrawn.

The power of levying entertainment tax has now been conferred on the Panchayats and Municipalities through amendment in entry 62 of the state list to the 7th schedule of the Constitution of India.

To enable farmers to lay underground irrigation pipelines through land of other holders, the cabinet also approved an amendment to the existing law to grant ‘Right of Way’.