Adani infuses Rs 8,339 crore into Ambuja Cements, raises stake to 70.3%

Last month, it infused Rs 6,661 crore into the cement company raising their stake in the company by 3.6 to 66.7 per cent.

The Adani Group’s market cap is now Rs 14.4 lakh crore and is on course to touch Rs 15 lakh crore (nearly $180 billion).

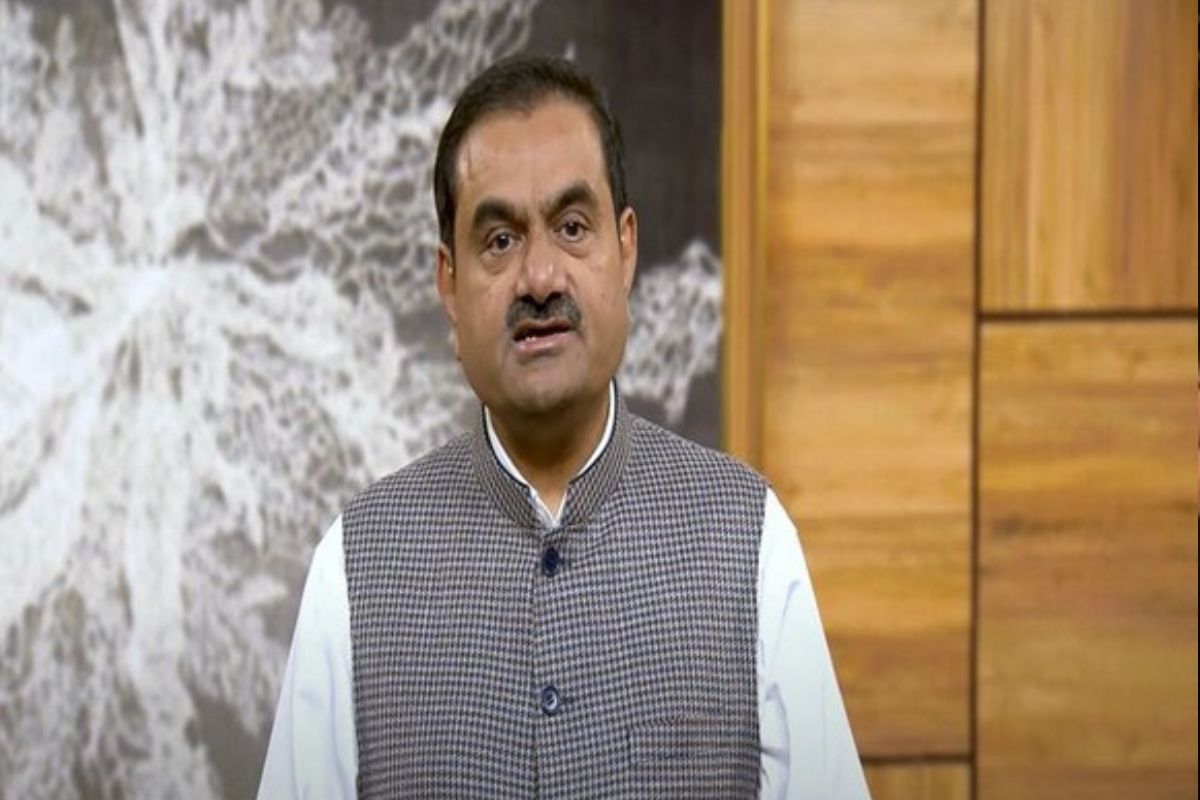

Adani Group's Chairman Gautam Adani (Photo: ANI)

The Adani Group’s market cap is now Rs 14.4 lakh crore and is on course to touch Rs 15 lakh crore (nearly $180 billion).

On December 1, the market capitalisation stood at Rs 11.22 lakh crore. In the trading week that ended on December 8, the market capitalisation gained Rs 3.15 lakh crore ($37.7 billion), the highest weekly rise this year.

The highest weekly gain of Rs 83,000 crore was recorded by Adani Green Energy, which recently raised $1.36 billion in construction facilities from a consortium of international banks.

Advertisement

The Group’s flagship company Adani Enterprises gained over Rs 52,000 crore in the same period. Adani Total Gas’ market cap was up Rs 50,000 crore and Adani Ports and Special Economic Zone over Rs 42,000 crore.

The recovery in the stocks and their resurrection in the market caps the end of a tough year for Adani Group Chairman Gautam Adani, a period in which one of India’s richest men displayed his resilience in the face of unending attacks that began in January.

Shares of all publicly traded group companies took a massive hit after Hindenburg Research made accusations of stock manipulation and accounting fraud.

Although Gautam Adani denied the allegations calling it a calculated attack on India but at one point the attacks cleared out more than $150 billion in market value from the Group’s publicly listed companies.

But Gautam Adani didn’t give in and started fighting back. To restore the trust of investors, investors like GQG and the Abu Dhabi conglomerate International Holding were sold shares of some companies.

The Group also paid back loans that were backed by stock. For example, only 2.4 per cent of the shares in Adani Ports continue to be pledged as of the September quarter, down from 17.3 per cent at the end of 2022.

The reports of Hindenburg Research and OCCRP posed a challenge to the Group’s growth, leverage and valuations. But its backers including TotalEnergies, Wilmar International and global banks including Standard Chartered and Singapore’s DBS stood their ground.

The U.S government’s investment in APSEZ’s Colombo port project also came as a helpful endorsement. As a result, Florida-based GQG Partners, which made big bets on Group companies this year, has seen the value of its investments soar.

Strong performance

In the first half of fiscal year 2024, the Adani portfolio demonstrated robust financial performance, further enhancing its strong credit profile. During the period, the portfolio level EBITDA stood at Rs 43,688 crore ($5.3 billion), up 47 per cent Y-o-Y.

This outpaced the portfolio’s historical five-year Compound Annual Growth Rate (CAGR) trajectory of 26.3 per cent. It is noteworthy that H1 FY24 EBITDA surpassed the full-year EBITDA of FY22. Additionally, Trailing Twelve Month EBITDA is notably close to three times FY19 EBITDA.

The growth was driven by an impressive performance of the core infrastructure businesses, which grew by 52 per cent Y-o-Y to Rs 37,379 crore ($4.5 billion), contributing 86 per cent of the total EBITDA.

These businesses include the utility (Adani Green Energy, Adani Energy Solutions, Adani Power and Adani Total Gas), transport (Adani Ports & SEZ) and other infrastructure businesses (those incubated by Adani Enterprises – green hydrogen integrated manufacturing, airports and roads).

The expansion reflects the portfolio’s focused investment in infrastructure development, which is yielding significant results. AEL’s strategic initiatives to bolster its infrastructure portfolio are in line with the rising demand for sustainable and robust infrastructure in India and beyond.

Market rally

In the last week of November, the Supreme Court, which is hearing four petitions in the Adani-Hindenburg case, reserved its order, saying it could not be assumed that the Hindenburg report was factually correct. This triggered a rally in the group stocks.

Following this came a statement by Group Chief Financial Officer Jugeshinder Singh that the Group plans to invest around Rs 7 lakh crore over 10 years with most funds being generated from within.

This spurt at the stock market led to Adani Enterprises Ltd being named as the best all-round wealth creator for the second time in a row in Motilal Oswal’s top 10-wealth creators for 2018-2023.

Attacks by short sellers pose a huge and unique challenge for companies. While the ultimate goal of companies is to increase shareholder value, short sellers destroy them. Their only aim is to gain through a drop in the company’s stock price by releasing unfavorable information about them.

But the attack on the Adani Group does not seem to have had the desired effect; in fact, it seems to have strengthened the Group even more by rallying investors behind it. Though its stocks fell immediately after the release of the report, the Group emerged from it stronger and more resilient.

Advertisement