RBI MPC member predicts ‘less severe’ high food inflation

The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) member highlighted that going ahead, as India develops, the problem of high food inflation would be "less severe".

RBI had last revised its policy rate on May 22, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

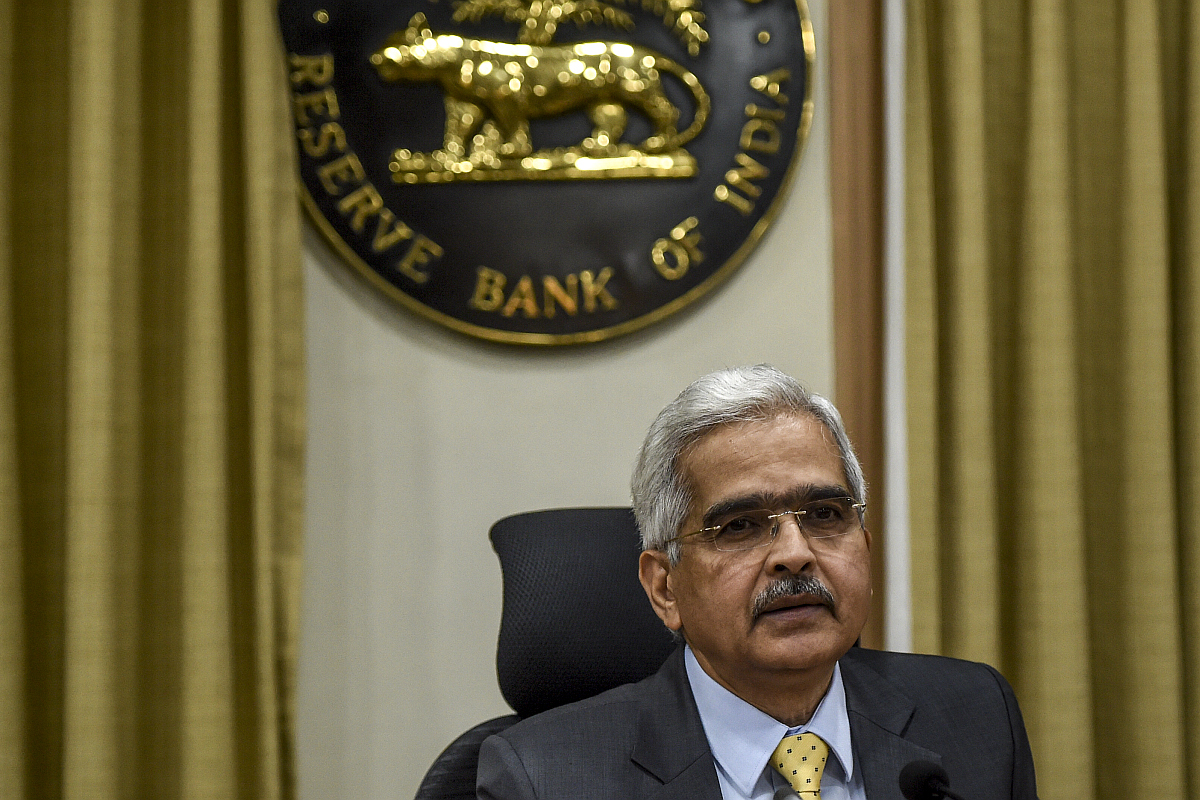

Das also said that the economy contracted by 23.9 per cent in the first quarter and 7.5 per cent in the second quarter on account of the COVID-19 pandemic. (Photo: AFP)

The Reserve Bank of India on Friday maintained the status quo on benchmark interest rates for the third time in a row and maintained an accommodative stance. The repo rate was left unchanged at 4 per cent while the reverse repo rate also continued at 3.35 per cent.

The benchmark repurchase (repo) rate has been left unchanged at 4 per cent, Governor Shaktikanta Das said while announcing the decisions taken by the central bank’s Monetary Policy Committee (MPC). He also said that the Central Bank expects the economy to record positive growth in the second half of the current financial year.

“MPC decided to continue with accommodative stands of monetary policy as long as necessary, at least till current financial year and into next year to revive growth on a durable basis and mitigate the impact of Covid-19 while ensuring that inflation remains within the target,” said the RBI Governor.

Advertisement

The central bank had slashed the repo rate by 115 basis points since late March to support growth.

RBI had last revised its policy rate on May 22, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

Das also said that the economy contracted by 23.9 per cent in the first quarter and 7.5 per cent in the second quarter on account of the COVID-19 pandemic.

“The second half is expected to show some positive growth,” he said, adding that during the financial year as whole the economy was likely to contract by 7.5 per cent, which is an improvement over its previous projection of 9.5 per cent contraction.

In October, the RBI had projected the contraction in gross domestic product (GDP) at 9.5 per cent.

The Governor said the GDP is expected to turn positive in the third quarter and expand at 0.1 per cent. The last quarter is likely to see an expansion of 0.7 per cent.

Hence, the growth in second half of the fiscal is expected to show a positive growth.

In its October monetary policy statement, RBI had said the real GDP growth in 2020-21 is expected to be negative at (-) 9.5 per cent, with risks tilted to the downside (-) 9.8 per cent in Q2 2020-21; (-) 5.6 per cent in Q3; and 0.5 per cent in Q4.

The 26th meeting of the rate-setting MPC with three external members: Ashima Goyal, Jayanth R Varma and Shashanka Bhide, began on December 2. This is the second meeting of these members who are appointed for a term of four years.

The government moved the interest rate setting role from the RBI Governor to the six-member MPC in 2016. Half of the panel, headed by the Governor, is made up of external independent members.

MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2021, with an upper tolerance of 6 per cent and lower tolerance of 2 per cent.

Advertisement