Challenge in Bihar

In the tumultuous arena of Bihar politics, where alliances shift like sand dunes in the wind, this election seems poised to redefine the political landscape.

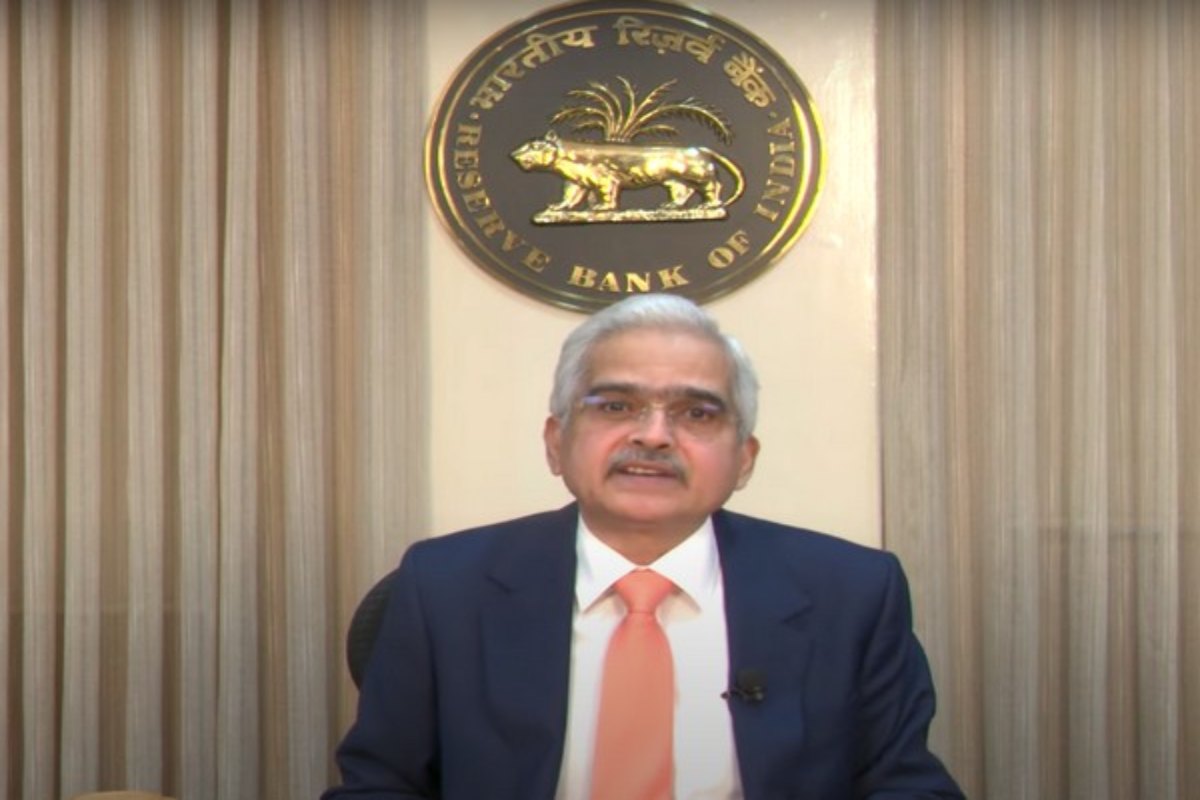

Monetary policy in India must remain actively disinflationary despite the recent sharp fall in core inflation, Reserve Bank of India Governor Shaktikanta Das said at the World Economic Forum in Davos.

[Photo : ANI]

Monetary policy in India must remain actively disinflationary despite the recent sharp fall in core inflation, Reserve Bank of India Governor Shaktikanta Das said at the World Economic Forum in Davos.

Headline inflation has substantially eased from its highly elevated level of the summer of 2022 underpinned by steady moderation in CPI core inflation. There is easing of price momentum across core goods and services.

“This would show that our monetary policy action of increasing the repo rate by 250 basis points between May 2022 and February 2023, together with rebalancing of liquidity, is working,” the governor said.

Advertisement

Even as the cost-push pressures induced by high commodity prices and supply-side shocks have eased, adverse transitory food price shocks with their increasing incidence and intensity, are imparting considerable volatility to headline inflation, he added.

Das added that going forward, the inflation outlook would be considerably influenced by food prices, which remain uncertain. Recurring food price shocks could lead to de-anchoring of inflation expectations and generalisation of price pressures.

Monetary policy, amidst these uncertainties, needs to be alert and remain actively disinflationary to steer inflation towards the target rate of 4per cent on a durable basis. Needless to add that a stable inflation will provide the bedrock to India’s growth ambitions, he said.

Shaktikanta Das further said amidst an uncertain and challenging global macroeconomic environment, the Indian economy presented a picture of confidence, positivity and optimism.

”Turning to the outlook on inflation and growth for the next financial year, our research teams are in the process of making a comprehensive assessment for our forthcoming February 2024 monetary policy.

“At this stage, our expectation is that the CPI inflation will average around 4.5 per cent in FY 2024-25,” he added.

Further talking about the GDP growth in India, the governor said it will touch 7 per cent in FY 2024-25.

Consequently, growth would be 7 per cent and above for four consecutive years starting from FY 2021-22, he added.

Notably, the International Monetary Fund (IMF) has projected that India’s contribution to world growth will rise from the current 16 per cent to 18 per cent by 2028.

The governor said the strong domestic demand remained the main driver of growth, although there has been a significant increase in the Indian economy’s global integration through trade and financial channels. Higher reliance on domestic demand cushioned India from multiple external headwinds.

Advertisement