Players should focus on sports: Haryana CM Khattar preaches wrestlers

The wrestlers are demanding action against Brijbushan Sharan Singh, accused of sexually harassing women players.

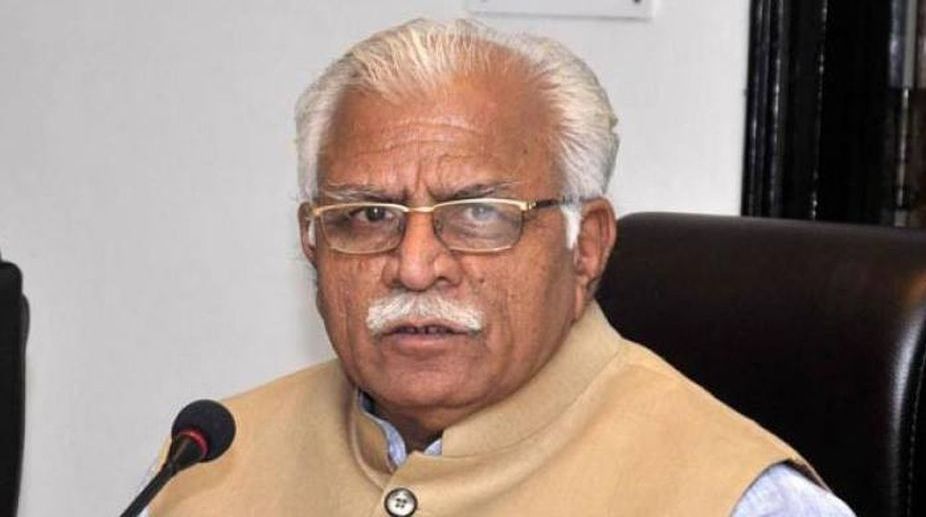

Haryana CM Manohar Lal Khattar (Photo: Facebook)

Haryana Cabinet which met on Thursday gave its approval to notify certain provisions of Haryana Goods and Services Tax (GST) Act, 2017 (Haryana Act No 19 of 2017) and also approved Composition and Registration Rules under Haryana Goods and Services Tax Act, 2017.

An official spokesperson said that The Haryana GST Act is to come into force with effect from 1 July, 2017.

The Cabinet led by Chief Minister Manohar Lal Khattar also notified ‘www.gst.gov.in’ as the common GST electronic portal to facilitate registration, payment of tax, furnish returns, computation and settlement of integrated tax and electronic way bill.

Advertisement

A draft notification, which has been approved by the GST Council for bringing in force various sections of Haryana GST Act was approved and has come into force on Thursday.

The government will appoint Excise and Taxation Commissioner (ETC) as the Commissioner of State Tax for carrying out the purpose of Haryana GST Act. There will also be Special Commissioners of State Tax, Additional Commissioners, Joint Commissioners, Assistant Commissioners, ET Officers and Assistant ET Officers of State Tax to carry out the purpose of Haryana GST Act. The government will also appoint Taxation Inspectors to assist the Commissioner for implementation of Haryana GST Act.

The Department has prepared draft rules of composition and registration on the recommendations of the GST Council, which would be notified in view of the process of migration and new registration required to be initiated even before 1 July.

In another notification, the government specified the persons who are engaged only in making supplies of taxable goods or services or both, the total tax on which is liable to be paid on reverse charge basis by the recipient of such goods or services or both under sub Section (3) of Section 9 of the Haryana GST Act.

Advertisement