The country’s economy is facing a familiar challenge ~ the perennial struggle to meet divestment targets. The revelation that the Centre is set to miss its divestment goal by a staggering sum in the current fiscal year is a stark reminder of the persistent hurdles on the road to economic reform. For the fifth consecutive year, the divestment targets have proven elusive, even as the Centre grapples with a misalignment of priorities exacerbated by the impending Lok Sabha elections. As electoral considerations take centre-stage, economic policies often take a back seat, creating a scenario where the government’s divestment ambitions are compromised. At the heart of this issue lies the delayed sale of state-run firms, notably the hurdles in vetting buyers for IDBI Bank and the protracted privatisation of NMDC Steel. The bureaucratic processes, particularly the vetting by the Reserve Bank of India, have elongated the divestment timeline, pushing it beyond the next general election.

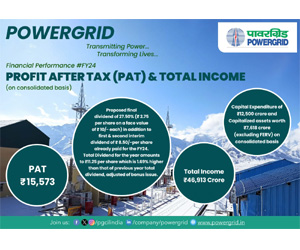

These delays compounded by state elections have left the government scrambling to achieve just over half of its divestment target. The stark reality is that the government’s plans to sell companies across diverse sectors ~ from steel to fertilisers and oil and gas ~ have been hampered since 2019. Lack of political interest in privatisation will likely stall any significant progress in the next six months. This struggle, however, comes against the backdrop of a resilient economic performance. Despite the government falling short of divestment targets, it has managed to accrue Rs 8,000 crore through stake sales this year, with higher dividends from some staterun firms partially offsetting the shortfall in earnings from divestment. Steady profits of these firms have allowed for increased dividend payouts, contributing to the government surpassing its Rs 4,300 crore dividend target from state-run entities. The elephant in the room remains the impact on the fiscal deficit target of 5.9 per cent of GDP. Despite the divestment setbacks, government officials assure that the delays in privatisation will not hinder this target.

The centre’s ability to adapt and leverage other revenue streams, such as increased dividends, underscores the resilience of India’s fiscal policies. In the stock market realm, the Centre has achieved a record high, with an index of state-owned entities reaching 13,242 on November 16. However, this success is tempered by the fact that only minority stakes in five companies have been sold through offer-for-sales on stock exchanges. While divestment targets might be a yardstick for economic progress, the broader economic indicators suggest a certain robustness that transcends the periodic challenges in achieving privatisation goals. As the nation navigates these economic crossroads, the emphasis should be on fostering a conducive environment for privatisation, addressing bureaucratic bottlenecks, and ensuring that economic policies remain a priority even in the face of impending elections. The balancing act between economic reform and political imperatives will undoubtedly shape India’s economic trajectory in the years to come.