Congress committing dacoity on rights of OBCs, SCs, STs: PM

“Wherever it (Congress) can do it, it will try to loot the claims of the SCs, STs and OBCs and give them to others,” said Modi.

In her letter she said, MSMEs contribute close to one-third to India’s Gross Domestic Product (GDP) and account for almost 50 per cent of the country’s exports.

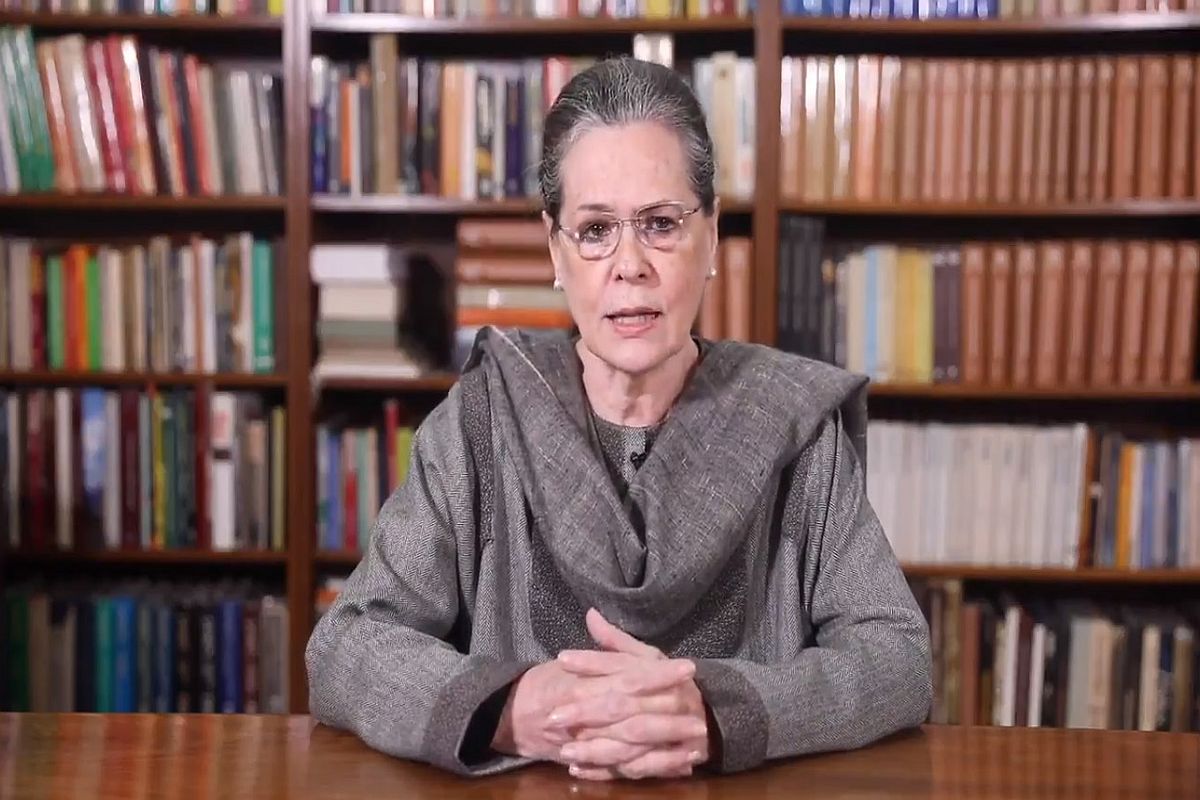

Congress chief Sonia Gandhi. (Photo: IANS)

Congress chief Sonia Gandhi has given ‘five-pointers’ to Prime Minister Narendra Modi on Saturday for the betterment of micro, small and medium scale enterprises (MSME) sector amid the nationwide lockdown.

In her letter she said, MSMEs contribute close to one-third to India’s Gross Domestic Product (GDP) and account for almost 50 per cent of the country’s exports.

The sector also employs over 11 crore people. But the lockdown necessitated by the COVID-19 pandemic has put most economic activities to a halt and over 6.3 crore MSMEs “stand on the verge of economic ruin”, she said in the letter.

Advertisement

“Every single day of the lockdown comes at a cost of Rs 30,000 crore to the sector. Nearly all MSMEs have lost sales orders, seen a complete cessation of their work, and have had their revenue negative impacted by the lockdown,” she said.

Congress President Smt. Sonia Gandhi writes to PM Modi on the grave economic crisis facing the nation. She reiterated the concerns of MSMEs & suggested five concrete ideas for redressal. pic.twitter.com/u1wYmI9AxI

— Congress (@INCIndia) April 25, 2020

The five points recommendations that she gave in her letter are as follows,

“First, announce a Rs 1 Lakh crore MSME Wage Protection package. This would go a long way in shoring up these jobs, boosting morale as well as greatly alleviating the predicted economic spiral,” Sonia Gandhi said.

“Second, establish and deploy a credit guarantee fund of Rs 1 lakh crore. This is necessary to provide immediate liquidity to the sector and ensure adequate capital is available to MSMEs at a time when they need it the most,” she said.

“Third, actions taken by RBI (Reserve Bank of India) must get reflected in actions by commercial banks to ensure adequate, easy and timely credit supply to MSMEs. Furthermore, any monetary action at the RBI’s end must be supported by sound fiscal support from the government. A 24×7 helpline in the ministry to provide guidance and to assist MSMEs during this period would also be of enormous value,” she added.

“Fourth, these measures need to be supported by expansion and extension of the RBI’s moratorium on payment of loans for MSME beyond the stipulated period of three months. The government should also explore a waiver/reduction of taxes for MSMEs and other sector-specific measures.”

“Fifth, high collateral security is leading to a denial of credit. Same is the case with limits on margin money being extremely high. These factors combine to ensure a lack of access to available credit for MSMEs and must be addressed,” Congress chief said.

In a late-night order, the Government on Friday allowed the opening of shops as part of the easing of lockdown restrictions announced on April 15.

The Ministry of Home Affairs in an order said that all shops registered under the Shops and Establishment Act of the respective State and Union Territory, including those in residential complexes and market complexes outside the limits of municipal corporations and municipalities, have been allowed with 50 per cent strength of workers, making the wearing of masks and social distancing mandatory.

Advertisement