Punjab Health Secy gets notice on Moosewala’s father’s harassment claim

The government has questioned why the matter was not brought to the attention of the Chief Minister or the Health Minister before an investigation.

(Photo: SNS)

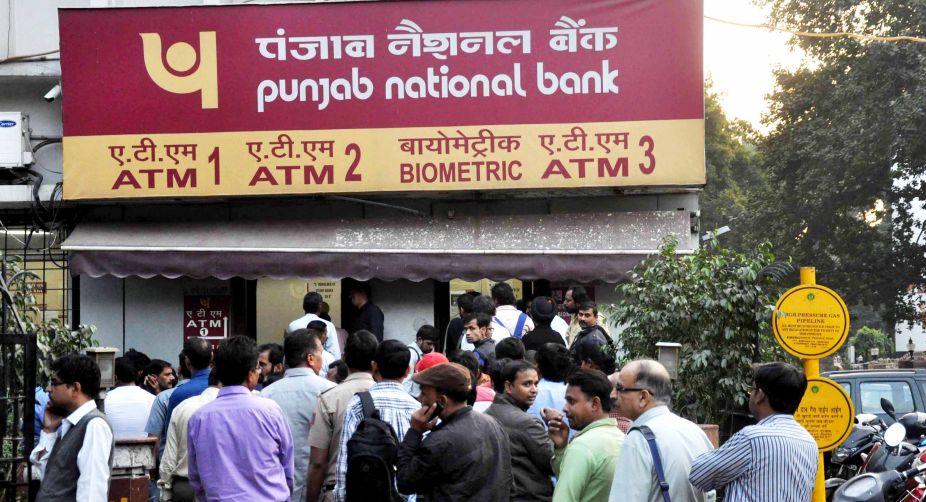

Punjab government promise for farm loan waiver is apparently costing banks in the state dear as their non-performing assets (NPAs) under agriculture sector have increased by `603 crore during the last quarter.

As per the latest figures with the State Level Bankers Committee (SLBC), which is set to hold its 141st meeting on Monday, `88,122 crore are outstanding under agriculture loans. Of this, NPAs under agriculture are to the tune of ` 6,334, which is 7.19 per cent of the agriculture advances outstanding.

As of 31 March 2017, the NPAs under agriculture stood at `4940. Going by this, the NPAs under agriculture have grown by `1394 crore since March 2017.

Advertisement

This increase under agriculture sector loans follows ruling Congress’ promise for total farm loan waiver in the run up to Assembly elections.

After forming the government in March, the Amarinder Singh government has, however, come with a partial farm loan waiver of up to `2 lakh for the small and marginal farmers as was notified on 17 October.

Bankers maintain as the hope to benefit from farm loan waiver scheme, Punjab farmers have stopped making repayment of their crop loans and the recovery scenario is being adversely affected.

“Because everyone is expecting to get benefit of the farm loan waiver scheme, even farmers other than small and marginal farmers are not making repayments of their loans,” said a public sector banker on the condition of anonymity.

The recovery of loans under agriculture has decreased by 20.28 per cent from 82.27 per cent in September 2016 to 61.99 per cent in September 2017.

What’s hurting the banks is the fact that despite the notification of the farm loan waiver scheme, the state government is yet to set timeframe for submission of claims and final payment of farm loans to the banks as part of its waiver scheme.

The Punjab government farm loan scheme would cover 10.25 lakh small and marginal farmers who own farm land up to 5 acres and are having loans up to `2 lakh or more.

Chief Minister Amarinder Singh maintains that full implementation of the scheme would require `9,500 crore and farm loans will be settled with banks in installments in four to five years.

Advertisement