Over 10 million Pakistanis may fall below poverty line: World Bank

The WB report also highlighted that Pakistan is expected to miss its primary budget target as well, which would keep Islamabad in deficit for at least three more years.

World Bank has said its shareholders endorsed a capital increase package, a series of internal reforms, and a set of policy measures to strengthen the international lender’s capabilities.

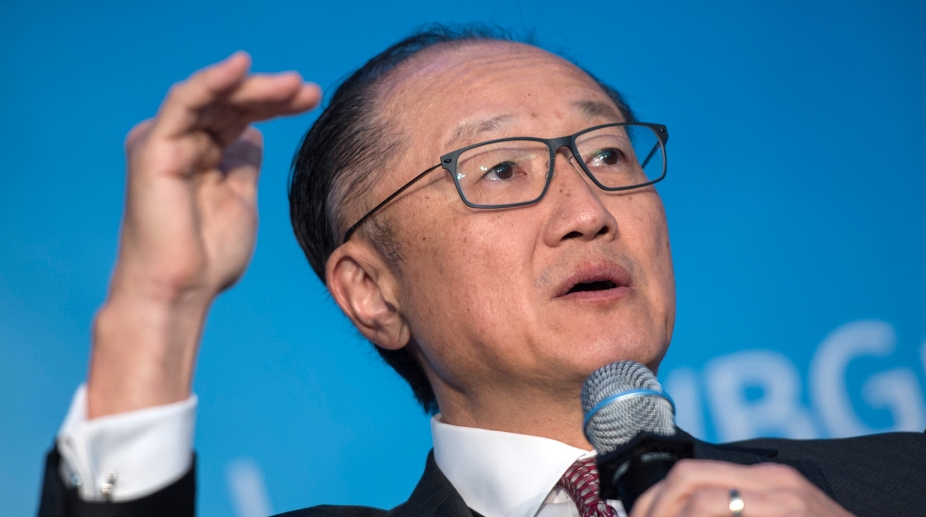

World Bank President, Jim Young Kim, speaks during the discussion 'Building Human Capital: A project for the world' in the IMF/World Bank spring meeting in Washington, DC on April 21, 2018. (Photo: AFP PHOTO / ANDREW CABALLERO-REYNOLDS)

World Bank has said its shareholders endorsed a capital increase package, a series of internal reforms, and a set of policy measures to strengthen the international lender’s capabilities.

The $13 billion capital increase package includes $7.5 billion of paid-in capital for the International Bank for Reconstruction and Development (IBRD), the group’s primary lending arm, and $5.5 billion for the International Finance Corporation (IFC), the group’s private sector lending arm, said the World Bank in a statement on Saturday, Xinhua reported.

World Bank shareholders also endorsed a $52.6 billion callable capital increase for IBRD, the statement said.

Advertisement

“Through the historic agreement endorsed today, our shareholders have clearly demonstrated a renewed confidence in global cooperation,” World Bank Group President Jim Yong Kim said.

“This capital package allows for greater responsiveness to risks to global stability and security, particularly in poorer countries and fragile states,” Kim added.

Following the capital increase plan announced Saturday, the combined financing arms of the World Bank are expected to reach an average annual capacity of nearly $100 billion between fiscal year 2019 and fiscal year 2030, said the World Bank.

Kim said at a press briefing this week that the capital increase package doesn’t target changes of loans to any specific country.

“It’s about how we think about income levels and how the World Bank Group can continue to be a partner and to support all of our member countries who are still clients,” he argued.

He said that the multilateral lender would increase lending to lower middle-income countries over time.

Advertisement