RBI MPC member predicts ‘less severe’ high food inflation

The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) member highlighted that going ahead, as India develops, the problem of high food inflation would be "less severe".

The scheme called, Retail Direct, will allow direct access to retail investors via the RBI in primary and secondary markets.

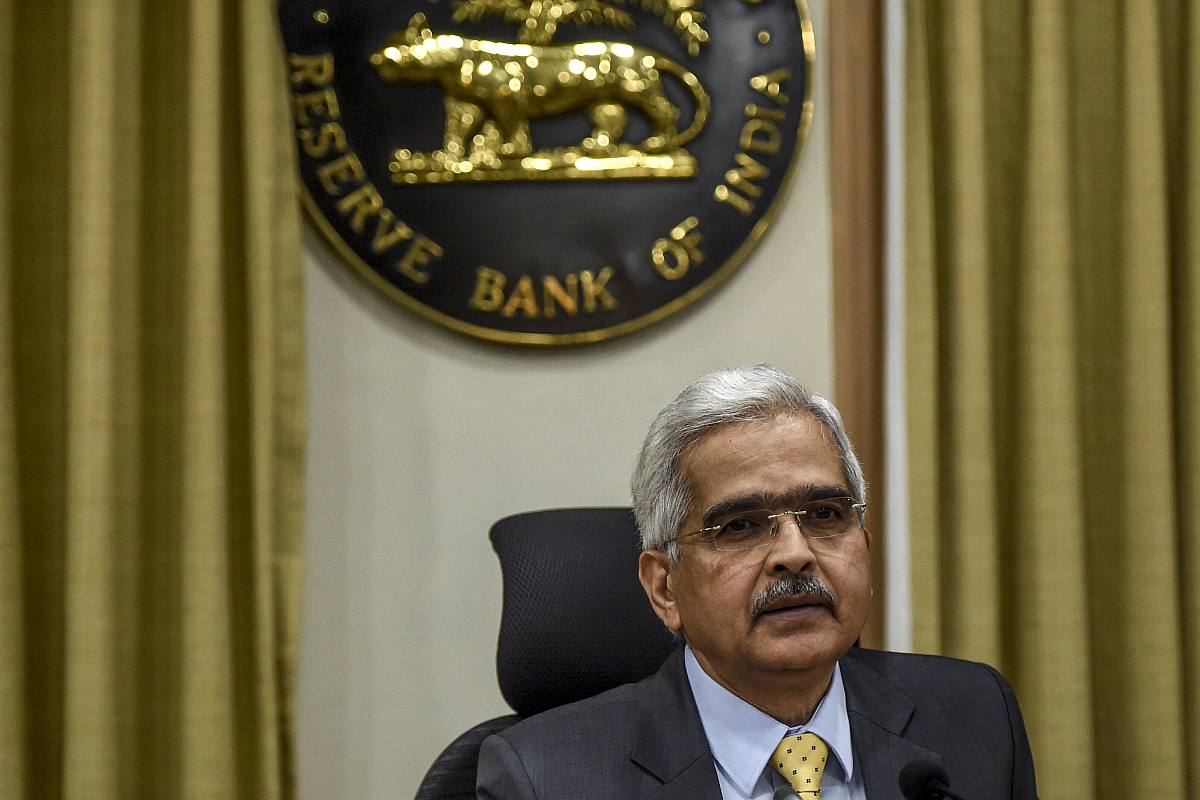

He added the move will help in smooth completion of the government's borrowing target for 2021-22. (Photo: AFP)

The Reserve Bank of India on Friday said that it has decided to give retail investors direct access to the government securities (G-Sec) market.

The major structural reform was announced by the RBI Governor Shaktikanta Das while he presented the bi-monthly Monterey Policy.

The scheme called, Retail Direct, will allow direct access to retail investors via the RBI in primary and secondary markets.

Advertisement

According to the statement on Developmental and Regulatory Policies: “As part of continuing efforts to increase retail participation in government securities and to improve ease of access, it has been decided to move beyond aggregator model and provide retail investors online access to the government securities market – both primary and secondary – along with the facility to open their gilt securities account with the RBI.”

Das in its statement said, “this will broaden the investor base and provide retail investors with enhanced access to participate in the government securities market. This is a major structural reform placing india among select few countries which have similar facilities.”

He added the move will help in smooth completion of the government’s borrowing target for 2021-22.

The move is a part of the government and RBI’s initiatives to boost retail participation in the G-Sec market. These initiatives include permitting stock exchanges to route primary purchases, introduction of non-competitive bidding in primary auctions and allowing a specific retail segment in the secondary market, Das said.

Advertisement