The Reserve bank of India (RBI) on Friday, after an unscheduled Monetary Policy Committee meet, slashed the repo rate by 75 basis points to 4.4 per cent in a bid to tide over the disastrous impact of the novel Coronavirus on the economy.

Repo rate is the key interest rate at which the RBI lends short-term funds to commercial banks.

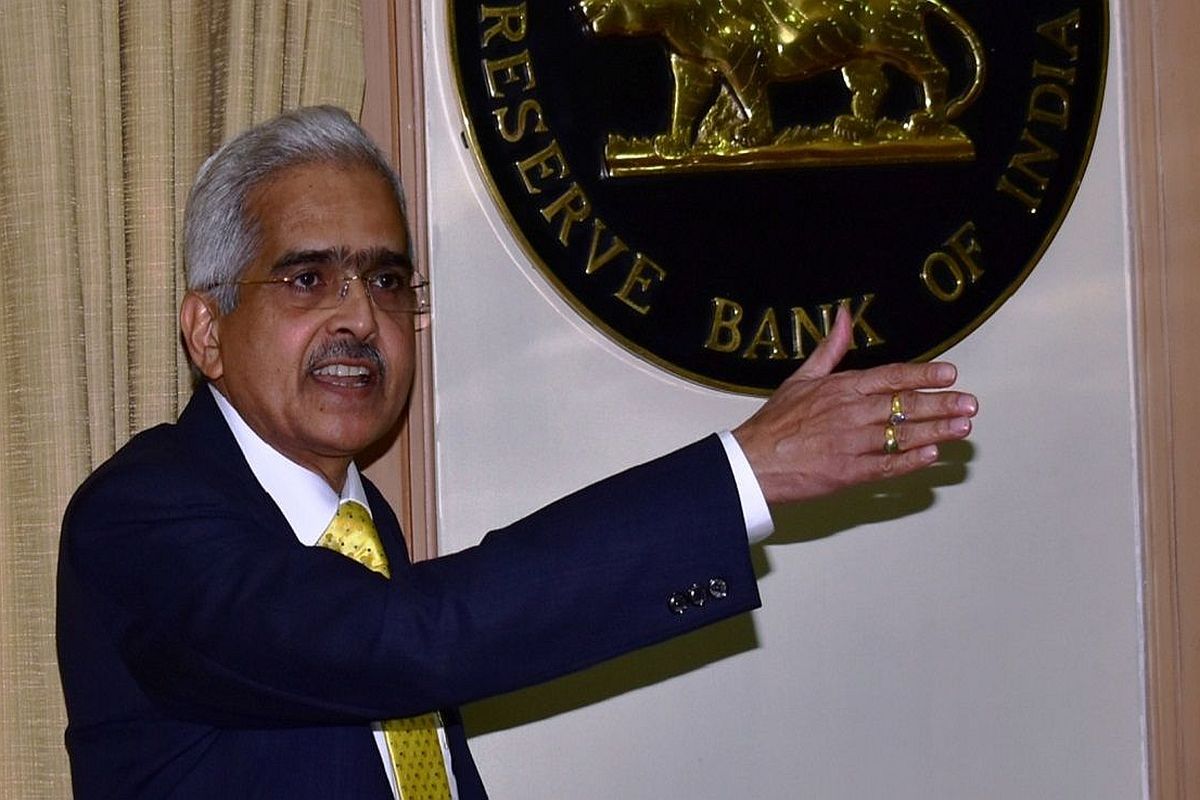

The cut has been made to encourage banks to give more to business rather than deposit it with RBI. “We hope to mitigate the negative effect of COVID-19 on the economy with these efforts,” said RBI Governor Shaktikanta Das.

Meanwhile, the reverse repo-rate has been reduced by 90 basis points to 4 per cent.

“We are not giving out inflation and growth projection numbers due to the uncertain conditions,” he added.

The move comes as India entered the third day of the 21-day nationwide lockdown to curb the spread of the Coronavirus pandemic.

Addressing the media, the RBI governor said the people of the nation are living in an extraordinary situation and a war effort is needed to be mounted against Coronavirus using conventional and unconventional tools.

If the COVID-19 crisis prolongs and the supply chain gets disrupted, it could jeopardise India’s growth, the RBI chief said and added, “We hope that drop in crude oil prices will help India”.

Das said the Monetary Policy Committee noted that the global economic activity has come to a near standstill as lockdowns and social distancing measures kicked in the affected countries.

Expectations of a shallow recovery in 2020 from 2019’s decade low in global growth have been dashed, he added.

The outlook is now heavily contingent upon the intensity, spread and duration of the pandemic, Shaktikanta Das said and added that there is a rising probability that large parts of the world will slip into recession. He noted that tough times were ahead but they don’t last, “only tough institutions do”.

“The outlook is highly uncertain and negative. Several nations are battling its exponential contagion. Countries are shutting down to prevent being sucked into a kind of black hole,” Das said at the press conference.

Keeping finance flowing is the ‘paramount objective’ of the RBI, while India has locked down economic activity and financial activity is under severe stress, Das added.

Meanwhile, the RBI has decided to reduce the Cash Reserve Ratio (CRR) of all banks by 100 basis points to 3 per cent of Net Demand and Time Liabilities with effect from the fortnight beginning 28 March for a period of 1 year.

The RBI chief said the measures will result in total liquidity injection of Rs 3.74 lakh crore to the system.

In a major announcement, the RBI has said that all banks, lending institutions may allow a three-month moratorium on all loans. The RBI chief added that lending companies, banks are allowed to defer interest on working capital repayments by three months.

Banks may also reassess working capital cycle and will not be treated as non-performing assets, he said. Mitigating debt servicing burden to prevent transmission of financial stress to the real economy, provide relief to borrowers, said RBI chief Shaktikanta Das.

He added that a three-month moratorium has been decided on payment of installments of loans outstanding on 1 March 2020.

The RBI governor further assured the citizens that the Indian banking system is safe and sound. “In recent past COVID-19 related volatility in stock market has impacted share prices of banks as well resulting in some panic withdrawal of deposits from a few private sector banks.” he said.

He urged people not to panic withdraw their deposits from banks. “Your funds are safe,” he said.

The RBI has injected liquidity of Rs 2.8 lakh crore via various instruments equal to 1.4 percent of GDP. “Along with today’s measures liquidity measures equal to 3.2 per cent of GDP. RBI will take continuous measures to ensure liquidity in the system,” said Shaktikanta Das in his address.

The RBI Governor’s address comes a day after the central government announced Rs 1.75-lakh-crore stimulus package to help the poor and migrants tackle the financial difficulties arising from the coronavirus (COVID-19) outbreak.

The apex bank had advanced its monetary policy committee meeting due on April 3 to March 25-27 in view of the emergency situation that has arisen because of COVID-19.

Earlier this month, reports stated that the Reserve Bank of India is considering to use unconventional policy steps to boost lending, amid rising fear that the deadly coronavirus (COVID-19) will attack the reviving possibilities of the economy.

The RBI had said that it is “monitoring global and domestic developments closely and continuously and stands ready to take appropriate actions to ensure the orderly functioning of financial markets, maintain market confidence and preserve financial stability.”