UP Mining Dept set to record increase in revenue

The Uttar Pradesh mining department is set to generate significantly higher revenue during the 2023-24 financial year than the previous fiscal.

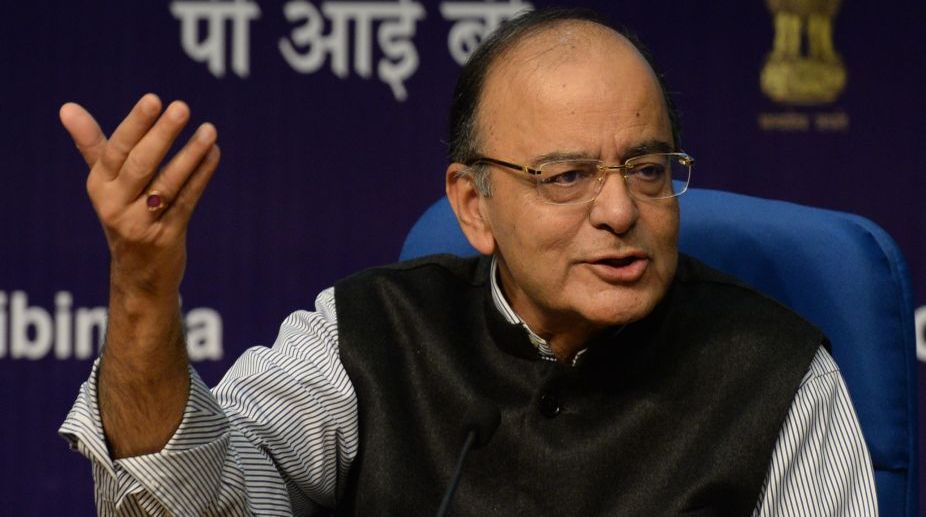

Union Finance Minister Arun Jaitley (PHOTO: AFP)

Taking stock of how to control the rising non performing assets of banks, Union Finance Minister Arun Jaitley on Wednesday said the rate of increase in NPAs has slowed down in the last quarter of the current financial year.

Jaitley added that dealing with NPAs of banks is a challenging task and the government was considering several oversight committees to help with resolution of bad debts. The core problem of bad debts is with very large corporates, predominantly in the steel, power, infrastructure and textile sectors, he said during a meeting of the Parliamentary Consultative Committee on subject of NPAs.

“One of the members said that the Chief Vigilance Officer of a public sector bank be made a part of the credit committee of the bank and that first the board of the bank should take a call about the decisions being taken by their officials rather than investigating agencies directly acting on the basis of their own information,” the ministry said.

Advertisement

Public sector banks NPAs surged by over Rs 1 lakh crore during April-December period of 2016-17. Gross NPAs in the first nine months of the current fiscal rose to Rs 6.06 lakh crore by December 31, 2016, from from Rs 5.02 lakh crore during the entire year of 2015-16.

“It was also suggested that apart from recovery proceedings, criminal action must be taken against the big willful defaulters and their photographs may also be published. A member also suggested that under the SARFAESI (The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, the focus should be on catching big willful defaulters,” as per the statement.

Some members suggested that the government must go ahead to establish a bad bank or a Public Sector Asset Rehabilitation Agency (PARA) and it should only consider those NPAs where sector specific reforms do not work. The Economic Survey for 2016-17 has suggested the idea of PARA to resolve the problem of bad loans. On the issue of setting-up a ‘bad bank’, Jaitley said that several possible alternatives exist and the issue is being debated on public platforms.

The minister added that the Reserve Bank of India has set up an Oversight Committee to look into process of the NPA cases referred to it by the different banks. Seeing the response and its performance, the government is considering multiplication of such committees, he said.

It was also suggested by various members that since Asset Reconstruction Companies (ARCs) are in the private sector and their performance is not up to the mark in many cases, therefore, close monitoring of the operations of ARCs should be done through stringent regulations.

NPAs are concentrated with large corporates, even though these have shown a declining trend in the last quarter of the current financial year, Jaitley said. Large corporates expanded their capacity during the boom period (2003-08) but could not face the onslaught of global financial crisis and consequent slowdown thereafter.

The government is taking sectoral specific measures to deal with the problem of NPAs specifically in the resolution of large debts. “The steel sector is on its path of recovery while many decisions have been taken in the infrastructure, power and textile sectors to resolve their problems,” Jaitley said.

During the meeting, government officials made a presentation on the various regulatory and legistlative measures taken recently by the Centre and the RBI to deal with NPAs. It was pointed out that the Insolvency and Bankruptcy Board of India (IBBI) has already been set up under the Insolvency and Bankruptcy Code, 2016. Several MPs and senior finance ministry officials participated in the meeting.

Advertisement