Stock market bounces back; banks, metals shine

Sensex was up 599.34 points, or 0.83 per cent at 73,088.33, while the Nifty was up 151.20 points or 0.69 per cent at 22,147.

Stock market

Equity benchmarks of Bombay Stock Exchange and National Stock Exchange continued to drop for the second straight session today as traders accumulated profits through selective sell-off taking advantage of the market’s worry over much rumoured revival of long term capital gain or LTCG Tax in tomorrow’s Budget for fiscal 2018-19.

Apart from profit booking, participants in Dalal Street were also keen on moderating their risky exposures in their efforts to cushion the adverse impact of finance minister Arun Jaitley’s Budget.

The decline in stocks was across the global markets starting from America’s Wall Street to Asia, including Dalal Street. Analysts say shares are losing charm in Wall Street on account of surge in long-term bond yields to four-year high.

Advertisement

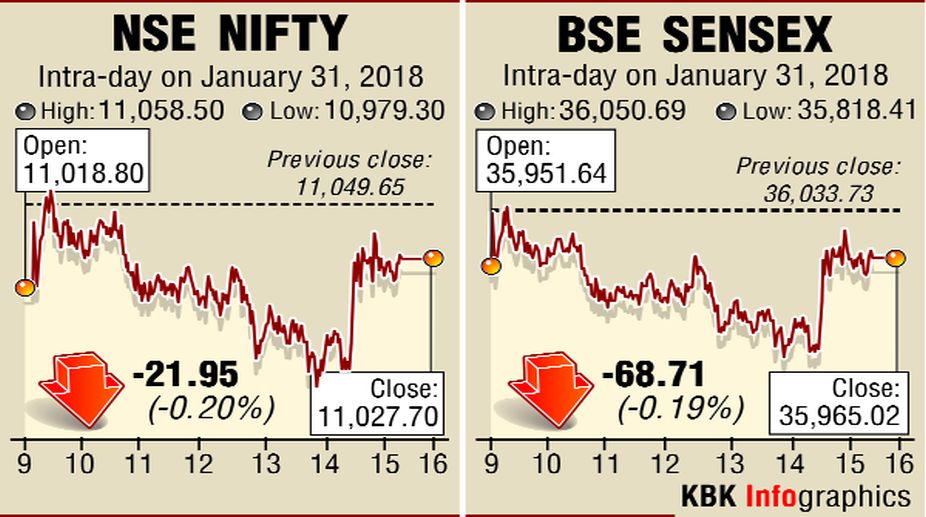

The Sensex fell below 36,000-level and closed at 35,965.02 points, registering a decline of 68.71 points or 0.19 per cent. The Nifty declined 0.20 per cent or 21.95 points to end at 11,027.70 points.

Bank shares survived profit booking today as it closed at 27,379.45 points, showing an increase of 110.40 points or 0.40 per cent. In the Sensex pack, 14 stocks were up and 17 were down. For the Nifty, the advance-decline ratio stood at 21 versus 28, while one share remained unchanged.

The market was also looking forward to the release of latest fiscal deficit data and GDP numbers after trade ended today. Considering improvement in IIP or index of industrial production and Purchasing Managers Index, particularly for the services sector, analysts expected corresponding positive impact on economic macros or fundamentals although the liquidity-driven rally has rendered them virtually ineffective for more than a year.

Fresh numbers suggested that foreign portfolio investors who have stepped up investment in domestic equity market were net sellers in shares worth Rs 105.56 crore yesterday.

Domestic institutional investors also book profit by net selling share worth Rs 281.65 crore.

Until 30 January, FPIs were net buyers of shares worth Rs 9,704.62 crore while DIIs booked significant profit after a long gap as they became net sellers in equities worth Rs 895.93 crore.

Analysts see domestic funds are hedging their over-bought positions ahead of the annual Budget.

Nevertheless, the occasional correction in the indices has been on the lower side when compared with record-breaking bull-run for more than a year.

Veteran brokers in Dalal Street discount fears over the possible imposition of LTCG Tax, saying it would not impact the current liquidity-driven bull rally since it is intermittently disrupted by profit booking and unwinding of risky positions.

In a related development, United States-based Morgan Stanley is believed to have shifted its main P-notes issuing activity from Singapore to France in view of the tough new treaty between India and Mauritius which aims at tightening tax norms for offshore investors who use participatory notes to access Dalal Street.

P-notes obviate several formalities and gives ready access to equity business without revealing the identity of investors. Morgan Stanley, according to market sources, is the largest facilitator of P-notes invest-

ment with a share of 14.3 per cent.

Advertisement