Sitharaman vs Chidambaram on India becoming 3rd largest economy

Sitharaman termed Chidambaram "arithmetic inevitability" remarks as "misleading" and explained her rationale.

The Finance Minister needs to be more realistic in the goals and assumptions for Budget 2020. Instead of trying to drum up revenue collection through taxation measures or resorting to off-Budget borrowings, budget makers should take a hard look at the disproportionately large revenue expenses. Another worthwhile initiative could be a revamp of the taxation system.

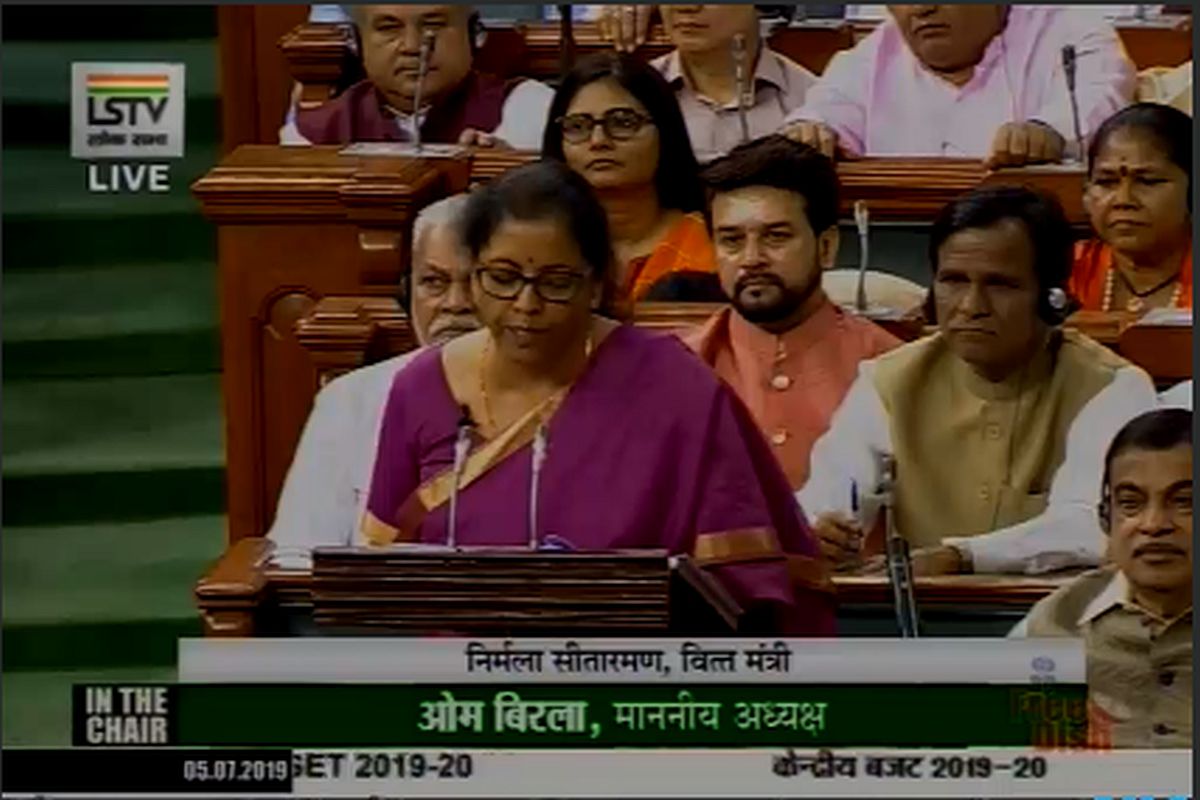

Union Finance Minister Nirmala Sitharaman presenting the Union Budget 2019 in Lok Sabha. (Photo: Twitter | @loksabhatv)

The Finance Minister must be a very worried person these days. Tasked with preparing a Budget that would kick-start the economy, Ms Nirmala Sitharaman finds herself with little room for manoeuvre. GDP growth has been falling quarter after quarter, touching its nadir of 4.5 per cent in the last quarter. After almost forcing the RBI to cut interest rates from 6.50 per cent in August 2018 to 5.15 per cent in October 2019, the FM finds no upsurge in credit offtake, no real reduction in the commercial banks’ lending rates and a spike in inflation, which touched 7.35 per cent last month as against the level of 3.5 per cent just a year ago.

Other indicators are equally gloomy, unemployment at 6.1 per cent is at a 45-year high, exports and imports are both declining and consumer spending is falling in real terms. To her credit, the FM has made a number of efforts to reinvigorate the economy; after the last Budget, she slashed corporate tax rates benefiting corporates by Rs 1,45,000 crore, handed out Rs 30,000 crores to Home Finance Companies, allocated Rs 20,000 crore for finishing stalled housing projects and gave export incentives of Rs.50,000 crore.

The reason why her efforts have not borne fruit, is that, firstly, the last Budget was based on several over-optimistic assumptions; tax revenues were expected to rise by 28.24 per cent and real GDP growth was estimated between 8 per cent and 8.5 per cent at a 4 per cent inflation level. Second, the panacea of growing the economy by garnering foreign capital, prescribed by the hurriedly prepared Economic Survey 2019, proved wide off the mark because of the current economic downturn and also because foreigners are genuinely uncomfortable with our legal and taxation systems and everchanging Government policies.

Advertisement

China could attract foreign capital by creating a bubble for overseas investors with different tax laws and labour regulations. This is not possible in our democratic set-up. The difficulties faced by China, as foreign capital leaves its shores, should also have been kept in mind by our policy makers before prescribing their magic formula. Most importantly, the FM’s Budget and the post-Budget largesse were almost exclusively reserved for the corporates and the formal sector. For example, all but the largest corporates got generous tax cuts while similarly placed individuals and firms continue to be taxed at 40 per cent higher rates vis-à-vis corporates and non-corporate manufacturing entities are taxed at double the corporate tax rate.

Coming to the present, large-scale disruptions in response to various contentious pieces of legislation have slowed down economic activity. Tourism and allied sectors are staring at huge losses. The economic situation appears unlikely to improve in the current quarter. While the alarmist view of Nobel Laureate Abhijit Banerjee, who recently said that “We are really extremely close to a point where we could be dipping into a major recession” may not be entirely warranted; but on the other hand dismissing genuine concerns of economists by blandly insisting that “our economy has strong fundamentals” and discovering ‘green shoots’ in the smallest upturn is a sure-shot recipe for economic disaster.

The Finance Minister needs to be more realistic in the goals and assumptions for Budget 2020. Instead of trying to drum up revenue collection through taxation measures or resorting to off-Budget borrowings, budget makers should take a hard look at the disproportionately large revenue expenses. The last Budget added four major schemes to the already existing 118 schemes on which Rs 12.03 lakh crore is to be spent in the current financial year, which was in line with the trend of the previous budgets. Old schemes are renamed, schemes are merged in one another, schemes are introduced/ discontinued, with no study on the outcome or the reason for the success or failure of the scheme. Surely, to conserve resources, unproductive schemes should be axed.

Another worthwhile initiative could be a revamp of the taxation system. Today, the underlying philosophy of taxation is to maximise tax collection which is not in tune with the current reality because the aim of taxation should be to promote desirable business activity. Remember, the last time we fundamentally reformed our economy was in the wake of liberalisation in the 1990s. The taxation system was revamped, income-tax rates and Customs duties were cut, controllers were replaced by regulators and most importantly, the licence-permit raj was marked for dismantling.

These moves paid rich dividends; from a lessdeveloped country (LDC) we leapfrogged to becoming one of the world’s leading economies. Most Indians are now enjoying undreamt of prosperity thanks to the reforms undertaken more than a quarter century ago. However, the earlier reforms have run their course and have been reversed in some cases. For example, the maximum tax rate now stands at 42.7 per cent as against the 30 per cent adopted in 1991 and import duties have been jacked up. Another round of reforms is sorely needed to address issues that have emerged in the new millennium.

As it obtains now, our tax system, conceptualised by the economist Nicholas Kaldor has been twisted out of shape. Collections from indirect taxes (GST and VAT), which are regressive, far exceed collection from direct taxes, which are progressive, resulting in the poor bearing the brunt of taxation. Indirect taxes are inflationary because the price of every item gets increased, for the consumer, by the taxes levied thereon. In addition to compliance issues, an omnipresent GST has priced our goods out of our own markets. The number of frauds bedevilling the GST regime point to poor conceptualisation. A relook at the entire GST structure is definitely required prior to the Budget.

Income-tax has its own problems. Recently, a trend of centralisation and reduction of discretion of field officers has been noticed. Suffice it to say that businesses are too complex to be pigeonholed into watertight compartments. Playing to their own constituency, pink papers often equate tax cuts and procedural changes to tax reforms. It does not help that unreasonably high tax collection targets are fixed which lead to conflicts between the Income-tax Department and tax-payers, giving the department a bad name. Reintroduction of taxes on wealth, inheritance and gifts would plug the gaps in the taxation system and would prevent concentration of wealth in the hands of a few.

The agriculture sector, which provides employment to maximum people also needs the Government’s urgent attention. Around 45 per cent of our population depends on agriculture which accounts for only 15 per cent of our GDP. A comparison of prices of agricultural products with those of other commodities, over the last fifty years, would show a huge worsening of the balance of trade against agriculturists. Sadly, successive Governments have neglected agriculture. Piecemeal measures like providing a subsidy of Rs. 3,000 per year under PM-KISAN, increasing MSPs or propagating “Zero Budget Natural Farming” would not achieve the PM’s promise of doubling agricultural income by 2022.

Rather, to end agricultural distress for good, we could implement the comprehensive Swaminathan Report on Agriculture of 2006 or have a policy like the Common Agricultural Policy of the European Union. Privatisation of railways, oil and gas, mining, coal etc. to drive growth, suggested by the CEO of Niti Aayog is unlikely to benefit the economy significantly because the effect of privatisation would be minimal on job and wealth creation. Also, in the current business climate it is questionable whether the private sector would be able to find the required finds for investment. Finally, poor implementation is the roadblock which derails most good initiatives.

This is a problem of governance that has to be tackled if the Government wishes to succeed in its objectives. Moreover, the States and the Centre have to cooperate in all essential fields. Well thought out initiatives are needed for health and education. What President Reagan had said about the American system holds true for India as well ~ “The government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.” The coming Budget may be a good time to revise this philosophy.

(The writer is a retired Principal Chief Commissioner of Income-Tax)

Advertisement