World must seek the path of peace

These times of an escalating environmental crisis are supposed to be times of increasing peace and international cooperation as without this it is impossible to resolve the life-threatening environmental problems.

These times of an escalating environmental crisis are supposed to be times of increasing peace and international cooperation as without this it is impossible to resolve the life-threatening environmental problems.

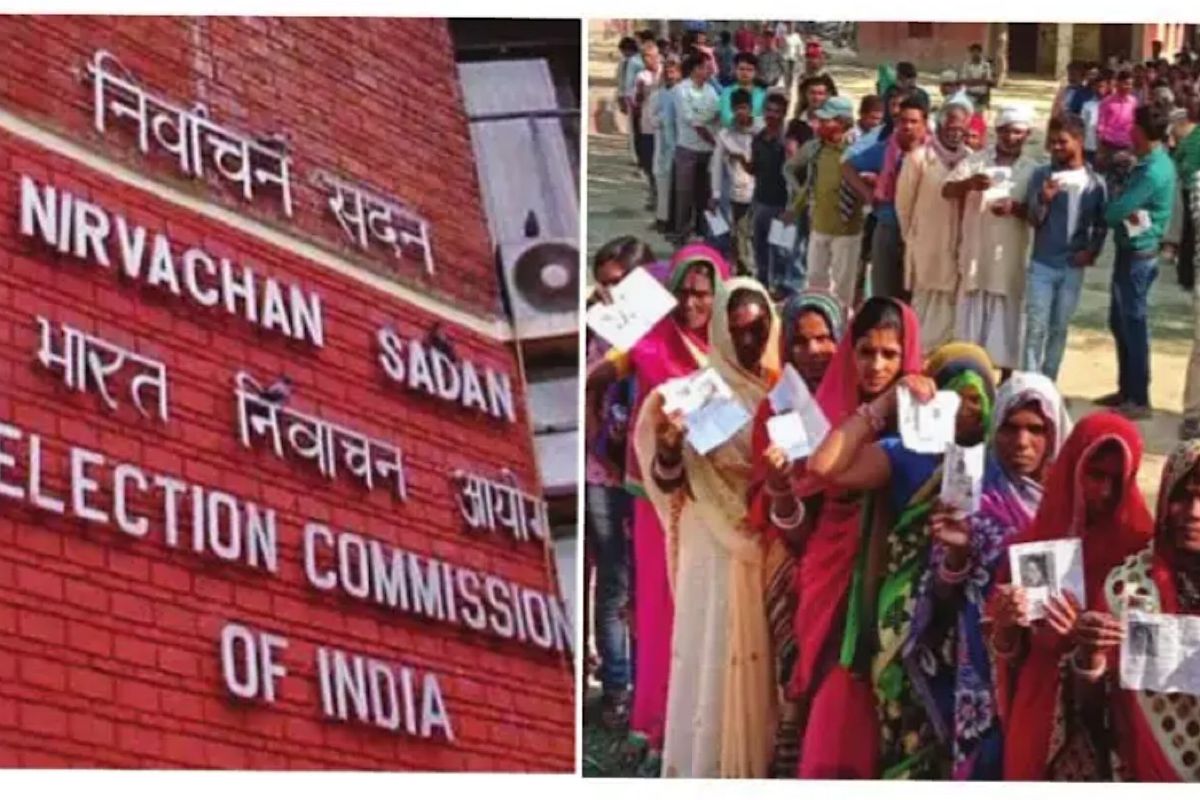

As voters head to polling booths in half of Karnataka’s 28 Lok Sabha constituencies in the second phase of the general election today, the political landscape of the state stands as testament to the intricacies of caste dynamics and shifting alliances.

The recent Parliamentary elections in the Maldives have sent ripples across the Indian Ocean, signalling a potential recalibration of diplomatic ties in the region.

Humanity has come a long way in the choices it has made in electing those who are called to govern. Understandably, the systems of governance throughout the world are far from perfect.

Relations between Iran and Israel have been strained for decades, primarily due to geopolitical, ideological, and religious differences. Historically, Iran and Israel enjoyed relatively good relations prior to the Iranian Revolution of 1979.

With all 20 Lok Sabha seats in Kerala at stake in the second phase of polling tomorrow, the electoral drama unfolds with its usual intensity, underscoring the unique political landscape of the state.

As Singapore stands on the cusp of a historic leadership transition, the imminent departure of Prime Minister Lee Hsien Loong ushers in a new era marked by continuity and change. Mr Lawrence Wong’s ascension as the country’s fourth Prime Minister heralds a departure from the legacy of the Lee dynasty, promising a leadership style that blends tradition with innovation.

On World Earth Day, the United Nations led the comity of nations by addressing a triple planetary crisis to foster climate stability, and asked that we live in harmony with nature and forge a pollution-free future.

Announcements almost every other day compel us to believe that India is now the fifth largest economy in the world; that India will be a $5 trillion economy very soon; that India will be the third largest economy of the world in 2027, and that India will become a developed nation in 2047.

Caste dynamics often play a pivotal role, especially in a state as politically significant as Uttar Pradesh.