Analysts predict big rally to take Nifty beyond 23K by next Samvat

The market is likely to witness a major rally before the next Samvat, says V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

The market is likely to witness a major rally before the next Samvat, says V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Even though the pause decision of the US Federal Reserve was on expected lines, the commentary was not hawkish as the market feared, says V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

The Nifty-50 reached the milestone of 20k last month.

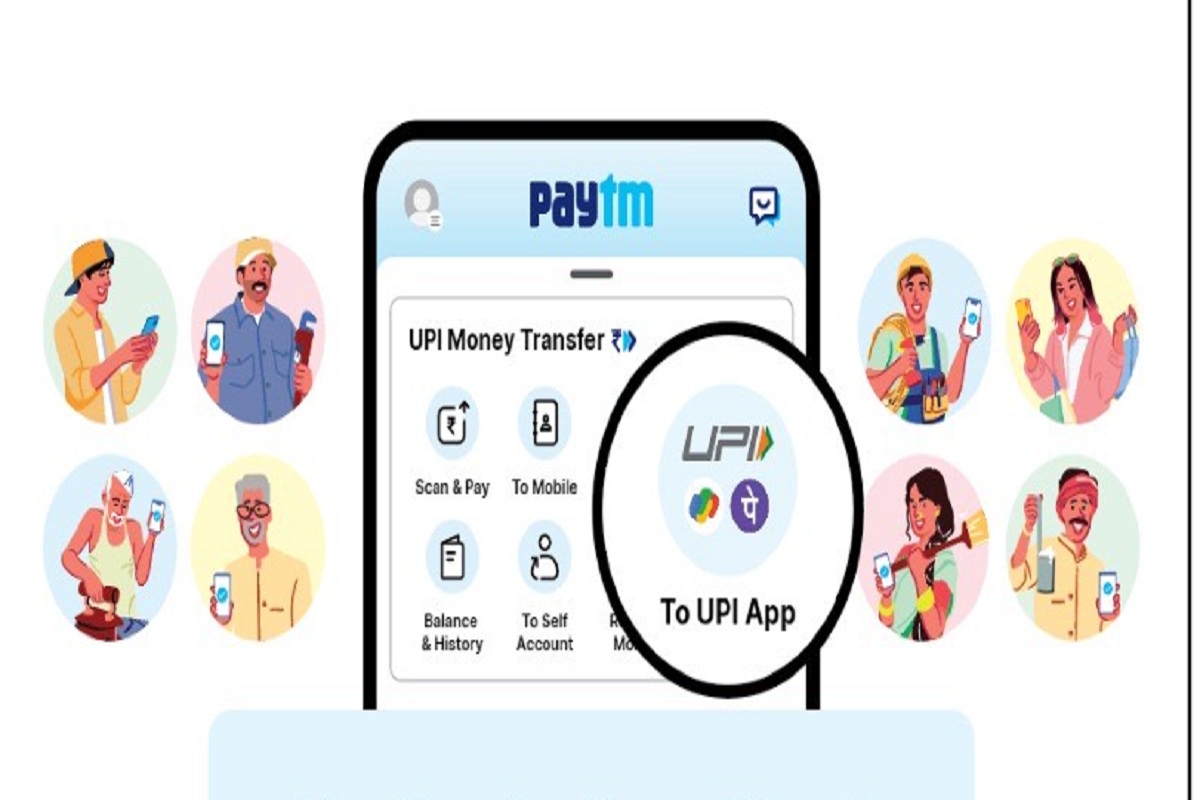

Indian fintech giant Paytm on Wednesday reported its financial performance for FY23, where its revenues swelled to Rs 7,991 crore for the fiscal year.

Wipro on Wednesday announced the launch of a new financial services advisory capability in India to boost its customers' end-to-end transformation journeys.

One of the most promising ways to close the stubbornly persisting gender divide is technology. For low-income women, digital financial inclusion offers an opportunity to upend entrenched gender inequalities. Financial services delivered via mobile phone can bridge the last-mile gap, bringing financial tools and services directly to women where they work and live

The grassroots level agents have a comparative advantage in serving rural households because they possess better knowledge and a keener understanding of local-level political and economic dynamics and market actors which fundamentally mediate developmental outcomes. On account of this, they are effectively placed to reduce several participation barriers

Governments will have to close the digital divide to reap the benefits of digital financial services. This means finding the right balance between enabling financial innovation and addressing several risks

The pandemic shows that the trend towards greater digitalization of financial services is here to stay. Governments must close the digital divide to reap the benefits of digital financial services

This trend is the likely to continue at least in the near term according to analysts, with high liquidity in the market post the measures announced by governments and central banks globally.