Maldives Election

The recent Parliamentary elections in the Maldives have sent ripples across the Indian Ocean, signalling a potential recalibration of diplomatic ties in the region.

China is about to celebrate ten years of its infrastructure building Belt and Road Initiative BRI) a symbol of its rise as a global power and a defining feature of its foreign policy which it touts as its gift to the world it claims to have created more than 420,000 lakh jobs and lifted 40 million people out of poverty.

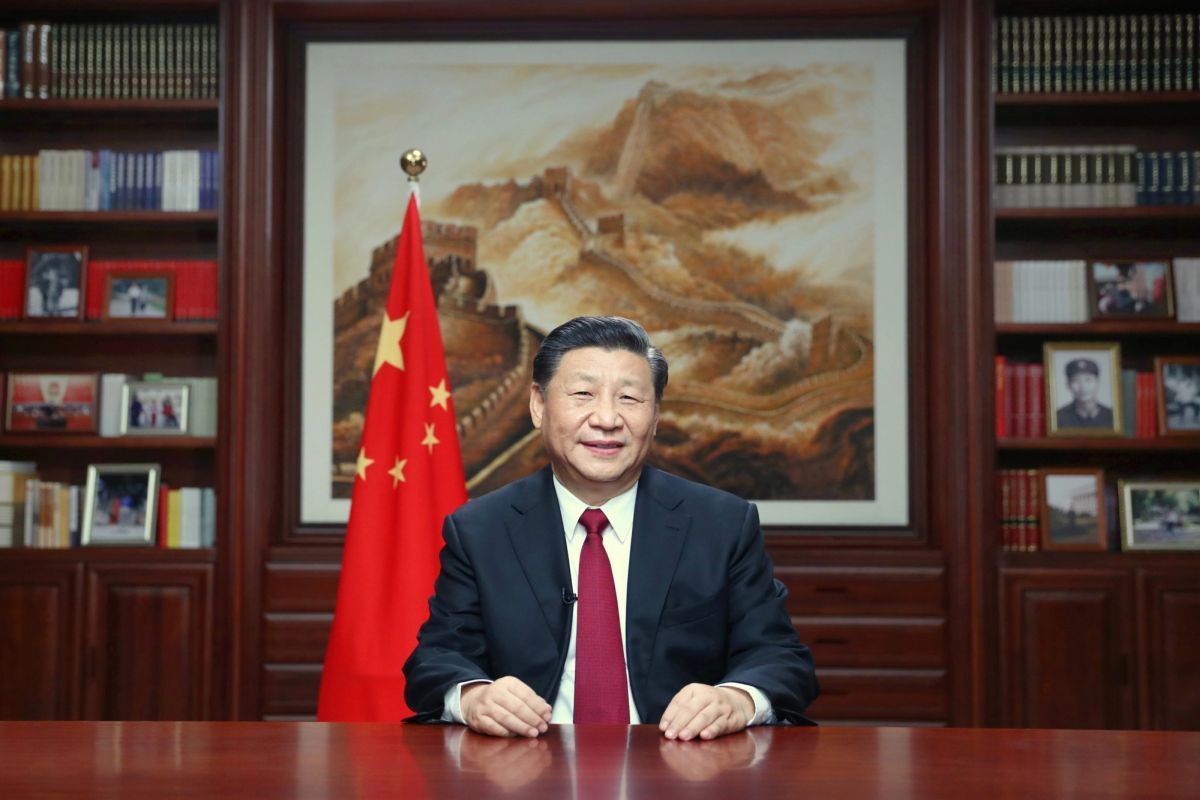

Chinese President Xi Jinping (IANS file photo)

China is about to celebrate ten years of its infrastructure building Belt and Road Initiative (BRI) ~ a symbol of its rise as a global power and a defining feature of its foreign policy which it touts as its gift to the world ~ it claims to have created more than 420,000 lakh jobs and lifted 40 million people out of poverty. Critics mainly in the Western democracies point that those were mostly Chinese jobs and Chinese people lifted out of poverty at the cost of poorer nations and its gift to the world is actually a curse of crippling debt into which it irrevocably entrapped those nations.

There is enough evidence that China’s infrastructure building in poorer countries only meant financing doomed infrastructure projects in strategic areas in those countries using Chinese materials, Chinese machinery, Chinese labour and Chinese managers so that all the loan monies flow back to China only, very little of it is aid. The projects are so unprofitable from the beginning that they would never generate enough revenue to pay off the Chinese debt, forcing the debtor countries to swap their debts by giving China ownership in the assets created through long-term lease to serve its strategic interests in the Indian Ocean, Persian Gulf and elsewhere. Hambantota port in which China obtained a 99-year lease in 2017 is the poster child of this strategy, but that is not the only one.

In 2005, the West still considered China as a friend they could work with to their advantage and an integral part of the global supply chain that served them. Chinese atrocities upon Xinjiang’s Muslim population were largely unknown and its sweeping National Security Law (2020) imposed on Hong Kong stripping its citizens of all their democratic rights was still years away. The West ignored the steady erosion of human rights in China and its stifling of protests in Tibet.

Advertisement

As many as 18 of the EU’s 27 members have signed up to the BRI, one of them was Greece. The global meltdown of 2008 badly singed the Greek economy, and the Chinese state-owned shipping giant Cosco signed a lease agreement in respect of two container piers at Piraeus, the country’s main port south of Athens. When the Greek economy went into a freefall by 2016, Cosco seized the opportunity to acquire a majority 51 per cent stake in the entire facility, giving a Chinese firm control over a European port for the first time in history ~ its stake would be increased to 66 percent by 2021.

Piraeus became the BRI’s “Dragon Head” in Europe; under Chinese control, its container handling capacity has expanded fourfold by 2023, and it is ranked 40th among the largest container ports worldwide, up from 93rd in 2016. Now, of course, the West considers China as a rival and the only G-7 nation to have signed the BRI, Italy, has declared its intention of pulling out of it.

Mr Xi Jinping hailed BRI, initially termed as “One Belt One Road”, putting China at its centre in an attempt to revive the ancient Chinese Silk Road that connected China to the rest of the world though the Pamir mountains, as the “project of the century”.

More than 150 countries covering three-fourths of the world’s population and more than half of its GDP, spanning different continents from Brazil to Kenya to Laos have joined the BRI. China has loaned over a trillion dollars to them for their infrastructure of railways, roads and other infrastructure ~ many of these have been built too.

In the process, these countries’ debt to GDP ratios have become unsustainable ~ especially their debt to China have soared much beyond their capacity to repay. These loans are not the low-interest loans that the IMF and other multilateral development banks provide to help the developing countries tide over their economic crises. Interest on IMF loans is typically around 2 per cent, compared to 5 per cent for Chinese loans. The Chinese loans are negotiated bilaterally on commercial terms, couched in extreme secrecy, outside public knowledge and skewed heavily in favour of China. The projects have mostly brought disappointing returns, making it hard for the indebted countries not only to service their debts, but also to secure financing for their future infraprojects.

Inability to repay their debts gives China the leverage for interfering in their domestic and foreign policies compromising sovereignty. This was perhaps the Chinese design from the beginning, and they are now fully exploiting it. This is happening not only in Sri Lanka, but in Argentina, Kenya, Malaysia, Montenegro, Pakistan, Tanzania, and many other countries. In the process, Chinese companies and the Chinese construction sector have been kept afloat, away from bankruptcy.

Being unable to generate the expected returns, the projects could hardly contribute to growth in their host countries. Pakistan’s 60 billion-dollar CPEC (only half has so far materialised) is a glaring example. In many countries, they are increasingly facing protests from the local indigenous communities ~ their land has been taken for the projects and livelihoods threatened, as in Pakistan’s fisherman communities in Gwadar.

The CPEC aimed to link Xinjiang to Gwadar in Baluchistan over 1,500 kms of difficult mountainous terrains to give China an alternative route for its energy imports bypassing the Malacca Strait, a choke point that could be throttled by the USA in the event of a conflict.

Gwadar has been managed by China since 2013, but it could not be an Asian Piraeus because of militant violence and Pakistan’s political strife. All it did was to raise Pakistan’s debt ratio by 15 per cent of GDP on account of CPEC alone, forcing it to seek an IMF bailout. Pakistan’s total debt ratio was 93 per cent, as of June 2023.

No region is more strategically important to China than South East Asia, and in 2021 China finished building a $6 billion, 422 km rail line connecting the Chinese city of Kunming with Vientiane, the capital of Laos, through mountainous terrain, half of it through tunnels, reducing the travel time only to 3.5 hours.

The Global Times ran a headline, “US dropped bombs in Laos, China builds railways.” But its debt ratio rose to 84 per cent of GDP, about half of it owed to China. Laos is one of the poorest countries in Asia, and its heavy debt servicing charges have resulted in neglect of critical needs like education and health. China has allowed Laos to defer the debt payments, but not a haircut. It is now working to extend the railway, and its influence, to much richer Thailand for selling Chinese goods. Montenegro built a highway connecting its Adriatic port of Bar with Serbia through Chinese loans, resulting in its debt ratio soaring from 59 per cent of GDP to 89 per cent in 2019.

Poor quality of Chinese construction has also plagued many projects. In a Foreign Affairs article, “China’s Road to Ruin”, Michael Bennon and Francis Fukuyama called China a “predatory lender” and “a rapacious and unbending creditor” that is forcing these countries to seek IMF financing for repaying their Chinese loans.

IMF has already given such bailout loans to many countries Sri Lanka ($1.5 billion in 2016, ($2.9 billion in 2023), Argentina ($57 billion in 2018 and $44 billion in 2022), Ethiopia ($2.9 billion in 2019), Pakistan ($6 billion in 2019 and $3 billion in 2023), Ecuador ($6.5 billion in 2020), Kenya ($2.3 billion in 2021), Suriname ($688 million in 2021), Zambia ($1.3 billion in 2022), and Bangladesh ($3.3 billion in 2023).

Shortfalls in the revenue projected for these projects have to be met by the governments in some cases as per terms of the loans like in Montenegro, Zambia and Sri Lanka, forcing them to raise additional taxes to foot the bills for failed projects. These contingent liabilities are hidden from the public and other creditors, the books of accounts also do not reflect them, suppressing the actual liabilities of governments and saddling them with the risk of a future crisis and years of low growth. Sri Lanka defaulted on its foreign debt last year, and Pakistan barely managed to avert a default, thanks to the IMF loan it got at the last moment.

A 2021- study in the Journal of International Economics estimated that almost half of China’s loans to the developing world are “hidden”, or undisclosed. Transparency does not exist in the Chinese lexicon. To ensure that a country has enough forex to repay the loan, the IMF requires all other creditors to take a haircut, or forgive a part of their existing loans to the distressed country seeking IMF bailouts. This has been a standard practice agreed to by the Paris Club of western lenders. But Sri Lanka is yet to get the second tranche of $330 million from the IMF because China is refusing to take any haircut.

In the case of Zambia which owed most of its foreign debt to China, it joined other creditors to restructure the debt owed in June 2023, but still did not agree to a haircut. Instead, only the interest payment was reduced which will be again ratcheted back if the economy improves ~ a terrible incentive for a low-income country to grow. Resentment of the debt laden countries, especially in Africa which has become what The Economist calls “a financial quagmire” for China, has forced China to soften its strategy a little and to provide its own bailout loans estimated at $185 billion to debtor countries between 2016 and 2021, though the terms are veiled in opacity. But credits have become better targeted to focus on “small but beautiful” projects with higher standards and better returns, as Mr Xi Jinping had ordained.

There is also talk about a “digital silk road” through telecom and cloud computing, using Chinese technology. The West genuinely is worried due to security concerns and is barring Chinese tech companies. The celebration of the 10th anniversary, unlike in 10 years ago, will have the usual fanfare without the splendour ~ no Western country will perhaps attend unlike in 2013. This time, its highlight will be the presence of Mr Vladimir Putin. But it sends a clear message that BRI is going to stay.

China and the rest of the world are struggling hard to recover from the pandemic and energy crisis precipitated by the Ukraine War, and enthusiasm for BRI is waning. Poor countries still badly need infrastructure financing. If the West doesn’t help, they will fall back upon China. To prevent that, the plan should be much larger than the India-Middle East-Europe Economic Corridor proposed at the recently concluded G-20 summit in New Delhi.

(The writer is a commentator, author and academic. Views expressed are personal)

Advertisement