Govt bonds worth Rs 32,000 crore to be auctioned on April 26

The Finance Ministry on Monday announced the sale of government bonds worth Rs 32,000 crore in two categories on April 26 (Friday).

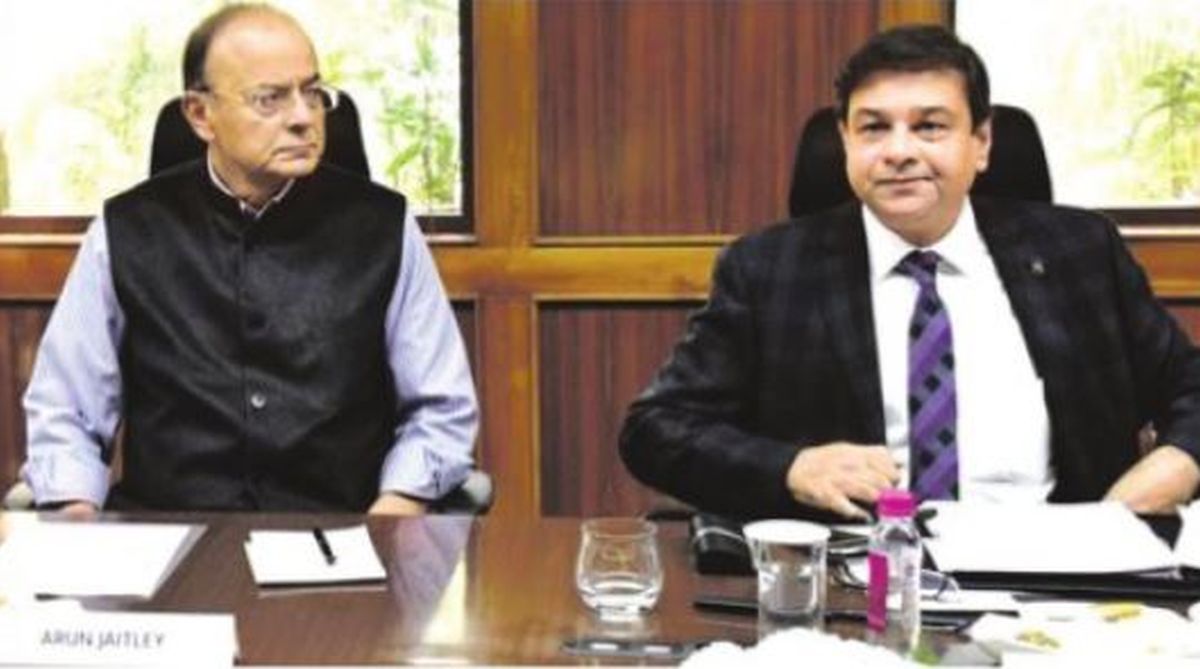

The uncharacteristic spat between the mandarins of North Block in the Ministry of Finance (MoF) on the one hand and the mainly Congress-led but joined by impartial academics spewing their acidulous onslaught on behalf of the country’s central bank in defense of the latter’s functional autonomy on the other, did eventually turn out to be a tame affair after the RBI board met in Mumbai on November 19.

Never in the annals of the close to eight-decade-old venerable institution, has the RBI been subjected to the public glare as in the last couple of weeks prior to its board meeting and ever since its Deputy Governor Viral Acharya made a forceful plea in a public lecture in October cautioning that “governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire and rue the day they undermined the institution’s autonomy”.

Subsequent developments on the country’s bourses and the tense build-up of relations between the two mighty dispensations of the country became grist to the media mills that lost little time in blowing up issues that could have been thrashed out sitting across the table sans acrimony.

Advertisement

From the viewpoint of the Finance Ministry, the motives behind its alleged move to eye the surplus funds vested with the apex bank are understandable as it is faced with a very tight fiscal situation. Besides, the ruling dispensation is in the dire need to indulge in pre-election sops to sustain its vote-banks lest the stakeholders in the real sectors of the economy including industry which is looking for fresh credit and forbearance from past ones and the people at large should penalize it if the credit spigot runs dry.

To boot, commercial banks are in a bind not being in the benign position to offer advances as they are cleaning the stables of the rotten ones scattered all over in the form of non-performing assets (read advances) piled up from past lending profligacy or under duress from political leaders of various hues.

In the run-up to the 2014 Elections, there was a flurry of forbearance in the banking regulator’s method to long maturity infrastructure loans with sufficient leeway to roll over loans. In May 2013, it was announced that such loans, even if they are restructured once, will be classified as NPAs with a convenient proviso of a two-year reprieve so that this was implemented effective from May 2015.

This accommodation was done to address the corking concerns of independent directors in the RBI board who raised the matter and duly got relief. Independent directors drawn from industry or any walk of life for being eminent do like to secure their interests undisturbed and this regulatory capture even on a small and unobtrusive scale is inherently built into the system.

Be that as it may, this time around, there was a hue and cry that the micro, small and medium enterprises (MSMEs), the backbone of the manufacturing and merchandise trade segments of the nation, are in difficulty for want of working expenses to run their outfit. Being small but collectively a big employment generator and contributor to the national income, they have no big lobby. But the government itself has a huge stake in their survival both for the sector and itself. The share of MSMEs in gross domestic product at current price during 2016-17 was 28.9 per cent.

In February 2008, the Union Cabinet approved a revised definition designed to promote the ease of doing business by putting in place a non-discretionary, transparent and objective criterion to substitute the earlier one based on investment in plant and machinery/equipment. In the changed scenario, a microenterprise is defined as one where the annual turnover does not exceed five crore rupees, a small enterprise as one where the annual turnover is more than five crore rupees but does not exceed seventy-five crore rupees and a medium enterprise as one where the annual turnover is more than seventy-five crore rupees but does not exceed two hundred and fifty crore of rupees.

Still, the stark reality is that bank finance is so meagre to this vibrant and growth-propelling segment that the third and fourth All India Census noted that only five per cent of MSMEs could access institutional credit. Even as sufficient and swift credit to the sector remains a pipe-dream with the Centre pitching in for easier NPA norms for the sector and more credit flow in the run-up to the November 19 RBI Board meeting, all that the marathon nine-hour session spawned was a nod from the apex bank for a credit recast to the MSME segment.

With corporate leviathans swallowing humongous amount of bank advances and leaving a festering balance sheet bruise, the complete cure of which remains a work in progress, the RBI has to bear the additional burden by its decision to consider a scheme for the restructuring of the stressed standard assets of MSMEs’ borrowers with aggregate credit facilities of up to Rs 25 crore, subject to certain conditions.

Rating agency Moody’s said “while more details are awaited, this approach has the potential for negative implications for the credit profiles of Indian banks”. No doubt, MSMEs deserve credit support but the mechanisms to fund their working capital requirements through direct budgetary support or other policy-oriented sops to popularise their products need to be given priority by the authorities so that the deterioration in their NPAs that exposed the inept functioning of various recovery steps instituted over the past decades is reversed for a robust credit culture to be sown.

In the final analysis, for all the brouhaha and hullabaloo over the growing perception hiatus between the RBI and the Government, both remaining interdependent institutions of the sovereign, they conducted themselves responsibly, leaving the Cassandras of doom nonplussed. On sensitive matters like the relaxation of the RBI’s Prompt Corrective Action (PCA) on weak banks and the capital framework the apex bank needs to keep for any eventuality, these have been adverted to the expert group to come out with pragmatic resolutions.

On the other weighty issues covering the liquidity position of the nonbank finance companies (NBFCs) and governance of the central bank, it would be discussed at the next month board meeting, bidding the time right now to the benefit of all the stakeholders, policy wonks wryly say.

The author is a free-lance economic journalist based in New Delhi.

Advertisement