India’s economy to attain size of USD 34.7 trillion by 2047: PHDCCI

The Indian economy is displaying robust growth post Covid pandemic despite continued global headwinds, the industry body said.

Further, to discourage the practice of making business payments in cash, Sitharaman proposed to levy TDS of 2 per cent on cash withdrawal exceeding Rs 1 crore in a year from a bank account.

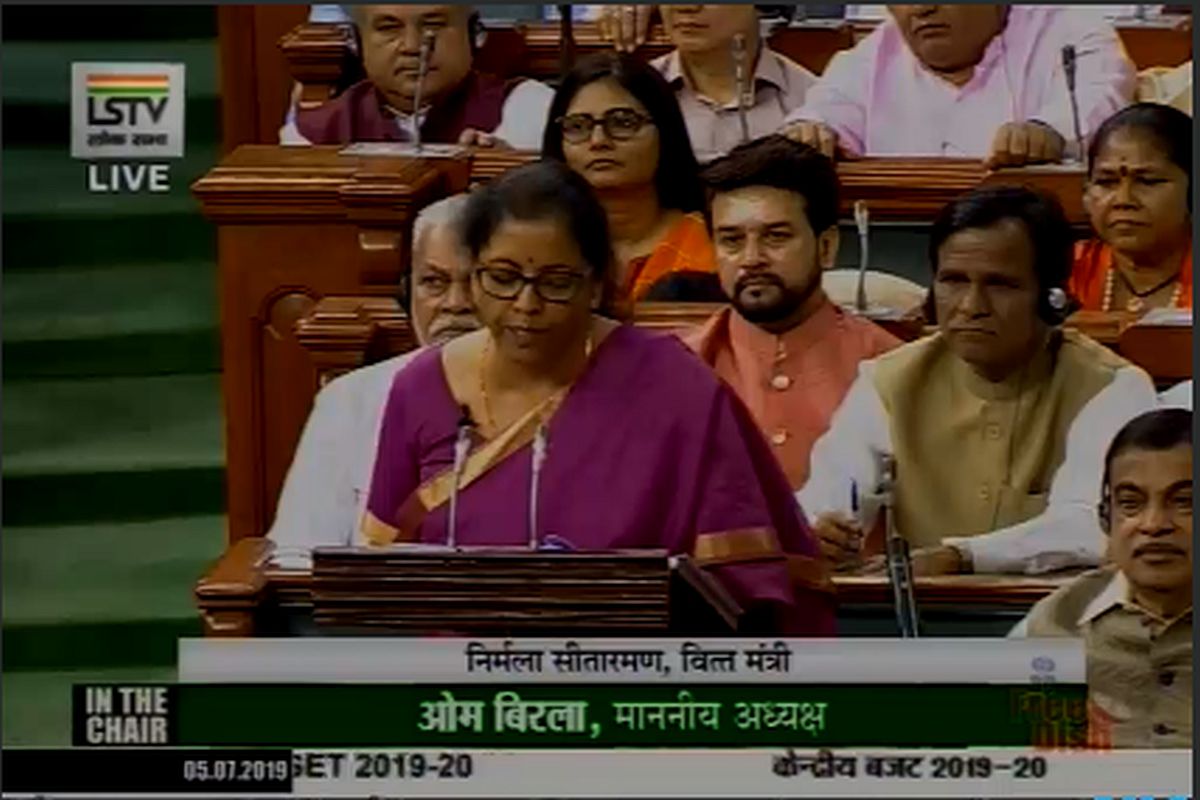

Union Finance Minister Nirmala Sitharaman presenting the Union Budget 2019 in Lok Sabha. (Photo: Twitter | @loksabhatv)

Union Finance Minister Nirmala Sitharaman on Friday presenting the full Union Budget in the Lok Sabha said that India will grow to become a $3 trillion economy in the current year.

She said from $1.85 trillion economy in 2014 India has grown to a $2.7 trillion economy now. India is now the sixth largest economy in the world.

“It took us over 55 years to reach $1 trillion dollar economy. But with hope, trust and aspiration, we in just five years, added $1 trillion,” Sitharaman said in the Lok Sabha.

Advertisement

The Finance Minister further said that India has the capacity to reach $5 trillion in the next few years.

Lauding the previous government, Sitharaman said the first term of Prime Minister Narendra Modi-led NDA government stood out as a performing one. “Between 2014-2019, he (PM Modi) provided a rejuvenated Centre-State dynamics, cooperative federalism, GST council and strident commitment to fiscal discipline.”

Sitharaman said schemes such as ‘Bharatmala’, ‘Sagarmala’ and UDAN have played a major role in bridging the rural and urban divide, improving the transport infrastructure.

Gone are the days of policy paralysis and license quota control regime, she said, adding that all private sector industries played a role in growing the economy.

“India Inc are India’s job creators and thereby nation’s wealth creators.”

Presenting her maiden budget, Sitharaman said comprehensive restructuring of National Highways Programme will be done to ensure the creation of National Highways Grid of desirable capacity. The Government envisions using rivers for cargo transport which will also decongest roads and railways.

Railway infrastructure would need an investment of Rs 50 lakh crores between 2018 and 2030, she said. Public–private partnerships (PPP) will be used to unleash faster development and the delivery of passenger freight services.

The minister said the government was examinng the performance of the Ujjwal DISCOM Assurance Yojana adding that it will work with the state governments to remove barriers, cross- subsidy, surcharges, undesirable duties on open access sales or captive generation for industrial and bulk power consumers.

Sitharaman said Rs 350 crore has been allocated for 2 per cent interest subvention for all GST-registered MSMEs on fresh or incremental loans. A payment platform for MSMEs will be created to cut down time.

Pension for 3 crore retail traders with turnover less than Rs 1.5 crore will be launched under Pradhan Mantri Karma Yogi Maan Dhan Scheme, the Lok Sabha was told.

The minister proposed changes to kickstart domestic and foreign investment.

The government, Sitharaman said, would invite suggestions for further opening up of Foreign Direct Investment (FDI) in aviation sector, media, animation AVGC and insurance sectors in consultation with all stakeholders. 100 per cent FDI will be permitted for insurance intermediaries.

To deepen corporate tri-party repo market in corporate debt securities, the government will work with regulators RBI and SEBI to enable stock exchanges to allow AA rated bonds as collaterals.

User friendliness of trading platforms for corporate bonds will be reviewed, including issues arising out of capping of International Securities Identification Number, Sitharaman told the Lok Sabha.

The government also proposed incentives for electric vehicles. The FAME II scheme aims to encourage faster adoption of electric vehicles by the right incentives and charging infrastructure.

Government has already moved GST council to lower the GST rate on electric vehicles (EV) from 12 per cent to 5 per cent. Also to make EVs affordable for consumers, the Government will provide additional income tax deduction of 1.5 lakh rupees on the interest paid on the loans taken to purchase EVs, the minister said.

Nirmala Sitharaman said it was the right time to consider increasing minimum public shareholding in the listed companies adding that the government has asked SEBI to consider raising the current threshold of 25 per cent to 35 per cent.

Annual Global Investors’ Meet will be organized in India, using National Investment and Infrastructure Fund (NIIF) as the anchor to get key sets of global players to come and invest in India, the finance minister said.

Moving on, the minister said, with the changing economic scenario it is important to upgrade roads connecting villages to rural markets. For this Pradhan Mantri Gram Sadak Yojana phase 3 is envisaged to upgrade 1,25,000 km of road length over the next 5 years.

Speaking on India’s achievement in the space sector, Sitharaman said the country has emerged as a major space power adding that to harness India’s space ability commercially, a public sector enterprise, New Space India Limited (NSIL) has been incorporated to tap benefits of ISRO.

The Government, in the Union Budget, has promised to invest widely in agricultural infrastructure.

“We will support private entrepreneurship in driving value addition to farmers produce and those from allied activities too, like bamboo, timber and also for generating renewable energy.”

Sitharaman proposed to expand the Swachh Bharat mission to undertake sustainable solid waste management in every village. “9.6 crore toilets have been constructed since October 2, 2014. More than 5.6 lakh villages have become open-defecation free.We have to build on this success,” she said.

“Happy and satisfied to report that India will be made Open-Defecation Free on October 2nd, 2019, as per the dream of PM Modi,” the minister added.

In a major announcement, the government has proposed to make PAN card and Aadhaar card interchangeable and allow those who do not have PAN to file returns by simply quoting Aadhaar number and use it wherever they require to use PAN.

Further, to discourage the practice of making business payments in cash, Sitharaman proposed to levy TDS of 2 per cent on cash withdrawal exceeding Rs 1 crore in a year from a bank account.

All companies having annual turnover of 400 crores will now be under the bracket of 25 per cent. This will cover 99.3 per cent of all the companies.

The Government has taken a slew of measures to ease burden on small and medium earners. Those having annual income up to Rs 5 lakhs are not required to pay any income tax.

To resolve the so-called Angel Tax issue, startups and their investors who file requisite declarations and provide information in their returns will not be subjected to any kind of scrutiny in respect of valuations of share premiums.

At present startups are not required to justify fair market value of their shares issued to certain investors including category 1 alternative investment funds. The Government has proposed to extend this benefit to category 2 alternative investment funds also.

The Government has also proposed to increase special additional excise duty and road and infrastructure cess each one by 1 rupee a litre on petrol and diesel.

The government also proposed to increase custom duty on gold and other precious metals from 10 per cent to 12.5 per cent.

The minister said the fiscal deficit this year is 3.3 per cent, brought down from 3.4 per cent.

According to the Economic Survey 2019, the revised fiscal glide path envisages achieving fiscal deficit of 3 per cent of GDP by FY 2020-21.

In a major boost to the Non-resident Indians (NRIs) for seamless access to Indian equities, NRI portfolio investment route will be merged with foreign portfolio investment route.

On ensuring India’s water security and providing access to safe drinking water, Sitharaman said the new Jal Shakti Ministry will look at the management of water resources and supply in an integrated and holistic manner and will work with States to ensure ‘Har Ghar Jal’ to all rural households by 2024 under the ‘Jal Jeevan Mission’.

Sitharaman, the first woman finance minister to present the full Union Budget also drew attention to the women of India ‘Naari tu Narayaani’, saying that the government believes that India can progress with greater women participation.

To further encourage women entrepreneurship, the Government has decided to expand Women Self Help Group(SHG) Interest Subvention Programme to all districts in India.

On affordable housing, the government said over 81 lakh houses with investment of about Rs 4.83 lakh crore have been sanctioned of which construction has started in about 47 lakh houses, under the Pradhan Mantri Awas Yojana. Over 26 lakh houses have been completed of which nearly 24 lakh houses have been delivered to beneficiaries, Sitharaman informed.

To provide further impetus to affordable housing, the government has proposed additional deduction of 1.5 lakh rupees on interest paid on loans borrowed upto 31 March 2020 for purchase of house up to Rs 45 lakhs.

To popularise sports at all levels, National Sports Education Board for development of sportspersons will be set up under ‘Khelo India’.

To give further impetus to India’s growing influence and leadership in the international community, the Government has decided to open Indian embassies and high commissions in countries where India does not have a resident diplomatic mission as yet.

“The government intends to open another four embassies, new ones, in the year 2019-20. This will not only increase the footprint of India’s overseas presence but also provide better and more accessible public services especially to the local Indian communities in these countries.”

Sitharaman also proposed to consider issuing Aadhaar card for Non Resident Indians (NRIs) with Indian passports after their arrival in India without waiting for the mandatory 180 days.

Further on, the government informed that there has been a recovery of Rs 4 lakh crore Non-performing assets (NPAs) over the last four years. NPAs are down by Rs 1 lakh crore in the last one year.

Sitharaman said ‘Gandhipedia’ is being developed to sensitize the youth about positive Gandhian values.

The minister informed that India’s sovereign external debt to GDP was among the lowest globally at less than 5 per cent. The Government will start raising a part of its gross borrowing program in external markets in external currencies.

The Government has been following policy of disinvestment in non-financial public sector undertakings, maintaining government’s stake not to go below 51 per cent. Sitharaman said the Centre is considering, in case where undertaking is still to be retained in government control, to go below 51 per cent to an apt level on case to case basis.

Strategic disinvestment of select Central Public Sector Enterprises will continue to be a priority, the Finance Minister said adding that strategic disinvestment of Air India will re-initiate. Rs 1 lakh 5 thousand is the disinvestment target for 2019-20.

Sitharaman further informed that a new series of coins of Re 1, Rs 2, Rs 5, Rs 10, Rs 20 easily identifiable to the visually impaired, released by PM Modi on 7 March 2019, will be made available for public use shortly.

Direct tax collection has increased by 78 per cent and tax collection rose from 6.38 lakh crore rupees in 2013-14 to 11.37 lakh crore rupees in 2018, the Lok Sabha was told.

This is the first full Union Budget of Prime Minister Narendra Modi-led National Democratic Alliance (NDA) government after returning to power for the second time.

In a departure from the British-era tradition, Sitharaman was seen holding a red cloth folder bound by a string and emblazoned with the national emblem ahead of the Union Budget.

Advertisement