Equity benchmarks of Bombay Stock Exchange and National Stock Exchange extended their record-breaking run for the second session today as the 30-share Sensitive Index and the 50-stock Nifty kept climbing fresh peaks on robust buying support not only by domestic institutional investors but also by foreign portfolio investors.

FPIs have apparently stepped up investment which analysts attribute to rising expectation about much-awaited and needed growth in corporate earnings in October-December quarter of this financial year.

Commenting on the latest surge in main indices, Mr Laurence Balanco of CLSA, said: “It is a start of a re-rating for emerging markets and the positive trade is to move out of international assets into EM assets.” The Hong Kong-based agency has now upped Nifty target to 12,000 in the first half of 2018 and for the Bank Nifty to 31,000.

Several brokerages have been revising their targets upward for the Sensex and the Nifty as they see the liquidity-driven rally of 2017 is now receiving a push from improving fundamentals. According to them, the biggest positive in near term is likely to be revival of private capital expenditure after a gap of almost three years.

CLSA analyst, on the other hand, sees three to five per cent pullback ~ but not big correction ~ in the United States stock market where Dow Jones hit 25,000-mark for the first time last week. Any correction should be taken as buying opportunity.

Dalal Street analysts say the domestic benchmarks too declined several times in 2017, but also displayed remarkable resilience in sharp turnarounds on the back of buying on dips by domestic institutional investors and retail investors.

Yesterday, FPIs were net buyers in equities worth Rs 693 crore, much more than DII’s Rs 126 crore investment. In calendar year 2017, they collectively net invested $26 billion in shares, according to the Securities and Exchange Board of India and depository data.

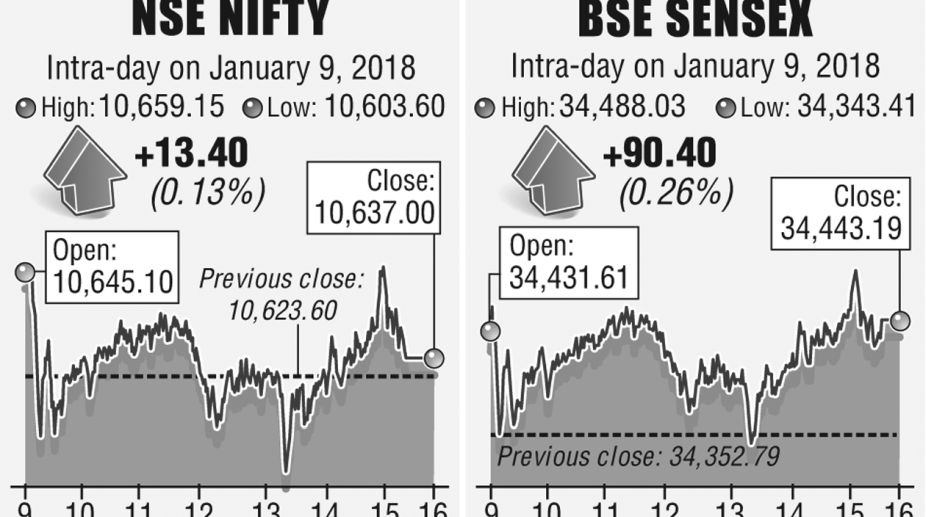

The Sensex today closed at 34,443.19 points, registering a gain of 90.40 points or 0.26 per cent. Broader market’s Nifty finished 0.13 per cent or 13.40 points up at 10,637 points. The Bank Nifty continued upside movement albeit slowly with an increase of 0.11 per cent or 27.70 points to end at 25,703.80 points. In the Sensex pack, 14 shares advanced and 17 declined. For the Nifty, the advance-decline ratio stood at 19 versus 31.

Aditya Birla Sun Life AMC’s Mr Mahesh Patil, who manages $6.3 billion assets, said: “Equity market has not done yet..it was a good 2017 in terms of returns but India has lagged global rivals on earnings and economic growth because of the impact of reforms. The pain of reforms is now behind us and slowly growth will start improving.”

He sees Nifty companies’ earnings to rise at an average of 19 per cent in the year starting 1 April 2018 as businesses have adjusted to the policy changes. Provisions for soured corporate loans at banks will reduce and earnings in telecom and drugmakers will drive indices’ profit growth. Foreign flows which were tepid in 2017 will turn favourable as economic growth returns and both these will continue to keep market buoyant and valuations high, says Mr Patil.

Today, top gainers in the BSE benchmark included Coal India at Rs 303.80, up 5.54 per cent; Yes Bank at Rs 341.10, up 2.31 per cent; Wipro at Rs 318, up 2.23 per cent and RIL at Rs 939, up 1.14 per cent. BSE’s market capital at close was Rs 1,54,86,079 crore.