Paytm was given sufficient time, action after persistent non-compliance: RBI

The Reserve Bank said that Paytm was given sufficient time for compliance with the norms.

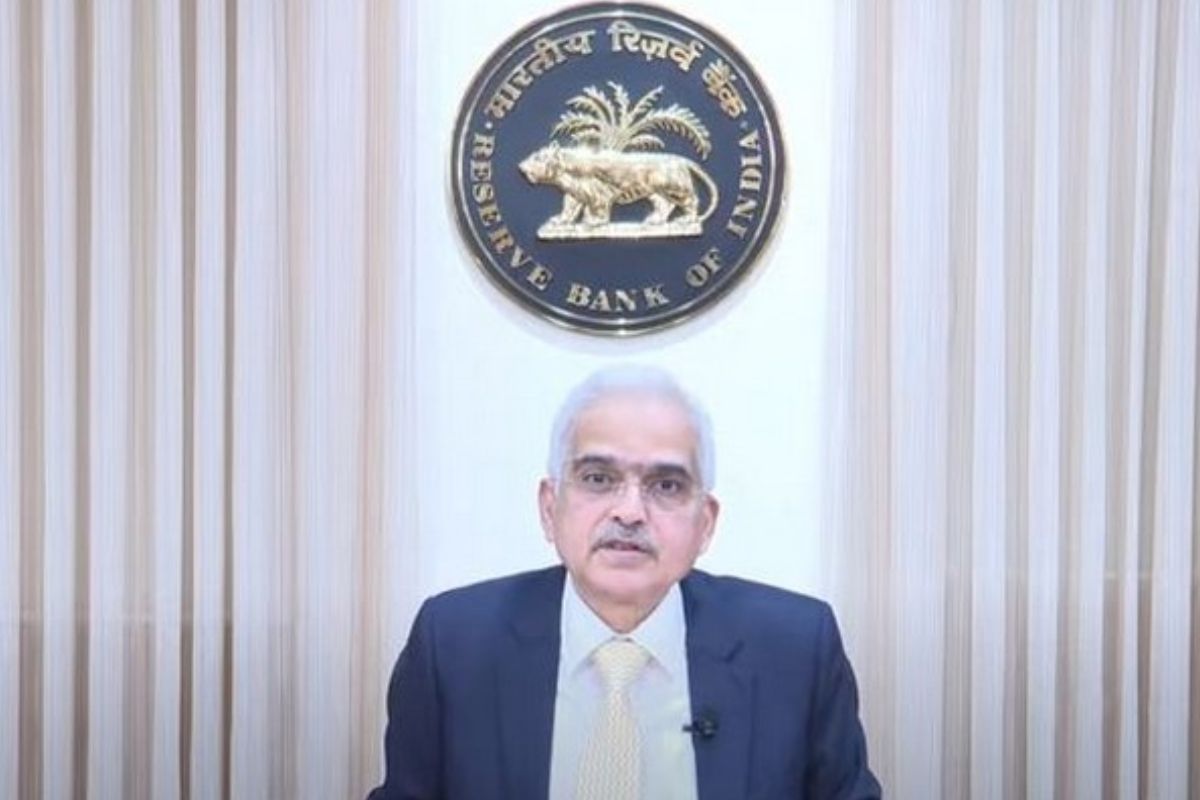

RBI Governor Shaktikanta Das attributed comfortable inflation and firm growth dynamics as the reasons behind keeping the repo rate unchanged.

The Reserve Bank of India (RBI) has kept the policy repo rate unchanged at 6.5 per cent for the sixth straight time. The decision was announced on Thursday after a three-day review meeting of the RBI’s Monetary Policy Committee (MPC).

Deliberating on the policy statement, RBI Governor Shaktikanta Das attributed comfortable inflation and firm growth dynamics as the reasons behind MPC’s decision to keep the repo rate unchanged.

A repo rate is basically the rate of interest rate at which RBI lends to other banks.

Advertisement

The retail inflation in India is in RBI’s comfort level between 2-6 per cent. However, it was above the ideal 4 per cent scenario of the RBI. In December 2023, the retail inflation in India was 5.69 per cent.

The RBI governor believed it is moving closer to the target and at the same time, the growth is also holding better than expected.

Explaining further, Das said, “…The Reserve Bank undertook six fine-tuning variable rate reverse repo auctions, that is, VRRR auctions from February 2 to February 7, 2024 to absorb surplus liquidity. Financial market segments have adjusted to the evolving liquidity conditions to varying degrees. While the short-term rates have fluctuated. Long-term rates have remained relatively stable, reflecting better anchoring of inflation expectations, as indicated in the softening of the term spread in the government securities market. In the credit market, however, monetary transmission remains incomplete…Our policy stance is in terms of interest rate, which is the principal tool of monetary policy in the current framework.”

He said that the central bank’s decided to focus on withdrawal of accommodation in order to ensure the inflation is back to the ideal scenario of 4 per cent.

“So far liquidity conditions are concerned these are being driven by exogenous factors which are likely to correct in the foreseeable future, aided by our market operations,” he added.

The Indian economy grew 7.6 per cent during the July-September quarter of the current financial year 2023-24, remaining the fastest-growing major economy. India’s GDP growth for the April-June quarter grew 7.8 per cent.

The three-day bi-monthly monetary policy committee (MPC) meeting of the RBI began on Tuesday. The RBI typically conducts six bimonthly meetings in a financial year, where it deliberates interest rates, money supply, inflation outlook, and various macroeconomic indicators.

(With agency inputs.)

Advertisement