When it comes to identification cards, Permanent Account Number, popularly known as the PAN card is the most vital document, and the easiest one to carry in wallets. Therefore, there is a possibility that it may get lost or someone steals it. In such a scenario, an individual would just like another copy of it and that can be easily done by ordering a reprint online.

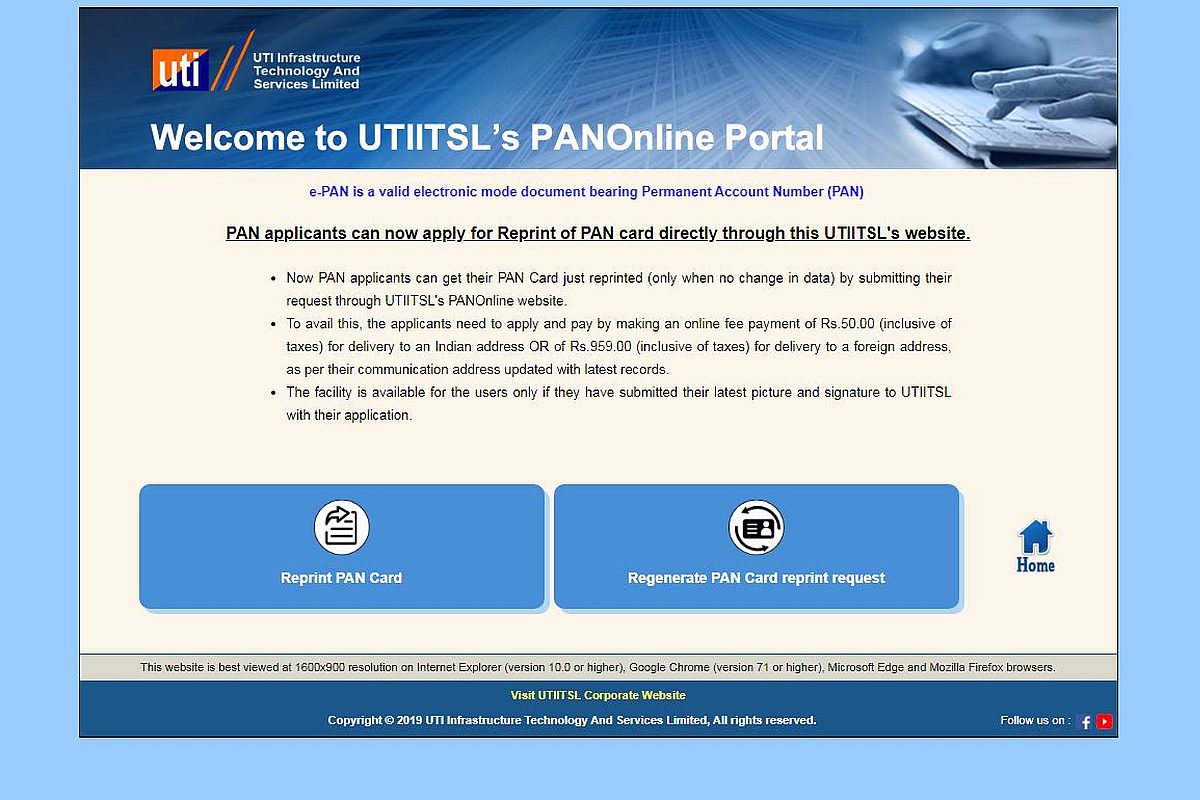

There are two agencies that issue the PAN cards–UTIITSL and NSDL-TIN. An individual can approach his agency and get a reprint of your ID.

Getting your PAN re-printed:

Go to the website of the respective agency i.e. NSDL and UTITSL and go to the ‘Reprint PAN card’ option. This section is used when you want another copy of your previous PAN to be delivered at the doorsteps, therefore, the details on the card will be the same as the old one. This option is not for the ones who are looking to make some changes in their existing data.

Fee charged:

For the Indian residents both the agencies charge Rs 50 as the delivery fee. For those who are living in abroad will have to pay Rs 959 to get it delivered at their doorsteps. Of course, it is suggested that the individual checks the address mentioned in the Income Tax department’s records and the copy will be delivered on that address only.

Details required:

In order to apply for the copy, the individual is required to provide PAN number as well as his date of birth. The NSDL also asks for the Aadhaar card number as it is mandatory to link the two (PAN and Aadhaar).

e-PAN card:

As per the Union Budget 2019, the Chief of the Central Board of Direct Taxes mentioned that soon it will introduce centers across the country to facilitate applications of e-PAN cards.

Both the agencies, UTITSL and NSDL-TIN, issue the e-PAN to both, new as well as the existing PAN cardholders.

The PDF issued by the income tax department is to be treated at par with the physical PAN card. In a similar manner, e-copies of Aadhaar cards, issued by the department itself, are also treated in a similar manner.

The e-PAN can be easily downloaded for free of cost by visiting the online portals of the respective agencies and providing PAN number as well as DOB.

(With input from agencies)