RBI issues circular on tighter liquidity norms for banks

The Reserve Bank of India (RBI) on Thursday issued a draft circular on the Basel III framework on liquidity standards, which will require banks to set aside more funds to cover their risks.

Addressing the media on monetary policy, Das said the GDP growth has been projected at 7.4 per cent for 2019-20.

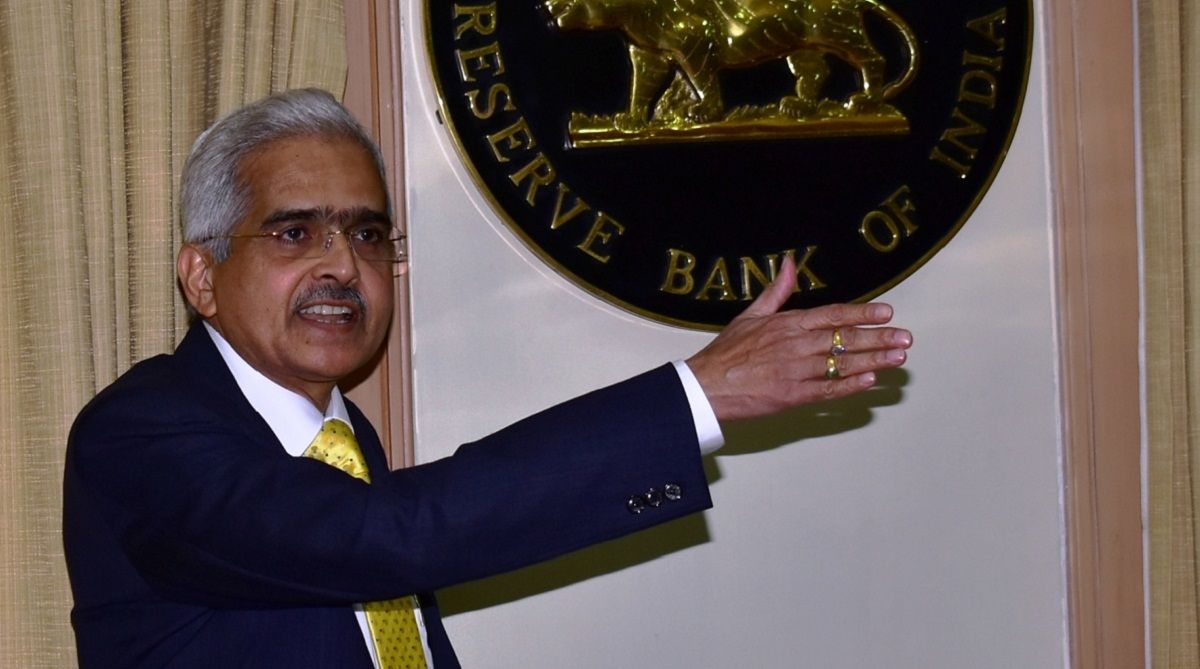

RBI Governor Shaktikanta Das (File Photo: IANS)

The Reserve Bank of India on Thursday in its sixth bi-monthly policy statement for 2018-19, reduced the repo rate by 25 basis points from 6.5 per cent to 6.25 points.

The apex bank also changed the policy stance to “neutral” from existing “calibrated tightening”.

“On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 6.5 per cent to 6.25 per cent with immediate effect,” said the policy statement.

Advertisement

Earlier, the Monetary Policy Committee had changed its stance to calibrated tightening in the meeting held in October 2018.

This is the first monetary policy committee meeting since Urjit Patel abruptly resigned in December 2018 and Shaktikanta Das took over as the new Governor.

Addressing the media on monetary policy, Das said the GDP growth has been projected at 7.4 per cent for 2019-20.

The inflation rate is estimated at 3.2-3.4 per cent in the first half of the year 2019-20 and 3.9 per cent in the third quarter of 2019-20, he said.

Headline inflation is expected to remain contained below or at its target of 4% per cent. “This has opened space for policy action. Investment activity is recovering supported mainly by public spending on infrastructure,” the RBI governor said.

Speaking on the export growth, the apex bank governor said that on a year-on-year basis it was almost flat in November and December 2018, primarily due to a high base effect and weak global demand.

The governor further informed that the RBI has decided enhancement of collateral free agriculture loan from Rs 1 lakh to Rs 1.6 lakh.

“This enhancement Rs 60,000 has been taken in view of the overall rise in inflation, marginal agriculture input and benefit to small farmers,” he said.

ANAROCK Property Consultants Chairman Anuj Puri welcomed the RBI’s decision to slash the repo rate with the loans being given by banks becoming cheaper after the move.

Rate cuts give a substantial push to property buyer sentiments.

In the Interim budget announced on February 1, the Government missed the fiscal deficit target for FY19 having revised it to 3.4 per cent from the earlier budgeted 3.3 per cent of the GDP.

Advertisement