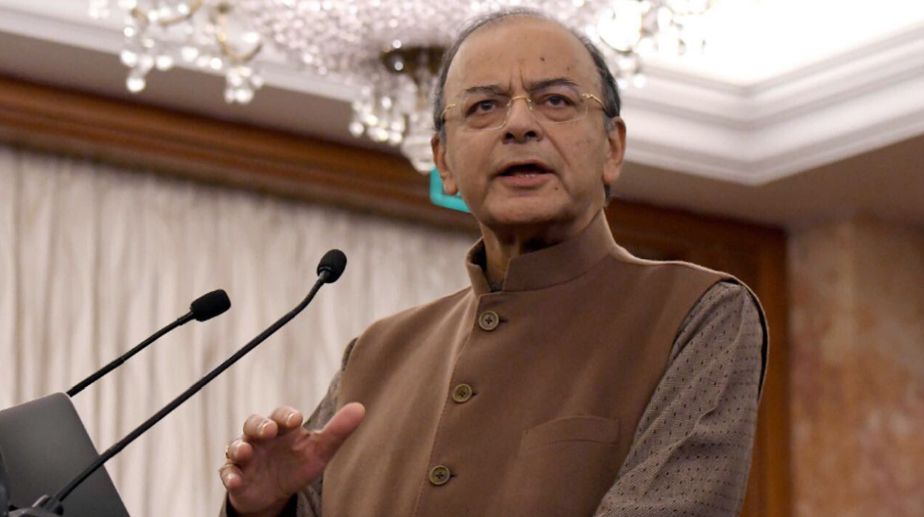

Bringing down the maximum Income Tax slab to 20 per cent, convergence to three-four GST slabs and bringing all items under it were among the demands made to Union Finance Minister Arun Jaitley on Wednesday by industry and trade representatives.

During his pre-Budget consultations, Jaitley urged business leaders to invest in the infrastructure sector to build a stronger India.

He said private investment, along with public and foreign investment, is the key to boost growth and create more job opportunities in India.

The Minister said the government had taken various steps, including setting up of the National Investment and Infrastructure Fund (NIIF), to boost investment in the infrastructure sector.

Industry representatives made various suggestions, including bringing down maximum income tax to 20 per cent to encourage investment, a Finance Ministry statement said.

The stakeholders also highlighted the need for only three-four tax slabs under the Goods and Services Tax (GST) regime and to include in it all items excluded till now.

They also demanded that the benefit of filing quarterly returns under the GST be extended to all, instead of limiting it to those with a turnover of above Rs 1.5 crore.

They urged the government to permit the purchase of Banks Recapitalisation Bonds by institutes and the public at large, reduce government stake in public sector banks, and allow banks to securitise their loans and sell the same.

The government should consider further consolidation and even privatisation of some of the public banks, having at the most five to six large banks, they said.

At the meeting, industry body Ficci’s President Pankaj R. Patel pitched for board tax rate cuts for businesses and individuals to spur domestic investment and demand.

Patel said the move will help in retaining India’s overall competitive environment globally.

Ficci stressed that many key global economies were opting for significant rate cuts. “for instance, the US is on the verge of historic tax reform that proposes to cut the

corporate tax rate from a top rate of 35 per cent to 20 per cent as well as provide relief to individuals and that this approach should also be followed by India.”

The Ficci President also stressed on the need to consider the impact of the dividend distribution tax and the buyback tax.

“Together with the basic corporate income tax, this pushes India’s overall tax rate for companies well beyond 40 per cent, which is quite high,” Patel said.

“Another suggestion was made to bring a ‘scrap scheme’ to take more than 15-year-old heavy commercial vehicles off the road since the demand in this sector is at its peak today. This will help in generating employment opportunities as it will bring about large-scale private investment in this sector,” the statement said.

At the pre-budget consultation meet CII’s President Shobana Kamineni said that to strengthen the package for the turnaround of the banking sector, the government needs to lower its stake in public sector banks to 52 per cent and progressively to 33 per cent.

“The banks may be allowed to reissue the recapitalisation bonds and securitize good loans,” CII said in a statement.

On the power sector, CII recommended creation of a National Power Distribution Company which can buy power from stranded assets and help formulate a national pricing benchmark.

In addition, the industry body recommended setting up of a Land Bank Corporation to create a publicly accessible inventory of excess land holdings with many public entities in urban areas.

The stakeholders also suggested incentivising industry for larger women participation in industrial jobs, including subsidy for providing transportation facilities for women and incentives for running women dormitories.

Various other suggestions relating to various tax benefits for industry and trade were made, including consideration of across-the-board tax rate cuts for businesses and individuals.