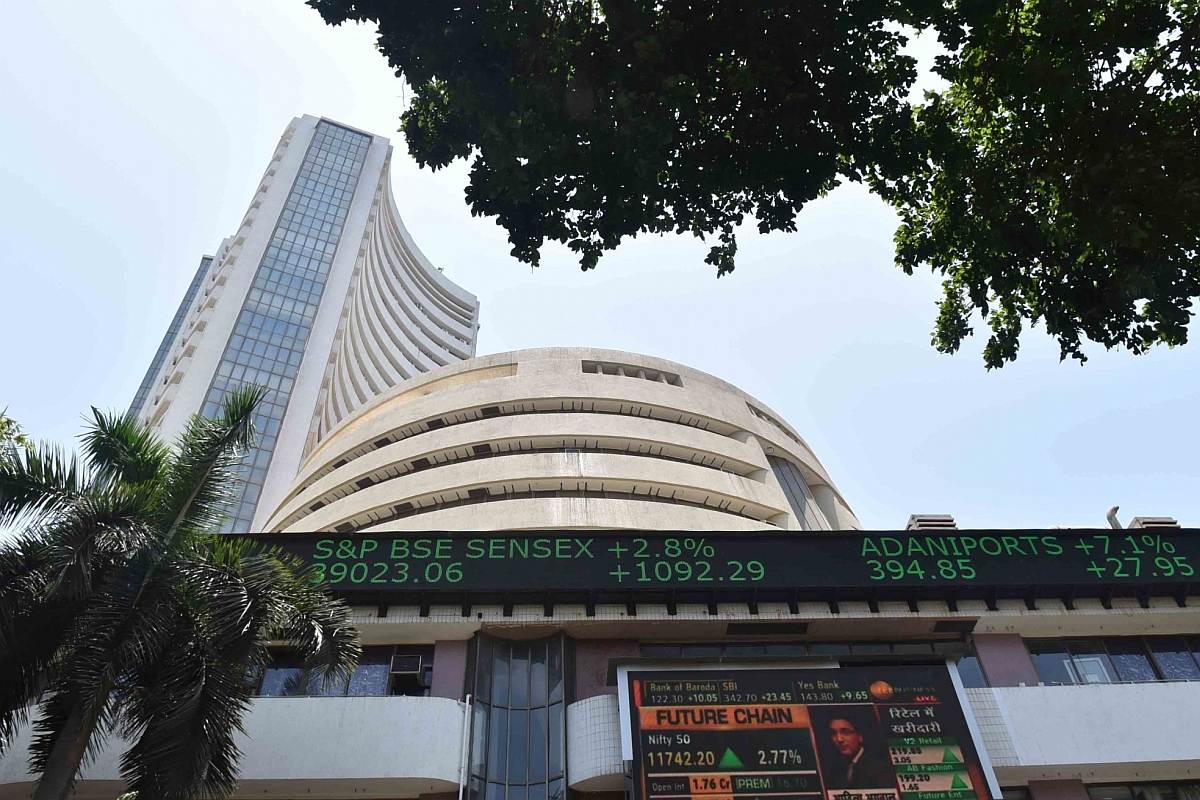

Stock market ends five-day winning streak

At close, Sensex was down 609.28 points, or 0.82%, at 73,730.16. Meanwhile, Nifty opened higher at 22,620.40 and touched a low of 22,419.90 in intraday trades.

At close, Sensex was down 609.28 points, or 0.82%, at 73,730.16. Meanwhile, Nifty opened higher at 22,620.40 and touched a low of 22,419.90 in intraday trades.

In 2022, Zomato had acquired Blinkit for $568 million but since then, on the back of improved performance, the latter’s implied valuation has grown to a staggering $13 billion, according to analysts at Goldman Sachs.

Inflation is expected to remain above the Reserve Bank of India's target level of 4 per cent over the forecast period due to strong economic activity, Majumdar said.

Natarajan is an acknowledged techno-business leader in the insurance and retirement industry, having spent over 25 years with Cognizant, serving clients in the US, the company said.

The Reserve Bank of India (RBI) on Thursday cautioned the public against Prepaid Payment Instruments issued by unauthorised entities.

The report, released on Thursday, also said that going forward robust foreign inflows and comfortable trade deficits are expected to keep the rupee within a comfortable range.

The extension was made considering the representations received by CBDT requesting for further extension of due date, and with a view to avoid genuine hardships to taxpayers.

Sensex closed 487 points, or 0.66%, higher at 74,339.44 while the Nifty closed the day with a gain of 168 points, or 0.75%, at 22,570.35 on the monthly F&O expiry day.

The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) member highlighted that going ahead, as India develops, the problem of high food inflation would be "less severe".

Singapore-based startup Zilingo came back to the news after its co-founder and former CEO, Ankiti Bose, filed a first information report (FIR) against co-founder Dhruv Kapoor and former COO Aadi Vaidya, for alleged cheating, fraud, and sexual and mental harassment.