Inheritance tax could nullify the progress India made in last 10 years: Nirmala Sitharaman

The finance minister criticised the Congress party for allegedly advocating the inheritance tax.

Making the announcement, Nirmala Sitharaman said the new tax rate will be applicable from the current fiscal which began on April 1.

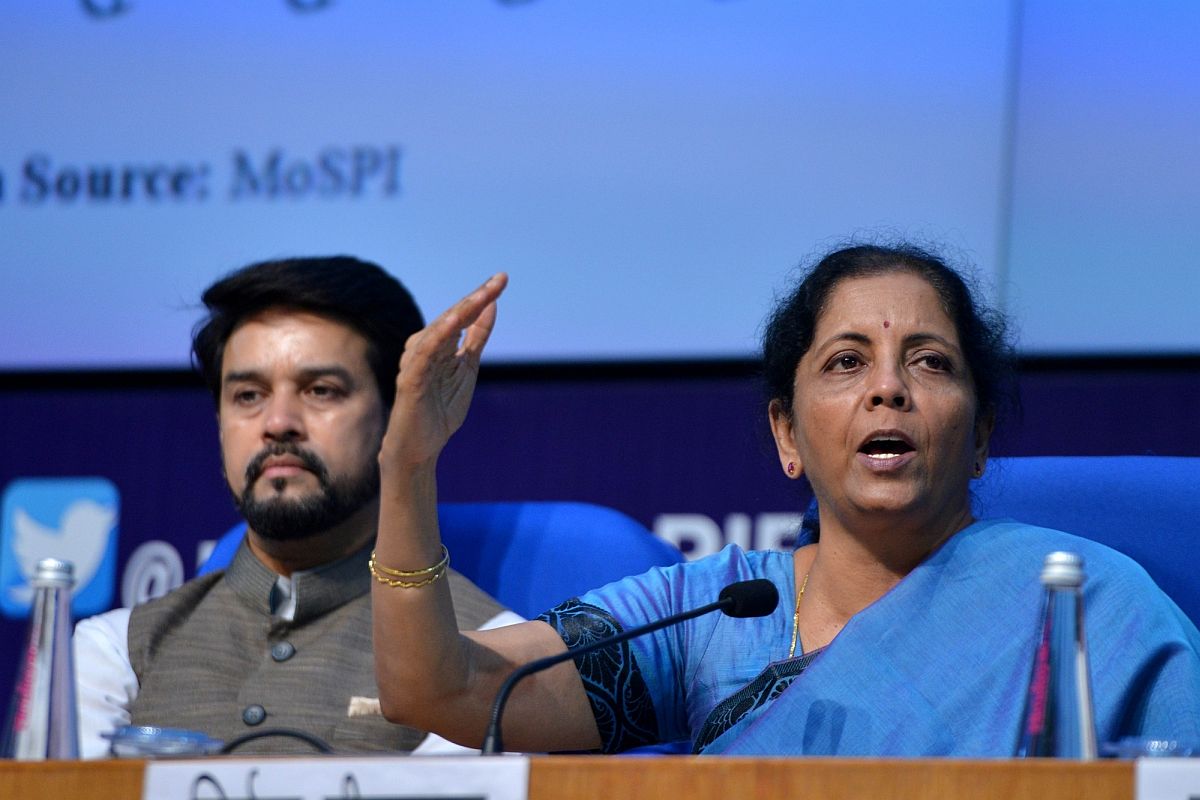

Union Finance Minister Nirmala Sitharaman. (File Photo: IANS)

Union Finance Minister Nirmala Sitharaman on Friday announced the slashing of corporate tax rate for domestic companies and for new domestic manufacturing companies.

“Ordinance to slash corporate tax rates for domestic companies has been cleared by Cabinet”, Sitharaman said in a press conference in Goa.

The government slashed the effective corporate tax to 25.17 per cent inclusive of all cess and surcharges for domestic companies.

Advertisement

In effect, the corporate tax rate will be 22 per cent for domestic companies, if they do not avail any incentive or concession.

“To promote growth, a new provision has been inserted in the Income Tax Act with effect from fiscal year 2019-20, which allows any domestic company to pay income tax at the rate of 22 per cent subject to condition they will not avail any incentive or exemptions,” Nirmala Sitharaman said.

To provide relief to companies which continue to avail incentive or exemptions, the Government has proposed to give a Minimum Alternate Tax (MAT) relief. The MAT rate has been reduced to 15 per cent from the existing 18.5 per cent.

Sitharaman also said that new domestic manufacturing companies incorporated after October 1, can pay income tax at a rate of 15 per cent without any incentives.

Sitharaman said that with this change, the effect tax rate for companies will be 17.01 per cent inclusive of surcharge and cess.

In order to stabilise the flow of funds into the capital market, it is provided that enhanced surcharge introduced in the Union Budget 2019 shall not apply on capital gains arising on sale of equity share in a company or a unit of an equity-oriented fund, the Finance Minister said.

The enhanced surcharge shall not apply on capital gains arising on sale of any security including derivatives in the hands of foreign portfolio investors.

Sitharaman further announced relief for listed companies which have already made a public announcement of buy-back before 5th July 2019. There will be no tax on buy-back of shares in case of such companies, she said.

These set of amendments are being brought about in taxation laws through an Ordinance to amend the Income Tax Act, 1961, the Finance Minister said.

Making the announcement, Nirmala Sitharaman said the new tax rate will be applicable from the current fiscal which began on April 1.

Sitharaman had on Thursday encouraged banks to increase public lending at a time when consumer demand has slumped sharply.

In a public outreach exercise, Sitharaman said public sector banks will organise credit “shamiana meetings” in 400 districts beginning October 3 to provide loans to NBFCs and retail borrowers, including homebuyers and farmers and banks won’t declare any stressed loan account of MSMEs as NPA till March 2020 and will work on recasting their debt.

She said the idea is to ensure maximum credit disbursal during the festive season. The aim is to bring all together at one place where retail customers can come and avail credit from banks and NBFCs.

In the past few weeks, the government has announced a series of steps to boost growth that had fallen to a six-year low of 5 per cent in June quarter.

Meanwhile, in a major relief for micro, small and medium enterprises (MSME), Finance Minister Nirmala Sitharaman on Thursday announced that stressed MSMEs would not be declared non-performing assets (NPA) till March 31, 2020.

Advertisement