Many large companies to move Appellate Authority against GST demand notices

In recent days, an increasing number of GST notices have been sent to many companies mainly on account of alleged discrepancy in input tax credit (ITC).

The Union Budget is an important document. An analysis of the budget statement is equally important. The main objectives of analyses and interpretation of the budget are to depict a true and fair picture of the country’s economic status. The other objective is to help discern the intention of the government in terms of economic development, inclusive growth and removing regional disparities.

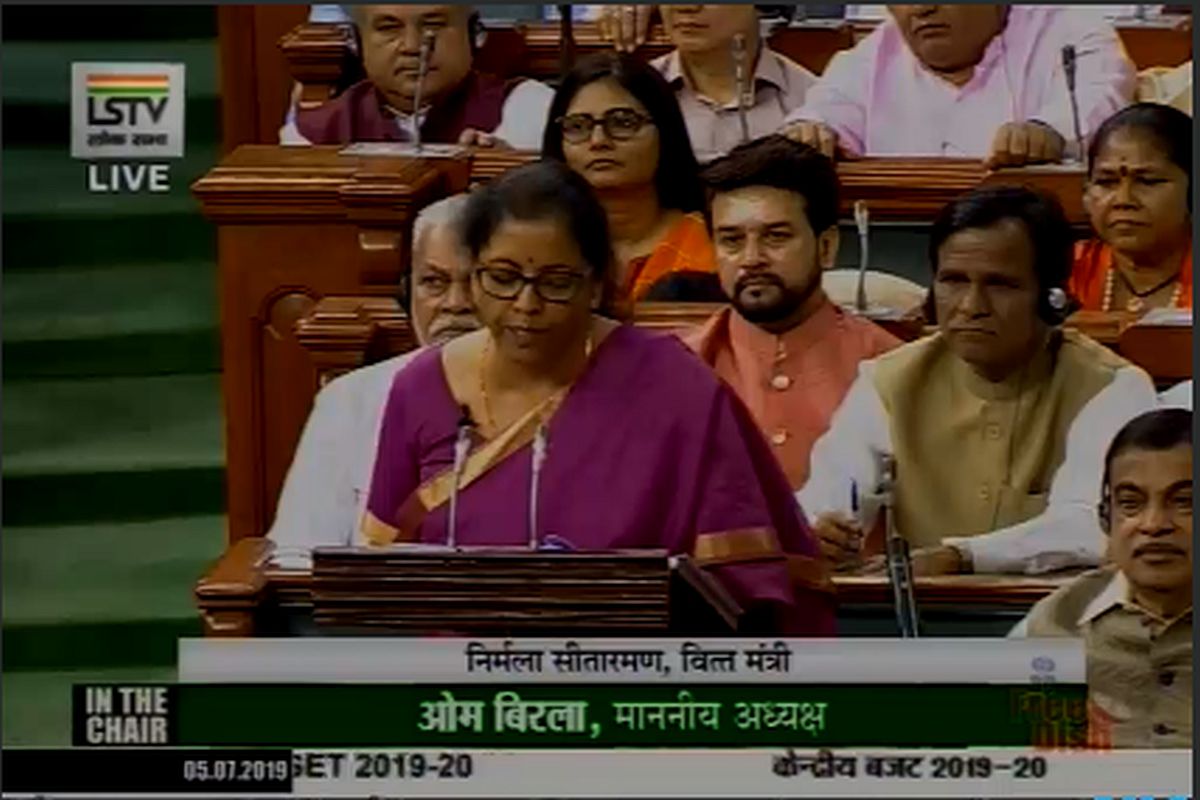

Union Finance Minister Nirmala Sitharaman presenting the Union Budget 2019 in Lok Sabha. (Photo: Twitter | @loksabhatv)

With the day of the Union Budget approaching, academia, corporates, tax-payers and common citizens are getting into the mist of guess-work. But, what is there in the budget that makes people sit glued to their television sets? Why is the budget day taken as a special day? One major reason is that the Union Budget for any fiscal year is a comprehensive statement of projected sources and applications of government funds for that year. It is true that common people get an idea about change in the price of consumables and their tax burden. But then, the purpose of the budget is much broader.

It reflects the plan of the central government for allocation of the country’s resources. An empirical analysis of the budget can reveal many macroeconomic parameters. The problem arises when the budget is dissected in divergent ways. Different perceptions emerge from different segments of the people. The next budget will be presented at a time when the Indian economy is passing through adverse conditions, specifically rising inflation, high fiscal and revenue deficit and low growth rate. The method to analyse the budget thus become very important. How should one do that? In my opinion, trend and variance analyses of the components of the budget is the first step.

Before we proceed further, one should have a conceptual understanding of various components of the budget. They are: Revenue Budget (estimate of revenue receipts and expenditure) and Capital Budget (estimate of capital receipt and expenditure). Gross tax revenues are collected from corporate tax, income tax, wealth tax, securities transaction tax, banking cash transaction tax, customs duties, excise duties, GST and taxes of the Union Territories. Non-tax revenues are collected from interest receipts, dividends, profits, external grants, other non-tax revenue and receipts from Union Territories.

Advertisement

The Centre’s net tax revenue is gross tax revenue net of the amount transferred to the National Calamity Contingency fund and the state’s share. Revenue expenditure has two components. Plan revenue expenditure includes central plan, central assistance for state and Union Territory plans. Non-plan revenue expenditure includes interest payments, pre-payment premium, defence services, subsidies, grants to state and Union Territory governments, pensions, police services, assistance to states from National Calamity Contingency Fund, payment for economic and other general services, postal deficit, expenditure of Union Tterritories without legislature, grants to foreign governments etc.

Capital receipt includes non-debt receipts (recoveries of loans and advances and miscellaneous capital receipts) and debt receipts (market loans, short-term borrowings, external assistance, securities issued against small savings, state provident funds and other receipts). Capital expenditure is also of two types ~ Plan and Non-Plan. The former refers to expenses on the central plan and central assistance for state and Union Territory. The other includes defence services, other non-plan capital outlay, loans to public enterprises, loans to state and Union Territory governments, loans to foreign governments and other non-plan capital expenditure.

One can understand a budget if it is presented in a horizontal form as: short term sources of funds (revenue receipt) + long term sources of funds (capital receipt) = short term applications of funds (revenue expenditure) + long term applications of funds (capital expenditure). Like accounting equation, sources of fund have to be equal to applications of funds. If this is not so, it is balanced from ‘draw-down of cash balance’. The next important component of the budget is ‘fiscal deficit’. Any government will aim at meeting its revenue and capital expenditure in a year from its revenue receipts and the amount recovered from loans given by it and other receipts of capital nature.

If this is not so, there will be ‘fiscal deficit’. Fiscal deficit is met mainly from additional borrowings. Carrying out trend and variance analysis based on percentage of past years’ GDP, one can find out whether the amount projected for various components of the current year’s budget are realistic or not. Exhibiting a comparative statement showing the amounts in the union budget and those derived from trend and variance analyses, one can assess the achievability of its main components. For budget analysis, the other important parameters are: debt servicing capacity (DSC), interest servicing capacity (ISC) and efficiency index for interest collection (EIIC).

If revenue receipts are divided by sum of ‘repayment of debt and total interest payment’, we get DSC. More the ratio (ideal ratio being 2) it is better. If revenue receipt is divided by only the amount of total interest payments, we get ISC. Ideal ratio is 3. More the better. The amount of interest received during a particular year as a percentage of mean value of total loan outstanding at the beginning and at the end of that year may be considered as efficiency index for interest collection (EIIC). What is the impact of the Union Budget on the economy of a country? The extent of the deficit and the means of its financing influence the money supply and the interest rate in the economy.

High interest rates mean higher cost of capital for the industry, lower profits and hence lower stock prices. The fiscal measures undertaken by the government affect public expenditure. For instance, an increase in direct taxes would decrease disposable income, thus reducing demand for goods. This decrease in demand will be translated into a decrease in production which ultimately affecst economic growth. Similarly, an increase in indirect taxes would also decrease demand. This is because indirect taxes are passed on to the consumers in the form of higher prices. How much real income can be generated from internal sources of a country during a particular year?

This can be captured from revenue receipts which reflect real income. How much the government is required to spend in a year is captured from revenue expenditure. In an ideal situation, there should be surplus of income over expenditure. In practice, it does hardly happen. The result is ‘revenue deficit’. This is met by the government by borrowings and market loans, or by curtailing the expenditure in important sectors, namely, education, health, infrastructure, agriculture etc. Increase in debt burden may create an unfavourable situation. DSC and ISC ratios fall below the threshold limit. The chance of the country running into debt brightens.

Declining trend in EIIC indicates an indifferent attitude of the government towards collection of interest on loans given to others. The Union Budget is an important document. An analysis of the budget statement is equally important. The main objectives of analyses and interpretation of the budget are to depict a true and fair picture of the country’s economic status. The other objective is to help discern the intention of the government in terms of economic development, inclusive growth and removing regional disparities. In this perspective, the methods suggested in this article for empirical analyses of the budget appear to be a realistic approach.

(The writer is Director and CEO, Sayantan Consultants Pvt. Ltd. Kolkata)

Advertisement