Scheme for investment, trading in sovereign green bonds in IFSC soon

The decision was taken at the Monetary Policy Committee (MPC) meeting of the apex bank.

RBI Governor termed the recent inflations as “transitory” and “driven by adverse supply side factors”

After a three-day meeting of the Monetary Policy Committee, the RBI has decided to keep the interest rate along with the repo rate unchanged at 4 per cent which consequently keeps the reverse repo rate unchanged at 3.35 per cent.

The decisions, said a statement from the RBI, are in consonance with attaining medium-term target for consumer price index (CPI) inflation of 4 per cent (+/-2), while supporting growth.

The MPC decided to continue the accommodative stance to sustain growth and alleviate the Covid-19 impact on the economy.

Advertisement

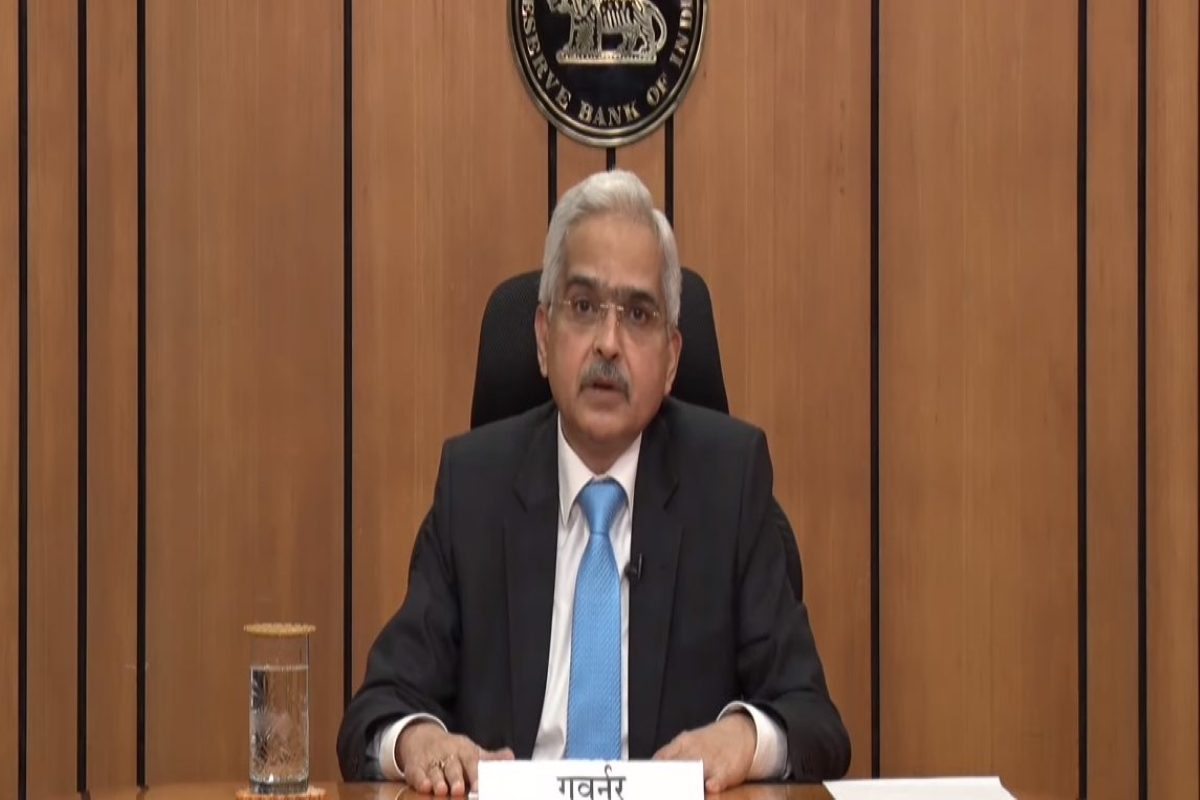

RBI Governor Shaktikanta Das said that as the second wave ebbs and the country gradually revive, “Yet the need of the hour is not to drop our guard and to remain vigilant against any possibility of a third wave, especially in the background of rising infections in certain

parts of the country.”

Explaining the rationale behind the MPC decision, Das said the they met in shadows of two inflations and noted that economic activity has “broadly evolved” in accordance with MPC’s expectations in June and “recovering from the setback of the second wave”.

“On balance, the outlook for aggregate demand is improving, but the underlying conditions are weak. Aggregate supply is also lagging below pre-pandemic levels,” Das said.

He termed the recent inflations as “transitory” and “driven by adverse supply side factors”.

In domestic growth, Das said the crippled economy has gained strength and as more curbs are eased coupled with ramped up vaccination, private spending will bolster. In turn, the “robust” agriculture outlook and rural demand would continue to support private consumption, he added.

Assessing investment demand as “anaemic”, Das expected to kick-start a long-awaited revival with rising steel consumption, higher imports of capital goods and economic packages by the Centre.

The projection of real GDP growth has been retained at 9.5 per cent in 2021-22 consisting of 21.4 per cent in Q1. Real GDP growth for Q1: 2022-23 is projected at 17.2 per cent.

CPI inflation has been projected at 5.7 per cent during 2021-22.

The RBI also announced additional measures to palliate the whittling impact of Covid-19.

The on-tap TLTRO scheme’s deadline has been extended by three months (31 December).

The Marginal Standing Facility (MSF) given to banks last March has also been extended by three months (31 December 2021).

The achievement of certain financial parameters under Resolution Framework for Covid-19 related stress announced in last August has been deferred to 1 October 2022.

Advertisement