Benchmark indices close lower amid selling; metal, real estate drag

Sensex fell 384 points, or 0.52%, closing at 73,511.85, while the Nifty 50 closed 140 points, or 0.62%, lower at 22,302.50.

Sensex fell 384 points, or 0.52%, closing at 73,511.85, while the Nifty 50 closed 140 points, or 0.62%, lower at 22,302.50.

A flag-off ceremony was held at the facility here in the presence of UP Chief Secretary Durga Shanker Mishra and senior delegates from the country's largest commercial vehicle manufacturer.

These are called ghost shopping centres because over 40% of their retail space is vacant.

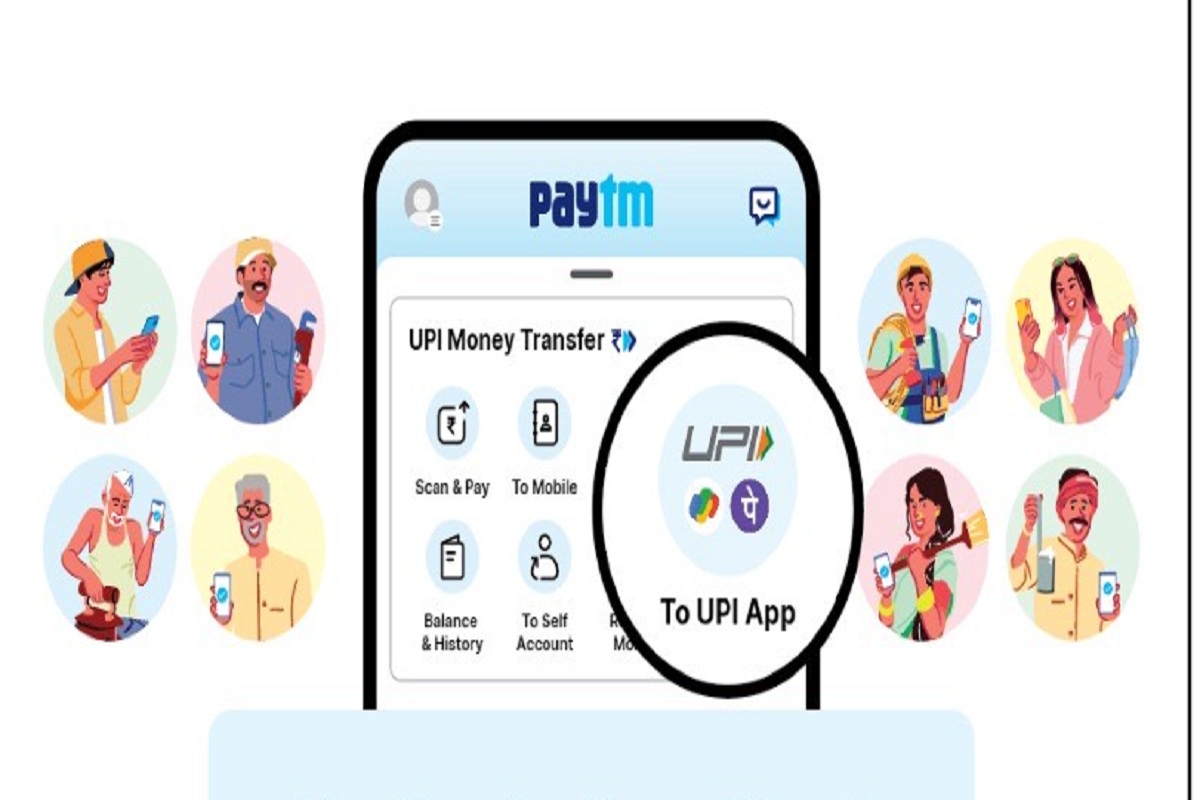

Data from the National Payments Corporation of India (NPCI) said it processed 1,117.13 million transactions in April, a 9 per cent month-on-month decline in volume from 1,230.04 million transactions handled in March.

In the January-March period of 2024, the Indian FMCG industry experienced a 6.5% growth in terms of volume at a national level, a recent report said.

The report points out that Indian airlines, such as Air India and IndiGo, are strategically adding new aircraft to their fleets and launching new international routes which are cutting travel time.

She also said that in 10 years, the UPA was unable to achieve political consensus on GST.

As the race for artificial intelligence (AI) chips intensifies, Apple has joined the bandwagon and is now reportedly working on its own chips for data centres.

South Korea has raised its automotive industry's concerns with the US over Washington's inquiry and envisioned rules to address potential security risks from "connected vehicles" that use technology from China and other countries of concern.

Embee Software, a leading IT company based in India known for its expertise in Microsoft 365 implementations, will deploy Microsoft 365 Copilot which will automate routine tasks and will provide real time assistance in data analytics.