India’s economy to attain size of USD 34.7 trillion by 2047: PHDCCI

The Indian economy is displaying robust growth post Covid pandemic despite continued global headwinds, the industry body said.

The adverse factors affecting the US and European economies put our own economy at risk. To enumerate: the Indian economy faces the danger of capital outflow because of higher US interest rates. Then, we are importing inflation through higher cost of imported goods and because household incomes in the West are falling, our own exports are unlikely to rise in the short run, ruling out a quick solution to the CAD problem

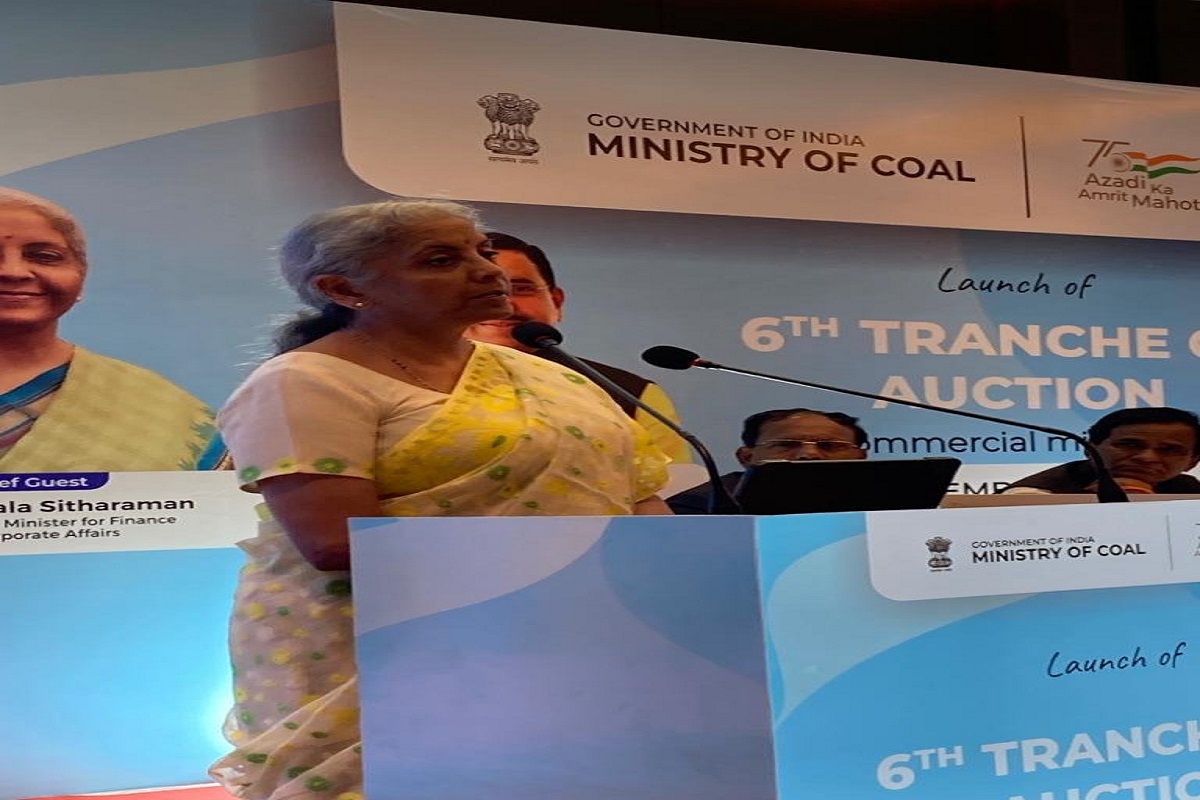

Photo: IANS

Thankfully, the Indian economy is maintaining some of its momentum, even as most Western economies slowly slip into recession. However, due to inter-connection between major economies, ill-winds are blowing our way, which have already led to layoffs in Indian tech firms and a persistently high Current Account Deficit (CAD) in our foreign trade.

But our Finance Minister sees a rainbow in the gathering storm clouds. Speaking at FICCI’s annual convention in New Delhi on 16 December 2022, the Finance Minister said: “The suspected long-drawn recession which is likely to affect in West will not just impact your (industry) exports but it gives us an opportunity for many of the investments which are now looking for a different place from where the activities can continue to happen. It is the best time for the Indian industry to work on strategies for drawing those manufacturers to India.”

On the face of it, the FM’s statement is unreasonably optimistic because the Indian economy would definitely be impacted by a downturn in major economies. The connected nature of major economies was obvious even in the 19th century. When France was the leading economy in Europe, the distinguished diplomat Metternich, had said: “When France sneezes, Europe catches a cold.” Subsequently, in the 20th century, this saying was modified to: “When America sneezes, the world catches a cold.” The truth of this saying was amply demonstrated by the global financial crisis of 2008-09, which followed on the heels of the collapse of the America’s housing market in the 2000s.

Advertisement

During the pandemic period when economic activity was anaemic throughout the world, investors in the US, motivated by the TINA (there is no alterna-tive) factor and flush with Covid handouts, invested heavily in the stock market, inflating stock prices to unprecedented levels.

An example is the S&P 500 Index, which appreciated by six hundred per cent between 2009 and 2021. After peaking on 3 January 2022, the same US stock market went down relentlessly, with the S&P 500 Index going down by 18 per cent. Similarly, MSCI’s market cap-weighted indexes for glo-bal equities also went down by 18 per cent. Aggregate value of cryptocurrencies, is down to $840bn, from $3 trillion in 2021. The value of US bonds, supposedly a risk proof investment, has dropped by 11 per cent. Such developments were not unique to the USA; the fall in the stock market in European countries was similar, with value of European bonds falling by 15 per cent.

Western economies are on the decline; runaway inflation, commodities shortages, energy shortages, supplychain disruptions and a labour shortage that has driven up wages, has dragged Europe into a recessionary phase, with the US likely to follow. Consequently, the US and Europe bond and stock markets, are not expected to recover soon. In these circumstances, investors are hard-pressed to identify assets in which they could deploy their capital for reasonable returns.

As such, there is a kernel of truth in the FM’s statement that venture capitalists are searching for avenues to invest their money, but luring such capital to India, is a tall order, easier said than done.

After adverse post-pandemic developments, foreign investors have either tapped the commodity market, that has risen sharply, or have invested in private equity funds/private ~ credit funds, which raise money from investors, to advance loans or invest in corporates, calling their change in investment strategy TARA (there is a real alternative).

With the threat of recession looming large and the Ukraine war casting a pall of gloom, inflation is peaking and household incomes are declining in Europe. Taking the UK as a representative case, the Bank of England, after raising interest rates eight times since December 2021, has warned that the UK is facing its longest recession since records were being kept.

The Bank warned that the UK would face a “very challenging” two-year slump with unemployment nearly doubling by 2025. Additionally, households in the UK face rising food prices, rising energy bills and higher home loan interest rates.

Aggressive rate hikes by US Fed, a sharp depreciation in rupee value, surge in US bond yields, fear of a global recession, and the continuing Russia-Ukraine war has fuelled a flight of capital from India; Foreign Portfolio Investors took out a record Rs 2.13 lakh crore from India in the first half of 2022. A paper, titled “Capital Flows at Risk: India’s Experience” published in the RBI’s June 2022 Bulletin foresees a US$ 100 billion capital outflow from India, should the differential between US and Indian interest rates rise and the share volatility index increase. We had tried to attract foreign capital to India by the Make in India initiative and later by the Production Linked Incentive (PLI) Scheme, without noticeable success.

According to an IMF study, a number of reasons deter largescale foreign investments in India, major ones being inadequate infrastructure, policy instability, inefficient bureaucracy, somnolent judiciary, restrictive labour laws, corruption, changing tax policies, poor work ethics amongst others.

Therefore, it would be highly surprising, if on their own, foreign investors start flocking to India. Moreover, deployment of additional investment and its fructification is a medium-term proposition, therefore, even if we get sufficient foreign funds, we are unlikely to see any positive results in the short run.

This year, led by tech giants like Meta, Amazon, Twitter, Microsoft, Salesforce, 965 IT firms have laid off more than 150,000 workers worldwide, with 73,000 lay-offs in the USA, and 17,000 in India. Erroneously believed to be immune to macroeconomic conditions, tech giants like Netflix, Meta, Amazon, Microsoft, Alphabet, and Apple have lost a combined market value of $2.5 trillion. This situation is mirrored in India; erstwhile market darling Byju’s is in visible distress, and after five uninterrupted years of annual gains, Nifty IT is down 24 per cent, its worst fall since the 2008 global financial crisis. Leading unicorns PolicyBazaar, Paytm, Zomato and Nykaa, respectively lost 68 per cent, 59 per cent, 50 per cent and 48 per cent of their value, aggregating to a total loss of Rs 2 lakh crore in market capitalisation.

Current economic indicators are not very encouraging. Growth rate of the Indian economy fell to 6.3 per cent in the July-September quarter, from 13.5 per cent of the March-June quarter. Manufacturing has declined by 4.3 per cent, year-on-year. Only for the first time in this year, inflation at 5.88 per cent is below 6 per cent. The repo rate has increased from 4 per cent in April 2022 to 6.25 per cent in December 2022. Unemployment has been consistently high throughout the pandemic period, and according to CMIE, unemployment stood at 9.26 per cent on 16 December. Due to falling exports and increasing imports, Current Account Deficit (CAD) for the third quarter is projected at 4.4 per cent of GDP. Significantly, a year ago CAD was only 1.3 per cent of the GDP.

Additionally, the adverse factors affecting the US and European economies put our own economy at risk. To enumerate: the Indian economy faces the danger of capital outflow because of higher US interest rates. Then, we are importing inflation through higher cost of imported goods and because household incomes in the West are falling, our own exports are unlikely to rise in the short run, ruling out a quick solution to the CAD problem. Probably, the FM would have been better advised to ask industry leaders to adopt measures to stop the malaise of Western economies from infecting the Indian economy.

Sadly, instead of reading the tea leaves, and taking steps to put the Indian economy in order, the FM is suggesting an undoable course of action for local industrialists. We can only ignore recent adverse developments in the global economy and our own economy, at great peril.

As US President Biden said: “You know, my Grandpop Finnegan used to have an expression: he used to say, ‘Joey, the guy in Olyphant’s out of work, it’s an economic slowdown. When your brother-in-law’s out of work, it’s a recession. When you’re out of work, it’s a depression.’”

By ignoring downturns elsewhere, let us not slip into depression.

Advertisement