Taxation Travails

While posts on WhatsApp would have us believe that taxpayers, who are allegedly in a minuscule minority, are a muchharassed lot, the Government pushes a diametrically opposite narrative viz.

Union Budget 2018-19

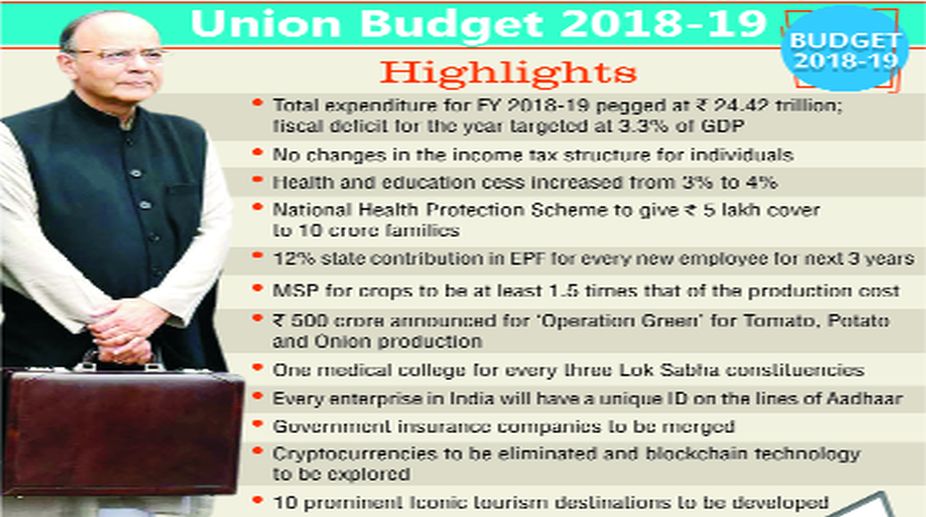

Eyeing as many as eight assembly elections this year and the general election in 2019 the Narendra Modi government has presented a populist Budget to woo rural voters, focusing on agriculture and health sectors.In his last full Union Budget, Finance Minister Arun Jaitley on Thursday sent a clear message that the exercise revolved around appeasing the electorate.

As most of the assembly elections are in the Hindi heartland, Jaitley broke into Hindi to make populist announcements in the budgetary proposals, which come at the cost of breaching the fiscal deficit target for 2017-18 ~ with the Budget estimate of 3.2 per cent of Gross Domestic Product at present being revised to 3.5 per cent.

However, the NK Singh committee’s recommendation for the fiscal deficit target of 3.3 per cent of GDP for 2018-2019 has been accepted.

Advertisement

The headline announcements include a revamped National Health Protection Scheme that will provide coverage of up to Rs 5 lakh per family per year for secondary and tertiary care hospitalisation for 10 crore families, and a promise to provide minimum support price (MSP) of at least one and half times of the production cost for the Kharif crop.Jaitley has used the Budget to address the high rural discontent across several states as farmers have been throwing away their surplus farm produce that failed to fetch the right price.

The farm livelihood package gets a cumulative allocation of Rs 14.34 lakh crore.A big dampener for the stock market was the reintroduction of the Long Term Capital Gains (LTCG) tax ~ of 10 per cent ~ on gains of more than Rs 1 lakh in the equity market.

At present, gains from equity investments held for more than 12 months are exempt from tax.The Finance Minister also proposed to introduce a tax on distributed income by equity-oriented mutual funds at the rate of 10 per cent, to provide a level field across growth-oriented funds and dividend-distributing funds.

“The proposed change in Capital Gains Tax will bring marginal revenue gain of about Rs 20,000 crore in the first year, in view of grandfathering,” Jaitley said.

The Budget extended the cut in the corporate tax rate introduced last year from 30 per cent to 25 per cent to companies clocking a turnover of up to Rs 250 crore, up from the earlier Rs 50 crore limit.

“This would benefit the entire class of micro, small and medium enterprises, which account for almost 99 per cent of companies filing tax returns,” Jaitley said.

“The estimated revenue foregone during Financial Year 2018-19 will be Rs 7,000 crore.

This lower corporate income tax rate would leave such companies with higher investible surplus, which would create more jobs,” he added.

A comprehensive package was also offered to the MSME sector, which bore the brunt of demonetisation and the chaotic rollout of the Goods and Services Sector (GST).

Much to the disappointment of the salaried classes, there are no changes to the income tax slab structure for individuals, except a provision to allow standard deduction of Rs 40,000 for salaried taxpayers in lieu of the existing provision for medical and transport bills.

Jaitley said 2.5 crore salaried employees and pensioners would benefit from this proposal and the revenue cost would be Rs 8,000 crore.

He mentioned the rising number of direct taxpayers and the increase in direct tax growth, and praised demonetisation. “We are enthused by success of our measures and pledge to take more measures in future by which black money is contained and honest taxpayers are rewarded,” he said.

There is some relief for senior citizens as the interest income exemption has been increased to Rs 50,000 from Rs 10,000 for all fixed and recurring deposit schemes, including small savings.Jaitley also extended the Pradhan Mantri Vaya Vandana Yojana up to March 2020. Under this, an assured return of 8 per cent is given by Life Insurance Corporation of India. The existing limit on investment of Rs 7.5 lakh per senior citizen under this scheme is being doubled to Rs 15 lakh.

Jaitley increased the education cess to 4 per cent from the present 3 per cent to help cover the cost of government-sponsored programmes in health and education. In the education sector, Jaitley proposed to revitalise infrastructure, opening schools for the Scheduled Tribe population as well as promoting programmes for teachers.

Since the major portion of indirect taxes has gone under the oods and Services Tax (GST) now, Jaitley has hiked custom duty on a range of sectors and items.

Mobile phones and import of mobile phone parts are set to be more expensive with an increase in custom duty on mobile phones from 15 per cent to 20 per cent Jaitley cheered up the House by announcing increased salaries for President, Vice President, governors and members of Parliament.

The President’s salary will go up to Rs 5 lakh a month from the current Rs 1.5 lakh and the Vice President’s to Rs 4 lakh from Rs 1.25 lakh.The Governor’s pay will be revised to Rs 3.5 lakh a month from Rs 1.10 lakh. The Finance Minister also proposed an inflation-linked revision of MPs’ salaries.

Advertisement