There was no change in the Income Tax slab for individuals in the Union Budget 2018-19.

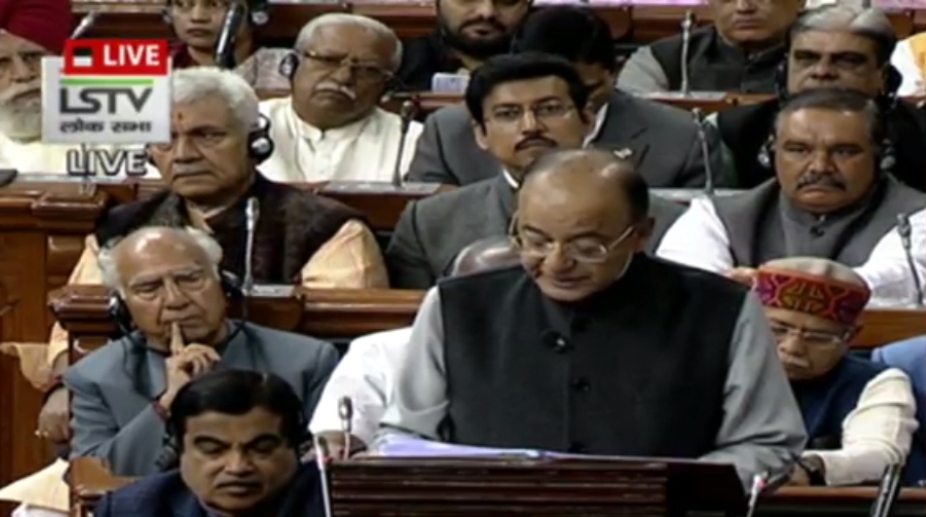

“Government has made many positive changes in the personal income tax rates applicable to individuals in the last three years. Therefore, I do not wish to make any changes to this,” Finance Minister Arun Jaitley told the Lok Sabha while presenting the Budget.

It was expected that the government will change the tax slab, bringing relief to salaried persons and the middle class.

Thus the current tax slab will continue.

As of now, those earning an annual income in the Rs 2.5 lakh to Rs 5 lakh bracket pay a tax of 5 per cent. Those earning between Rs 5 lakh and Rs 10 lakh are required to pay a tax of 20 per cent, and those who fall in the highest income slab of Rs 1 crore and above pay a tax of 30 per cent. The highest income slab also pays a surcharge of 10 per cent of their income tax amount.

If one’s personal income is above Rs 1 crore, the surcharge is 15 per cent of their income tax amount.

A cess of 3 per cent is paid by all taxpayers on the total of their income tax and surcharge amounts.

Jaitley tried to keep the middle class happy by granting Rs 40,000 as standard deduction against travel and medical expenses.

Read More: Union Budget 2018: Rs 1.48 lakh cr for railways, capacity expansion priority

At the same time, a major relief to senior citizens was announced.

The exemption of interest income on deposit with bank and post offices has been increased to Rs 50,000. The limit of deduction under Sec 80-D in respect of health insurance premium has been raised to Rs 50,000.

The number of effective taxpayers has increased to Rs 8.27 crores. Excess revenue from personal income tax now amounts to Rs 90,000 crore.

The Finance Minister said that there has been a 12.6 per cent growth in direct taxes and 18.7 per cent growth in indirect taxes in 2017-18.