India’s economy to attain size of USD 34.7 trillion by 2047: PHDCCI

The Indian economy is displaying robust growth post Covid pandemic despite continued global headwinds, the industry body said.

India may face delays in consignments and the closure of potential future deals as a result of sanctions on Russia. The immediate impact of the Russia-Ukraine war on the Indian economy can be seen in the form of financial markets volatility.

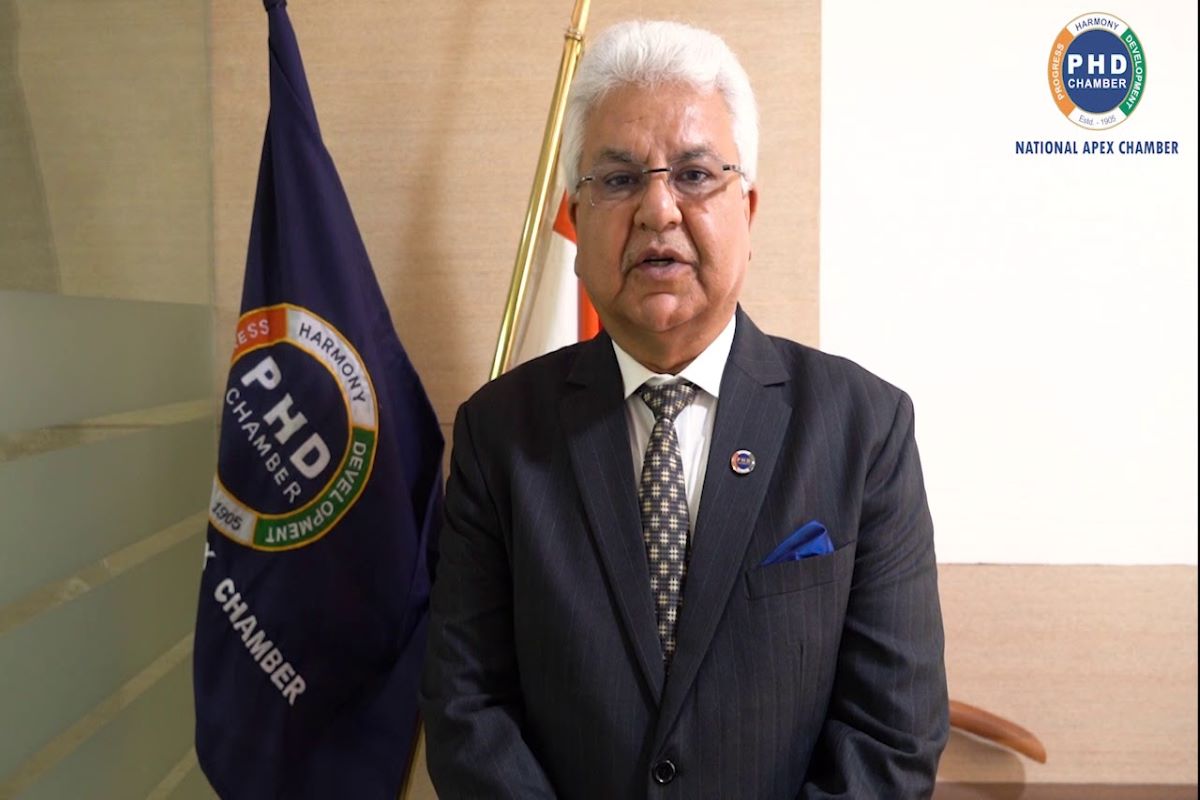

Pradeep Multani, president of PHDCCI

Pradeep Multani, serving as the President of PHDCCI, is an eminent industrialist and a renowned name in the field of traditional medicine. For the last 32 years, he has been the Chairman of Multani Pharmaceuticals Limited, an 83-year-old multi-crore limited company. He has experience of more than 40 years in manufacturing Ayurvedic and Unani medicine and products.

He is also the Co-Chairman of the FICCI AYUSH Committee and the President of the Association of Manufacturers of Ayurvedic Medicines (AMAM). Multani has been conferred with the ‘Distinguished Entrepreneurship Award for MSME 2019’ by PHDCCI. Multani’s vision of utilising PHDCCI’s expertise and nationwide mechanism in support of ‘New India’ is inspired by India’s resilience in challenging times and he is determined to put concerted efforts to lead with a positive momentum forward.

In an interview with Nikhil Vyas, Multani talks at length about the performance of the Indian economy over the past two years and Prime Minister Narendra Modi’s Aatmanirbhar Bharat initiative.

Advertisement

Excerpts:

Q. What is your opinion on the impact of Covid on the Indian economy?

A: After experiencing the daunting impact of Covid-19 and the resultant restrictions on economic activity and physical movements of goods and people, the Indian economy is experiencing a higher growth trajectory in recent months supported by a strong and sustained performance of key economic indicators.

The economy witnessed its worst GDP contraction ever at around (-)24% in the April- June 2020 quarter. Trade and industry was impacted in four major ways; the partial/complete lockdowns in many states; labour shortage; skyrocketing price of commodities, and depressed demand scenario. However, on the back of supportive policies of the government, calibrated measures by the RBI, rapid vaccination drive in the country and improved consumer and business sentiments, the economy has recovered from the severe contraction of FY 2020-21. The GDP growth recovered to around 20 per cent in April- June 2021 quarter. The growth rate of GDP for FY2022 is estimated at 8.9% as compared to (-) 6.6% in FY 2021.

Q. Can you elaborate on the GDP and also the GST collection in the country?

A: The GDP has shifted tracks towards the higher growth trajectory on the back of meaningful structural reforms undertaken by the government over the last two years. The pace of economic activity is expected to remain strong in the coming quarters and India will be able to attain the anticipated high economic growth trajectory in FY2023.

GST collections have been robust in recent months, indicating that the economy has significantly rejuvenated from the daunting impact of Corona waves. February 2022 has been the fifth month when GST collections crossed the Rs 1.30 lakh crore mark, registering y-o-y (year over year) growth of 18 per cent from the same month last year and growth of 26 per cent from the GST revenues in February 2020.

Q. What is the impact on the economy of the ongoing conflict between Russia and Ukraine?

A: The recent geo-political developments i.e. Russia Ukraine crisis, which started on 24 February 2022, has soared Brent crude oil prices from $ 99.08 per barrel that day to the sky scraping level of $131.64 per barrel on 9 March 2022 (day high). The imposition of sanctions on Russia will hit global trade and aggravate supply bottlenecks. India may face delays in consignments and the closure of potential future deals as a result of sanctions on Russia. The immediate impact of the Russia-Ukraine war on the Indian economy can be seen in the form of financial markets volatility.

Q. Will it add to the high cost of raw materials for businesses and thereby impact the price-cost margins of the producers?

A: On the domestic front, the rising crude oil prices amid recent geopolitical developments could further add to the inflationary pressure through effect on retail prices of petrol and diesel along with upside pressure on the prices of other commodities. This could add to the high cost of raw materials for businesses and will impact the price-cost margins of the producers. At this juncture, there is a need for continuous handholding of the economy by the government along with strengthening of Global Value Chains of India by leveraging the strategic trade avenues.

Q. How is PM’s Aatmanirbhar Bharat initiative progressing?

A: The Aatmanirbhar Bharat initiative has accentuated the Prime Minister’s vision of transforming India into a manufacturing hub. Since May 2020, the government has rapidly and continuously undertaken reforms and policy initiatives to fulfil this vision. The recent Union Budget 2022-23 has also laid strong focus on Aatmanirbhar Bharat, with various proposals aiming at advancing this vision. Further, the achievement of the $400 billion export target in 2021- 22 is a key milestone in India’s Aatmanirbhar Bharat journey.

Q. How do you look at India achieving the export target of $400 billion dollar recently?

A: It is highly appreciable that the Government of India succeeded in achieving the highest- ever goods exports target of $400 billion in 2021- 22 with an increase of 37 per cent from the previous year’s $292 billion. This has been made possible by enhanced focus of the government on export incentive schemes, integration of domestic manufacturing into global value chains, facilitation of the financing of trade, among others. Going ahead, further improvement in logistics infrastructure and trade facilitation measures would enhance India’s exports growth trajectory and create millions of new job opportunities.

Advertisement